More On: btc

Bitcoin mining hash rate increases by 60% despite falling revenue per terra hash

BTC research: Bitcoin's realized price indicates that a bottom may be forming

Bitcoin sell-off causes $20 million in long positions to be liquidated

Daily Crypto Wrapped: BTC short liquidations exceed $9 million, and Ava Labs CEO calls CryptoLeaks allegations a 'conspiracy theory'

Ethereum (ETH) hits $2000 as Merge nears

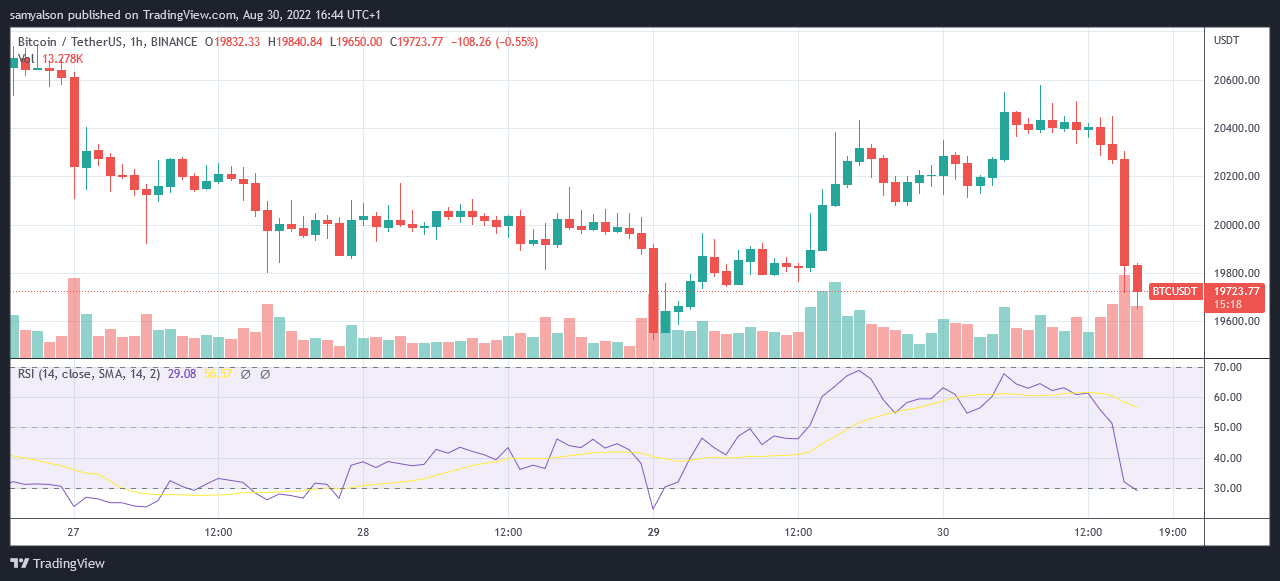

Bears pushed Bitcoin down below $20,000 as macroeconomic concerns continued to weigh heavily. Meanwhile, derivatives traders are indicating a pessimistic outlook.

Bitcoin bears have driven the price down below $19,600 in the last hour, wiping off the majority of yesterday's gains. The next level of assistance is at $19,200.

Previous instances of psychologically losing the $20,000 threshold have resulted in recovery in that area. However, due to macro worries, such as runaway inflation and the Fed's apparent incapacity to address the issue, some experts predict BTC to go below the previous $17,600 local low, which was reached on June 18.

Meanwhile, according to Glasscoin, the decline was accompanied by the liquidation of $20.28 million in longs. On August 29, $9 million in shorts were liquidated due to choppy price activity.

Bitcoin market interest

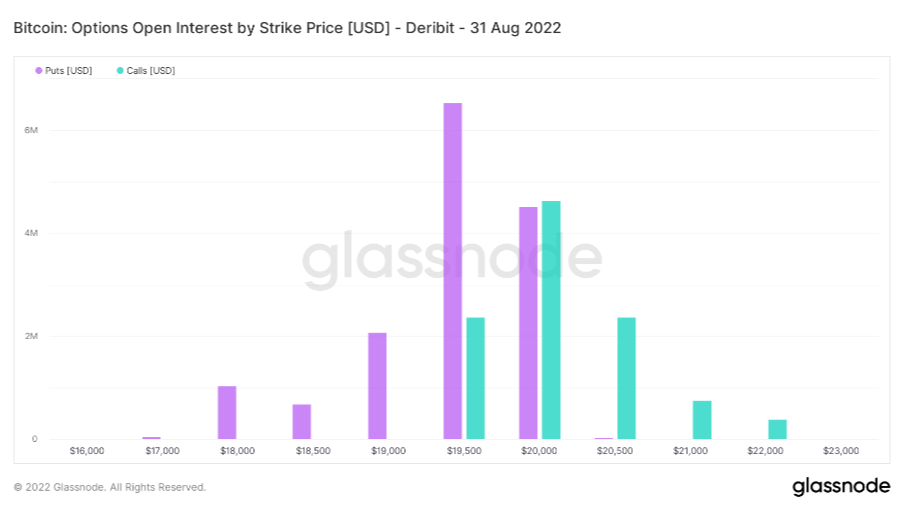

For August 31, data from Glassnode on Deribit's Bitcoin Open Interest by Strike Price indicates puts at $19,500 as the most favored call by traders.

