More On: btc

Bitcoin mining hash rate increases by 60% despite falling revenue per terra hash

BTC research: Bitcoin's realized price indicates that a bottom may be forming

Bitcoin sell-off causes $20 million in long positions to be liquidated

Daily Crypto Wrapped: BTC short liquidations exceed $9 million, and Ava Labs CEO calls CryptoLeaks allegations a 'conspiracy theory'

Ethereum (ETH) hits $2000 as Merge nears

Bitcoin is up 5% today, as the July 4th daily candle is about to close. During the holiday season, market optimism increased, and Celsius FUD faded.

Celsius lending, which froze customers' funds around the time of the June Bitcoin crash to $17,600 and Ethereum crash to $880, has reduced the price at which their Bitcoin assets will be liquidated.

Why is Bitcoin increasing in value?

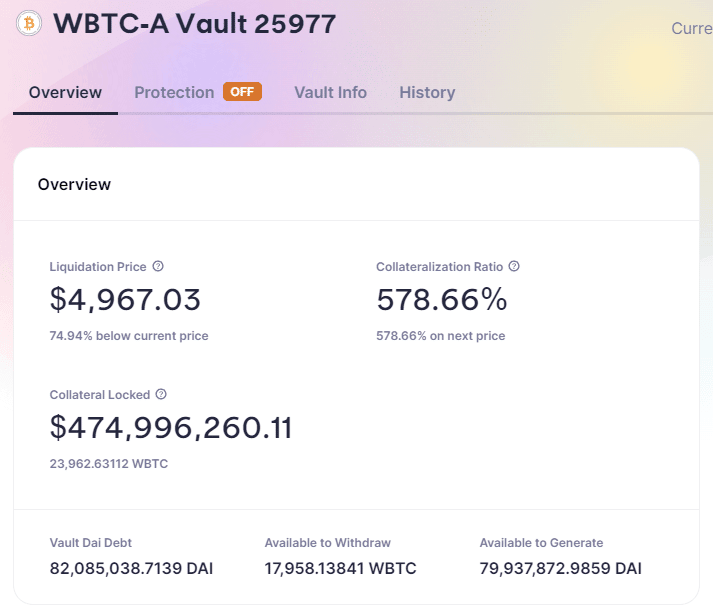

The latest Celsius liquidation price of $4,967 - a significant decrease from around $14k, then $12k - significantly reduces the chances of a flash crash in the crypto markets.

If Celsius were to liquidate their position, their position is so large - 23,962 BTC - that there may not be enough willing buyers with bids to fill below that point. Liquidation is the forced market sale of a position.

Traders reacted favorably to the lower likelihood of a larger Bitcoin crash, which could take months to recover from, and the higher likelihood of the Bitcoin bottom already being in place for 2022 at $17,600 - or close to it (lows tend to get run again).

Some previously bearish crypto traders have turned bullish, at least in the short term, for a relief rally; for example, TraderSZ is long with a price target of $22k.

Another reason Bitcoin is rising could be CZ Binance, the CEO of the Binance exchange, tweeting about the good news that banks can now hold Bitcoin as reserves. If just 1% of bank holdings were BTC, it would amount to trillions of dollars, raising the price of Bitcoin, which currently has a market cap of $386 billion.

Banks now use #bitcoin for reserves. Probably nothing.

— CZ 🔶 Binance (@cz_binance) July 3, 2022

» Bank for International Settlements to allow banks to keep 1% of reserves in Bitcoin https://t.co/4ge46zZMWE

During the recent 'crypto winter' and wider financial market correction in 2022, the total crypto market cap fell below $1 trillion to $762 billion. Although it is also recovering and rising, currently standing at around $900 billion. Its all-time high was just over $3 trillion in November 2021.

Will Bitcoin Increase in 2022?

However, a large volume of Bitcoin long positions were opened on crypto exchanges on July 4th - trader optimism tends to improve during holiday periods, according to Santiment data. One of the largest markets, the United States, is betting heavily on Bitcoin's continued rise.

If the price corrects to around $19,400 and some of those positions are liquidated, it could fuel further downside movement and sweep the June 18th lows of $17,600. Based on the low order flow that day, a Saturday, some respected analysts, such as @jimtalbot, have predicted on streams that the June bottom will be tested again.

Some long-term Bitcoin bulls predict that it will take an accumulation cycle of one or two years up to the next Bitcoin halving - in mid-2024 - before Bitcoin can truly recover and rise to new highs.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.