More On: btc

Bitcoin mining hash rate increases by 60% despite falling revenue per terra hash

BTC research: Bitcoin's realized price indicates that a bottom may be forming

Bitcoin sell-off causes $20 million in long positions to be liquidated

Daily Crypto Wrapped: BTC short liquidations exceed $9 million, and Ava Labs CEO calls CryptoLeaks allegations a 'conspiracy theory'

Ethereum (ETH) hits $2000 as Merge nears

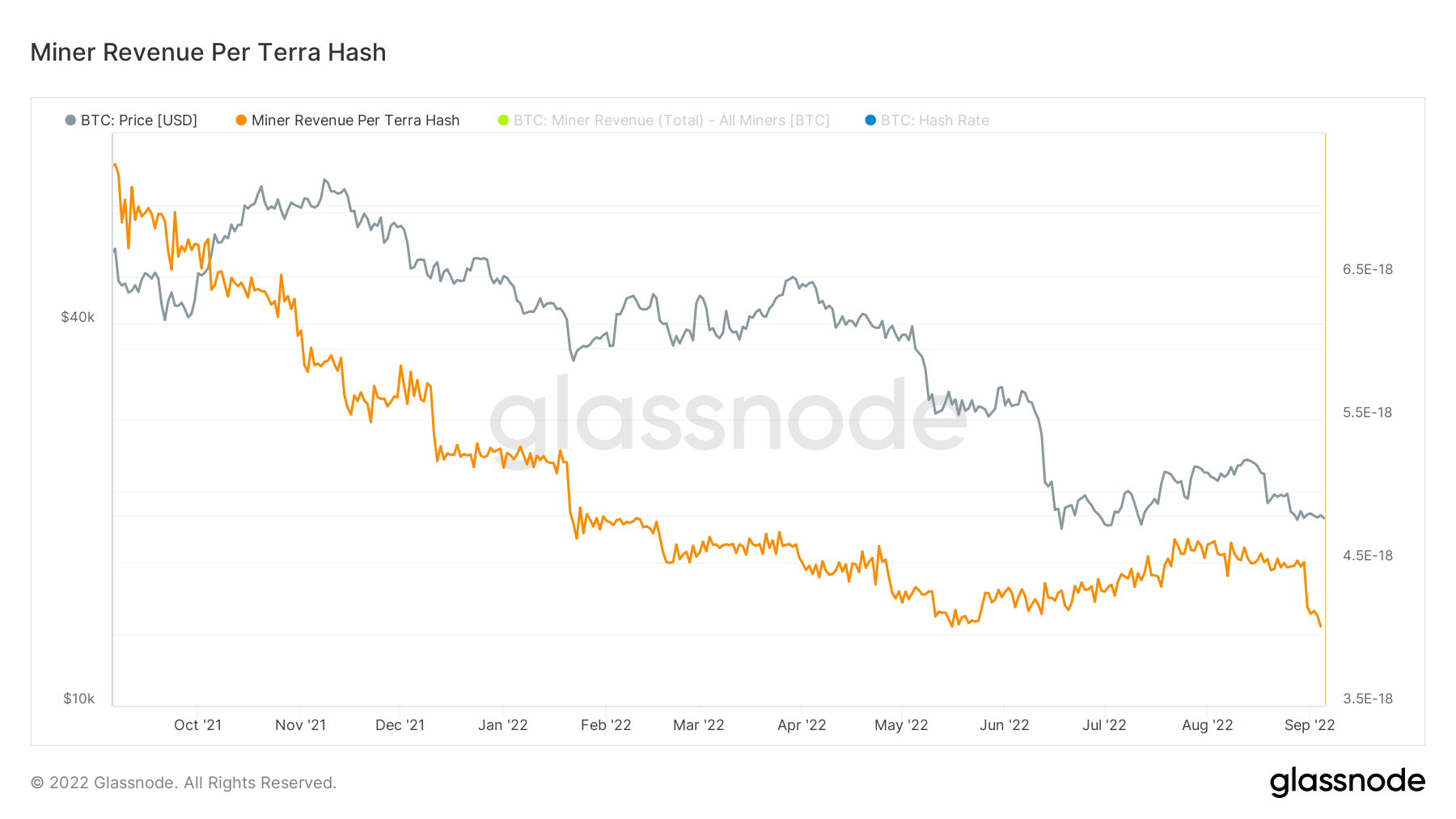

The Bitcoin hash rate continues to increase but the revenue per tera hash continues to decline.

