More On: btc

Bitcoin mining hash rate increases by 60% despite falling revenue per terra hash

BTC research: Bitcoin's realized price indicates that a bottom may be forming

Bitcoin sell-off causes $20 million in long positions to be liquidated

Daily Crypto Wrapped: BTC short liquidations exceed $9 million, and Ava Labs CEO calls CryptoLeaks allegations a 'conspiracy theory'

Ethereum (ETH) hits $2000 as Merge nears

In this edition of CryptoSlate Wrapped Daily, we discuss the liquidation of $9 million in Bitcoin shorts, restrictions on Singapore retail investors, Chainplay's GameFi report, and much more.

Crypto Markets

Bitcoin was up 1.19% on the day, trading at $20,215, while Ethereum was trading at $1,544, reflecting an increase of over 4.54%.

Biggest Gainers (24h)

Fruits +48.19%

Voyager Token +28.05%

Synthetix +12.62%

Biggest Losers (24h)

Netvrk -5.47%

ABBC Coin -4.26%

Energy Web Token -3.99%

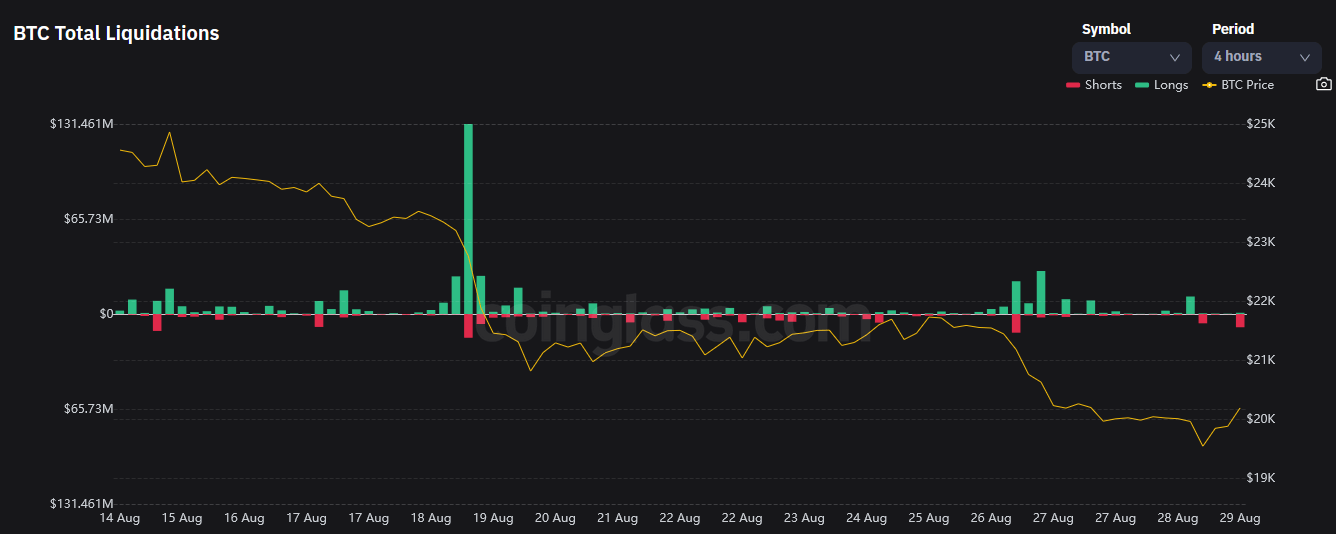

As BTC rises back above $20,000, $9 million worth of Bitcoin shorts were settled.

Powell's comments at Jackson Hole on August 26 caused the cryptocurrency market to bottom out at $19,500 on August 29. At 14:00 UTC, though, BTC had reached a high of $20,300.

Bitcoin bulls fought to reestablish psychological resistance near the $20,000 mark, causing the sharp increase. According to statistics from Coinglass, $9 million in Bitcoin shorts were liquidated as a result.

Singapore is considering tighter cryptocurrency rules to safeguard individual investors.

The managing director of the Monetary Authority of Singapore (MAS), Ravi Menon, stated that additional restrictions will be implemented to restrict the use of leverage and credit facilities by retail investors who are readily enticed by quick profits.

Due to the global nature of the cryptocurrency business, a complete restriction on its use in the region is improbable. Nonetheless, the MAS is presently working on ways to regulate stablecoins and will publish a detailed guidance in October.

The DigiDaigaku NFT collection of Limit Break increases by nearly 1000% when the company raises $200m.

Limit Break, a Web3 gaming business, said that its parent company has received $200 million to pioneer its "free-to-own" gaming model, in which the brand will give away its NFTs for free.

In response to the announcement, the price floor of DigiDaigaku's free mint NFT jumped to 15.67 ETH. According to nftgo data, the collection's 24-hour trading volume jumped by almost 400%, resulting in approximately $4 million in sales.

According to a research by Chainplay, 3 in 4 investors join crypto because to GameFi.