The strike price is the price at which a put or call option may be executed, indicating that traders anticipate the BTC price falling below $19,500 and intend to sell their contract holdings.

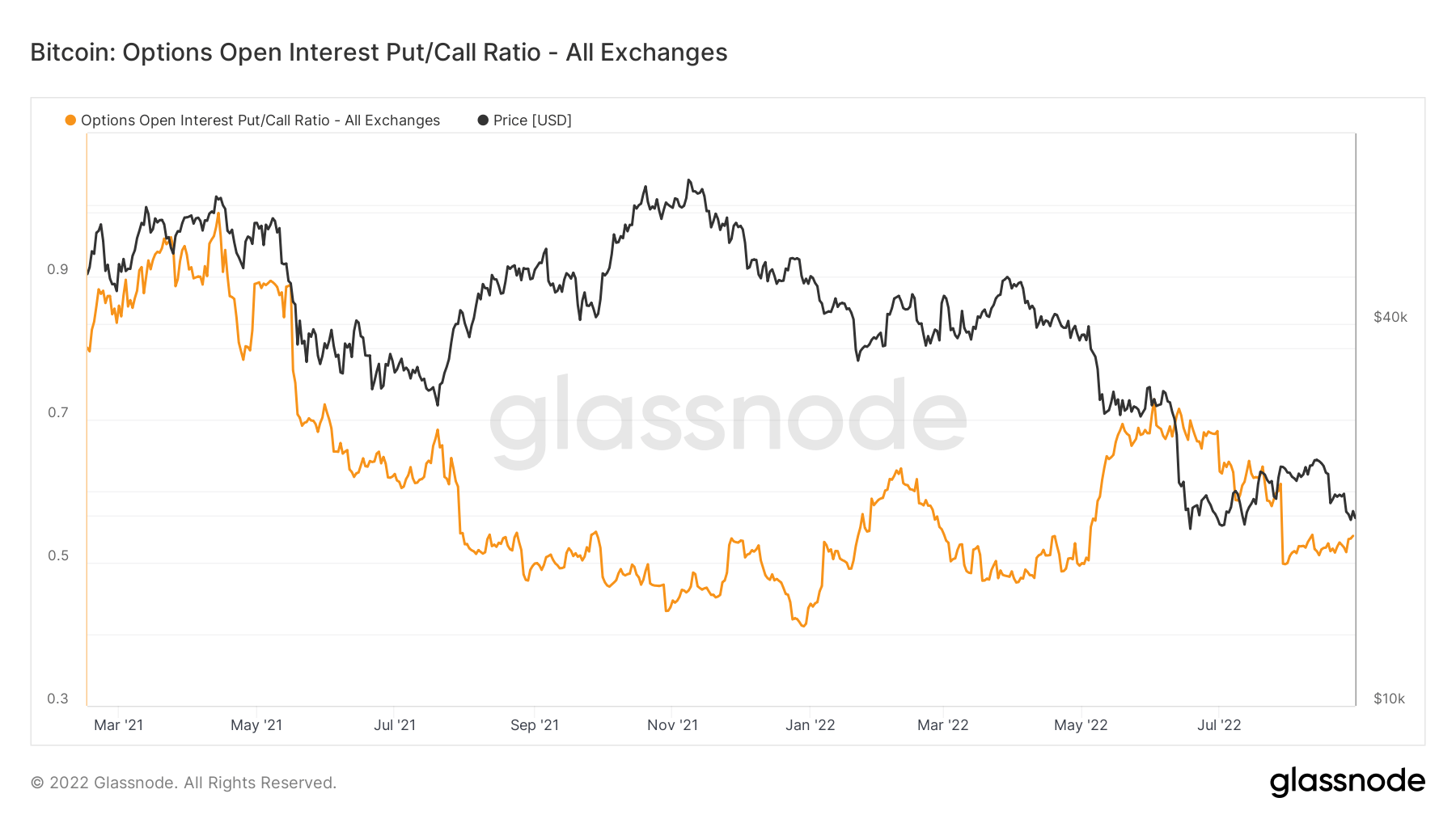

Similarly, as shown in the figure below, the Put/Call ratio has been progressively increasing in recent weeks, indicating pessimistic sentiment among derivative traders.

related video

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.