The Bitcoin mining hash rate reached a maximum of 298.5134 EH/s on September 4, a +60% increase in just 24 hours.

Mati Greenspan, the founder of the fintech research firm Quantum Economics, stated that the rising hash rate marked a new all-time high for the leading cryptocurrency.

Huge spike in bitcoin's hashrate this weekend. New record high attained. pic.twitter.com/p7AQZBxNuO

— Mati Greenspan (@MatiGreenspan) September 4, 2022

Despite a decline in June due to the Terra implosion and related liquidity crisis, a year review of the hash rate revealed an upward pattern of higher highs, which was far from an anomaly.

Throughout this time period, Bitcoin's price has depreciated, lending support to the claim that hash rate and price are unrelated.

Price volatility persists.

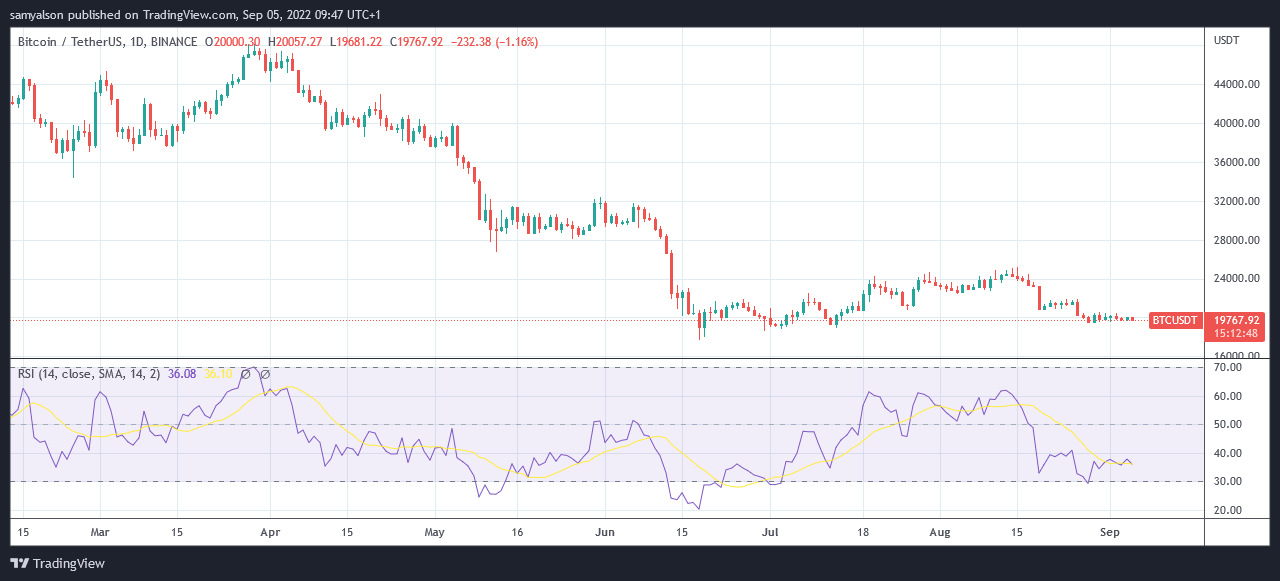

After bottoming out at $17,600 on June 18, Bitcoin began a slow ascent that culminated on August 15 at $25,100.

Since then, macro events have taken hold as market participants exercise prudence in response to the impending danger of interest rate hikes.

BTC has been trending downwards since August 28 and is currently trapped in a tight trading range between $19,400 and $20,400.

Recent commentary by analyst MarcPMarkets indicates that the bearishness on the stock market and the rising dollar weigh heavily on Bitcoin. He said:

"...the bearish price action in the S&P and the Dollar's new highs continue to foster an atmosphere that supports LOWER prices over the next week or two."

Bitcoin miners under pressure

The strain on Bitcoin miners is increasing because to price volatility. Since the market's peak in November 2021, miner revenue per tera hash has continued to decline, as depicted in the graph below.

Recent events have caused a substantial decline in revenue per terra hash, despite the fact that a bottom was reached in late May, resulting in a gradual increase.

In tandem with the rising hash rate, the mining difficulty is also increasing. Between May 11 and May 24, mining difficulty reached an all-time high of 31.25 T, which was surpassed by 30.98 T on August 31.

For the time being, all attention is focused on the Bitcoin price, as more sell-offs will compel inefficient miners to cease operations.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.