According to a research provided by Chainplay, three-quarters of GameFi investors are anticipating a speedy payoff. Only 18% of the 2,428 investors who participated in the study were interested in the game's gameplay.

The participants reported losing over fifty percent of their earnings in the previous six months while attempting to profit from the GameFi business. Their losses were primarily attributable to bad game economy design and worsening market conditions.

Research Emphasis

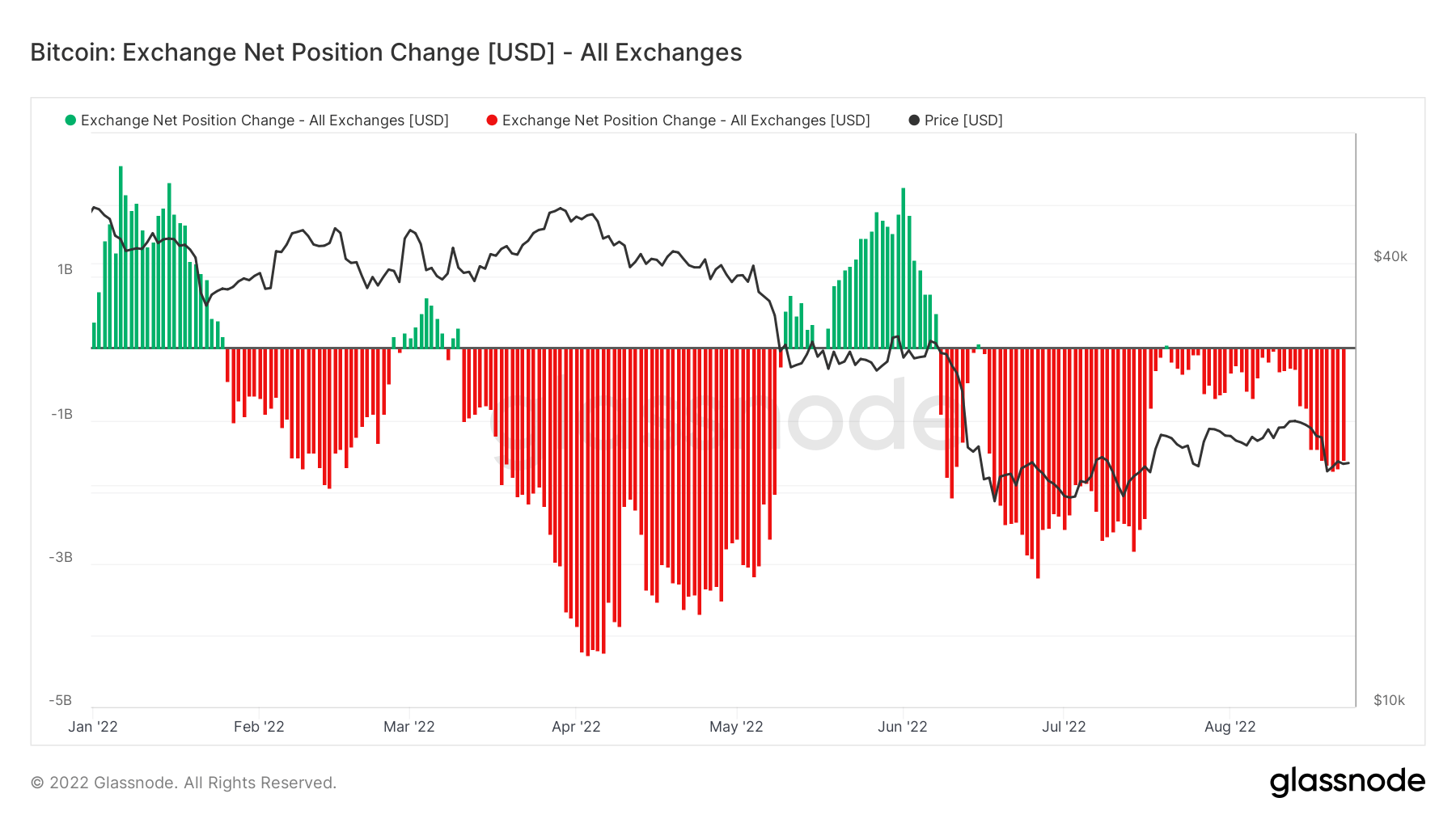

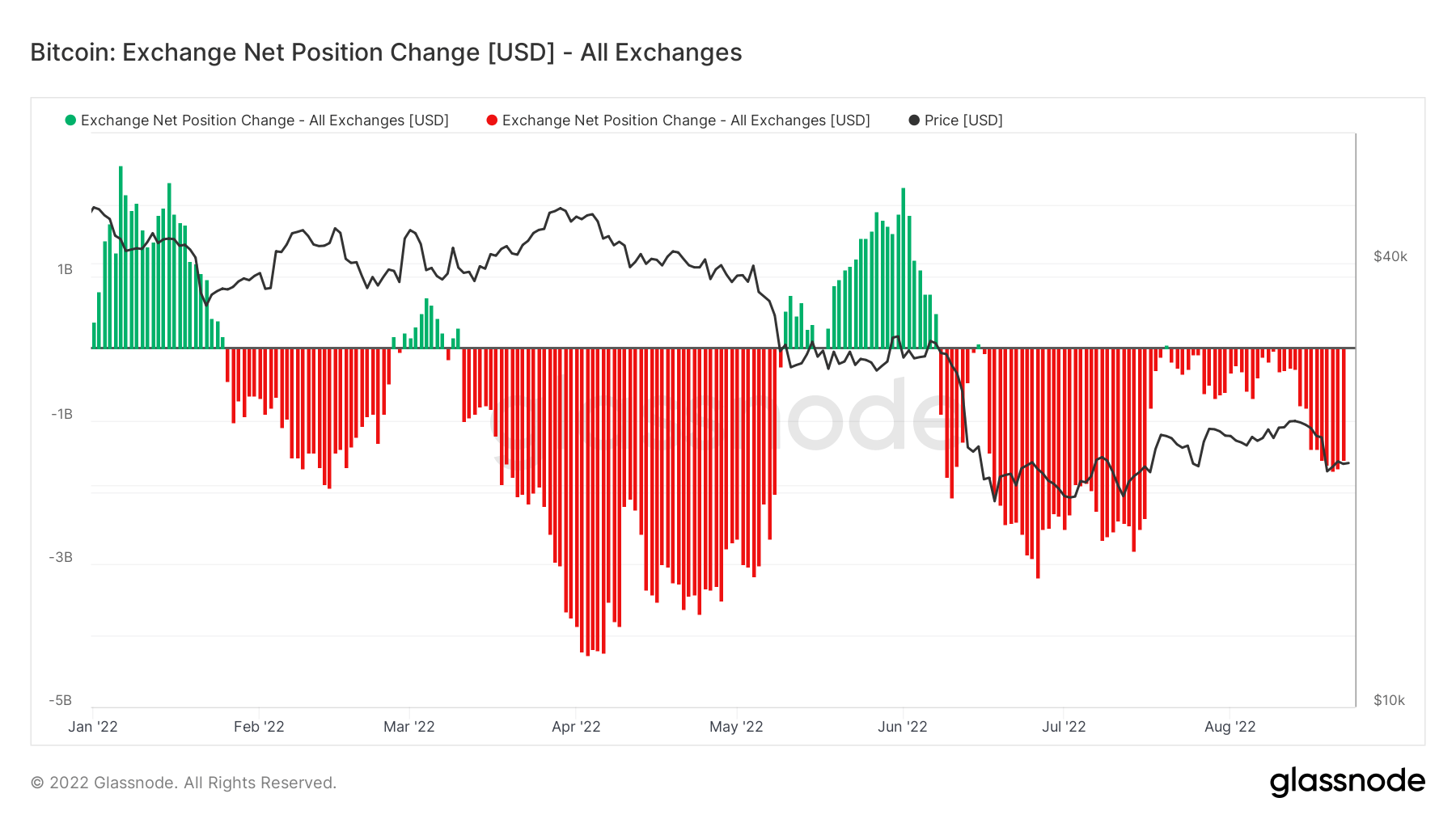

Daily Bitcoin exchange outflows exceed $1B, whilst Ethereum sees net inflows.

CoincryptoUS studied the Bitcoin and Ethereum trade flows to determine the assets' divergent behavior.

As daily outflows from exchanges reach $1 billion, investors have become increasingly optimistic about Bitcoin.

In contrast, Ethereum has witnessed little inflows as speculative investors keep their holdings on exchanges to facilitate a quicker sale following the Merge's conclusion.

According to data, Bitcoin whales are liquidating their holdings en masse.

According to Glassnode data collected by CryptoSlate, the Bitcoin accumulation trend score between April 2020 and August 2022 has neared zero, indicating that BTC whales are selling their holdings.

On the opposite end of the spectrum, shrimp's Bitcoin accumulation data indicates that despite the fact that small-sized BTC holders have lowered their purchasing rate, they continue to accumulate more than whales who have ceased accumulating altogether.

The latest news from the CryptoVerse.

The U.S. Federal Reserve is scheduled to debut its payment system in 2023.

The Wall Street Journal stated that FedNow, a payment system that the U.S. Federal Reserve has been developing for almost seven years, will launch in 2023.

The payment system will upgrade the Federal Reserve's outdated railways and offer near-instant global payments. It will also reduce expenses and increase the efficiency of the United States' financial system.

The CEO of Ava Labs views the CryptoLeaks article to be "conspiracy theory garbage"

Recent recordings produced by CryptoLeaks allege that Ava Labs had an agreement with the law firm Roche Freedom to get legal services in exchange for AVAX tokens and Ava Labs shares. The videos further claimed that the law firm and Ava Labs would use "litigation as a tactic" to disrupt competitors and mislead regulators.

The CEO of Ava Labs, Emin Gun Sirer, responded to the claims by tweeting that the report was "conspiracy theory trash." He asserted that AVA Labs would never engage in illegal or unethical conduct as depicted in the film.

related video

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.