More On: btc

Bitcoin mining hash rate increases by 60% despite falling revenue per terra hash

BTC research: Bitcoin's realized price indicates that a bottom may be forming

Bitcoin sell-off causes $20 million in long positions to be liquidated

Daily Crypto Wrapped: BTC short liquidations exceed $9 million, and Ava Labs CEO calls CryptoLeaks allegations a 'conspiracy theory'

Ethereum (ETH) hits $2000 as Merge nears

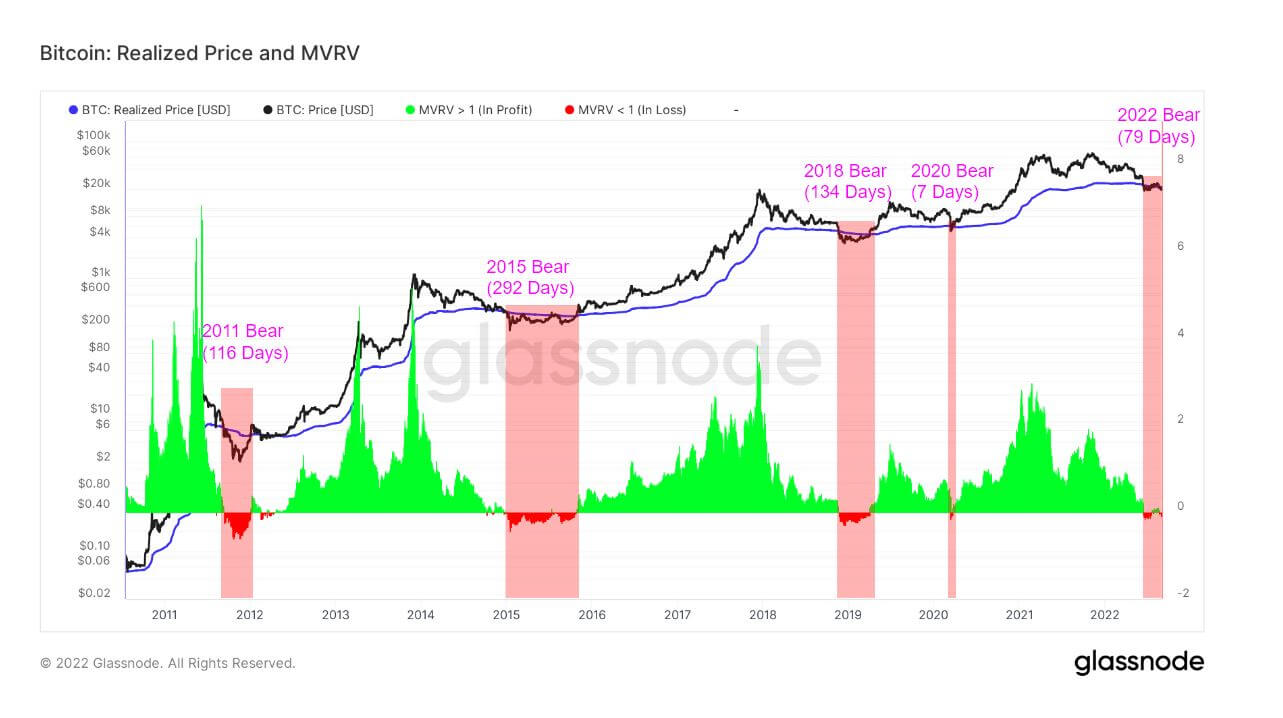

Bitcoin has fallen below its realized price in all previous bear market cycles. After 79 days in the red, Bitcoin's current price suggests a bottom may be forming around $20,000.

To determine a market bottom, various sets of data must be examined. When it comes to Bitcoin, however, there are two commonly used on-chain metrics that have historically acted as reliable predictors of its price bottom — realized price and MVRV ratio.

The realized price is the average price of the Bitcoin supply as of the day each coin was last transacted on-chain. Realized price is an important metric because it represents the market's cost basis. The MVRV ratio is the ratio of Bitcoin's market capitalization to its realized value. The ratio is used to assess market profitability and is a reliable indicator of whether Bitcoin's current price is above or below "fair value."

When the spot price of Bitcoin falls below the realized price, the MVRV ratio falls below one. This indicates that investors are holding coins at a discount to their cost basis and are carrying an unrealized loss.

A consistent MVRV ratio indicates where support is forming and, when combined with additional analysis of the realized price, can indicate a market bottom.

Throughout Bitcoin's previous bear market cycles, prices have fallen below the 200-week moving average realized price. The average dip below the realized price has lasted 180 days since 2011, with the exception of March 2020, when the dip lasted only 7 days.

Bitcoin's price has remained below the MVRV ratio for 79 days as part of the ongoing bear market that began in May with Terra's collapse. While Bitcoin's price managed to break through the MVRV ratio in the final week of August, it's still too early to tell whether this marks the end of the bear market.

