More On: btc

Bitcoin mining hash rate increases by 60% despite falling revenue per terra hash

BTC research: Bitcoin's realized price indicates that a bottom may be forming

Bitcoin sell-off causes $20 million in long positions to be liquidated

Daily Crypto Wrapped: BTC short liquidations exceed $9 million, and Ava Labs CEO calls CryptoLeaks allegations a 'conspiracy theory'

Ethereum (ETH) hits $2000 as Merge nears

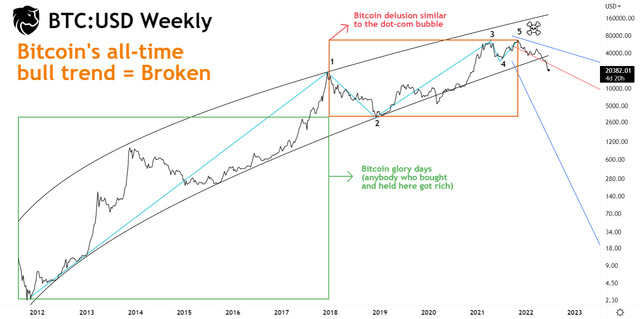

The lure of quick riches, similar to the dot-com bubble, has led the cryptocurrency market to deviate from reality.

- The cryptocurrency bubble is imploding in the same way that the internet bubble did in the early 2000s.

- While decentralized software is the way of the future, protocols that do not generate revenue will fail within the next 6-12 months (this includes Bitcoin).

- We anticipate that Bitcoin will fall below $10,000 by the end of 2022.

- In the long run, we believe Ethereum will overtake Bitcoin's market share.

Disinformation (pushed by VC funds and social media influencers) has spread like wildfire among a global population of inexperienced investors since 2020. Bitcoin (BTC-USD) and crypto-companies became overvalued as a result of massive retail inflows and Fed support.

As a result, cryptocurrency prices have fallen precipitously throughout 2022. Bitcoin fell below its previous cycle high of $20k/BTC on June 18th. Although many investors believe this is the "final bottom," we believe there is still significant downside to come. In fact:

We believe this crypto crash marks the beginning of Bitcoin's decline as a market leader.

This article describes the new perspective necessary to successfully invest in the changing crypto market.

Bitcoin: A Never-Before-Seen Death Spiral

At the risk of repeating myself, there are fundamental reasons why this crypto crash is unique. This crash is similar to the dot-com bubble in that it represents the demise of many deeply ingrained beliefs in the crypto market.

- Bitcoin's secular bull trend has bounced between several failed narratives over the last decade:

- 'Bitcoin is a hedge against inflation.' X

- X says, 'Bitcoin can be used as collateral.'

- 'Millions will use Bitcoin as a store of value and peer-to-peer currency,' X predicts.

- 'Bitcoin's price never exceeds its previous cycle high.' X

While these narratives made sense in the post-2008 expansionary market, we believe they are no longer valid in a contracting economy. When viewed objectively, we believe that Bitcoin's only actual use case is to persuade others to buy it.

As a result of Bitcoin's lack of real-world application, the asset is vulnerable to a death spiral when the music stops.

Bitcoin investors are realizing that their asset has no tangible price floor as BTC prices fall. A falling Bitcoin price encourages investors to sell their holdings in order to take advantage of any available liquidity. This positive feedback loop eventually leads to widespread panic and capitulation.

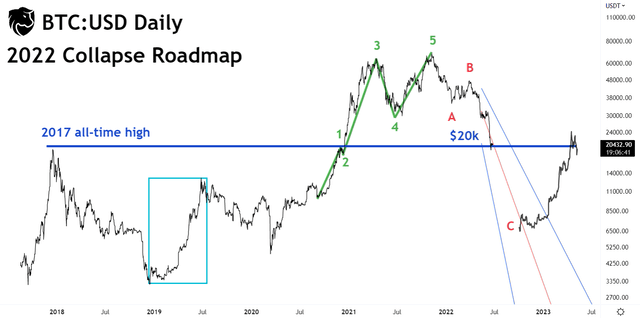

We believe Bitcoin's death spiral price drop is currently underway. At the time of writing, the bulls are defending the previous cycle high of $20k/BTC. However, we believe that this support will not last, as $20k represents the last chance for hedge funds, venture capital firms, and other financial institutions to sell before an ugly cryptocurrency crash.

Bitcoin Price Prediction

Markets reprice excess valuations given to financial assets during the previous expansion during a recession. We believe this repricing will have a significant impact on Bitcoin as investors realize the asset has no monetary value.

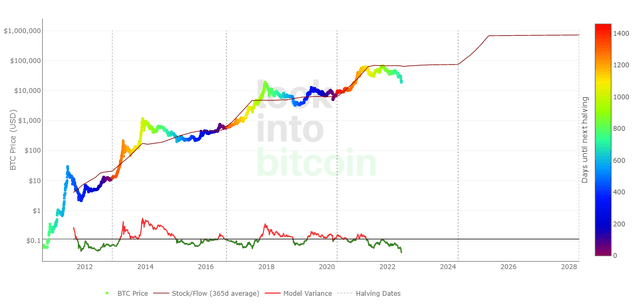

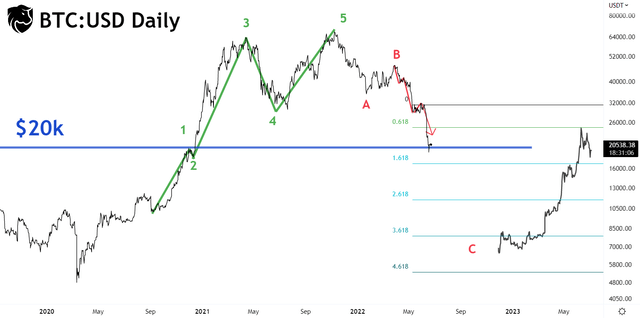

Assuming the aforementioned scenario plays out, we expect Bitcoin to fall below $10,000 between September and November 2022. This forecast is a rough estimate based on Bitcoin's Price Cycle theory.