What it does indicate is the formation of strong resistance at the $20,000 levels. This resistance ultimately determines the market's strength and the potential low it could reach in a future bear cycle.

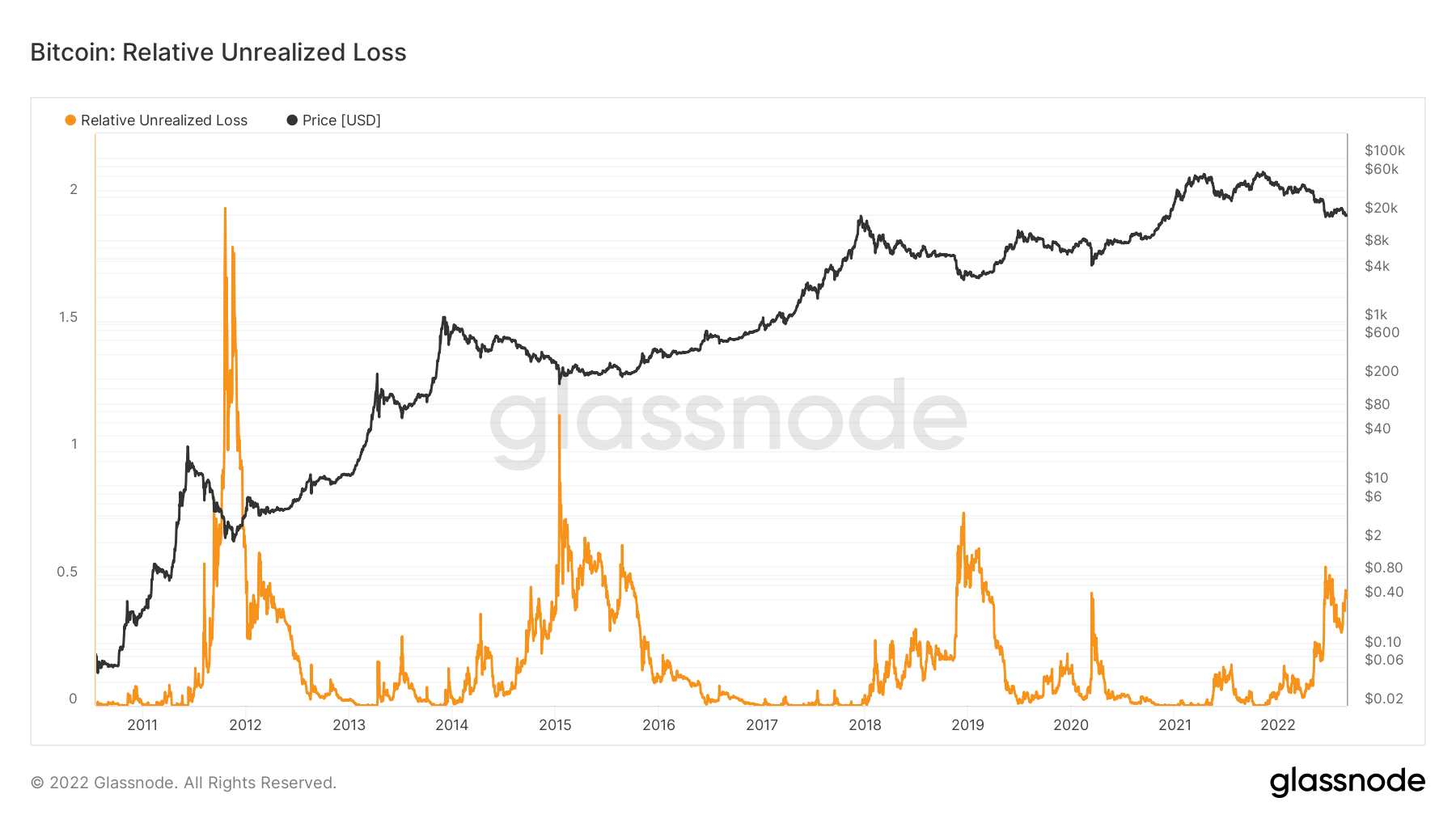

According to Glassnode data, Bitcoin's relative unrealized loss increased significantly in August, following a similarly sharp increase at the start of the summer. The relative unrealized loss shows how much value coins whose realization price was higher than the current price lost. A rising unrealized loss score indicates that addresses are keeping their coins despite their relative depreciation and not selling them at a loss.

Looking at historical data, Bitcoin posted a higher low every time the unrealized relative loss spiked. Bitcoin attempted to retest the high it reached before the bear market in each subsequent market cycle, but almost always failed to beat it. It took at least two years for Bitcoin's price to reach the previous market cycle's high.

According to the data, there is a good chance that a bottom is forming. While this suggests an upward price movement in the coming months, it could be another two years before the market fully recovers and enters a full-fledged bull run.

related video:

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.