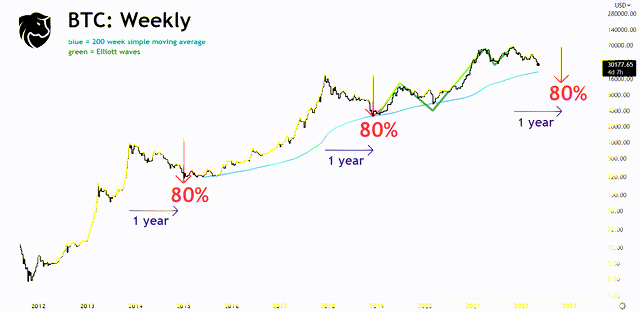

As previously stated in our Bitcoin article,

"After each parabolic run-up, Bitcoin fell by 80 percent from peak to trough approximately one year later."

As a result, $13,757 is exactly 80% less than Bitcoin's previous all-time high of $68,789. While we previously considered this price to be Bitcoin's bottom, we now believe momentum can push BTC even lower, below $10,000. In contrast to the previous two Bitcoin bear markets (in 2018 and 2014), this is the first time Bitcoin has ever fallen below its previous cycle's high. As a result, we expect the crash to be more severe than the usual 80%.

We also expect Bitcoin to re-emerge above $20k in the first half of 2023. As shown in the chart below, we believe that $20k will be a critical level for Bitcoin in the coming year.

When Bitcoin reaches bottom support, a subsequent melt-up could be fueled by highly oversold conditions and looser monetary policy as inflation falls.

Important Takeaways

- Bitcoin is experiencing an unprecedented crash. A paradigm shift is taking place, which will eventually force Bitcoin to abdicate its throne.

- Rather than dying immediately (going to zero), we expect Bitcoin to follow previous cycles and bottom below $10,000 between September and November 2022.

- A violent bottom could fuel a reflexive rally back to $20k by 2023.

The Harsh Reality

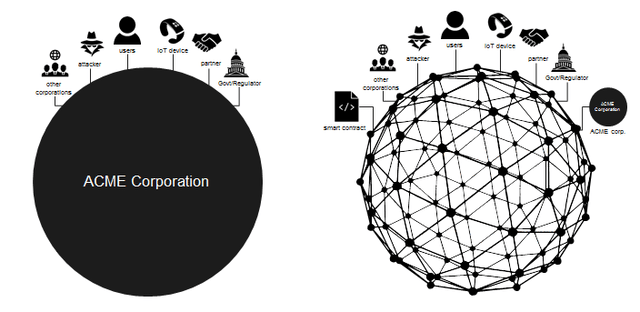

In reality, Ethereum (ETH-USD) best fulfills the narratives desired by the majority of Bitcoiners. While Bitcoin is an old and limited technology, Ethereum is the only one that exists as a decentralized application network, a store of value, and a widely accepted form of money.

The following is a simple mental model for comparing Bitcoin and Ethereum:

While Bitcoin is the first decentralized digital currency,

Ethereum is the first decentralized digital currency application.

Ethereum will become the market's most dominant player in the future as the crypto market dies and regrows to support protocols with positive organic cash flow. Indeed, we believe that Ethereum's unrivaled decentralization and subsequent network effects will propel it to become the primary settlement layer for the entire internet!

As stated in a September 2021 article:

"All institutions that prioritize power over efficiency will continue to absorb value from Ethereum."

Ethereum's application efficiency and distinct structure as a triple-point asset give it a competitive advantage over traditional corporations. As Ethereum's software stack evolves, applications built on Ethereum will identify and capitalize on any inefficiencies in legacy technology networks. DeFi, for example, is already removing the need for financial intermediaries.

DeFi, we believe, will reshape traditional finance and grow into a trillion-dollar industry. However, we are only at the beginning of this journey. As a result, the current state of Decentralized Finance has many issues (specifically, a lack of regulation or 'rules').

Decentralized, autonomous, and efficient software applications built on Ethereum are likely to overtake all industries given enough time. This conclusion is based on Ethereum's open-network reliance on the free market. Because the market is always looking for the highest possible profit, it stands to reason that the next era of business will involve the most decentralized and trustless technology networks, maximizing profitability for all parties. More information about this thesis can be found here.

By replacing bureaucracy with automation, Ethereum applications maximize profits for everyone.

In a nutshell, we believe Ethereum - a decentralized, self-governing, ever-expanding, and widely trusted transaction network - will eventually develop more efficient applications than most traditional businesses.

Because the general public is still unaware of Ethereum's long-term growth potential, we anticipate that it will crash along with all other cryptocurrencies near the end of 2022. However, we believe that after a sufficient cooling period, ETH will rise from the ashes to begin another long-term bull trend, reaching $10k/ETH in 2025.

Following the 2022 crash and subsequent bear market, we expect Ethereum to be the biggest winner in the crypto market. We will expand on this thesis in future Ethereum/altcoin articles. Although most altcoins are bad investments, some do generate legitimate revenue. We intend to identify and capitalize on these opportunities during the decade-long transition from the Industrial to the Information Age, which will take place between 2020 and 2030.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.