More On: Bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

Not all cryptocurrencies are created equal, and Bitcoin stands out as one of the first decentralized digital assets.

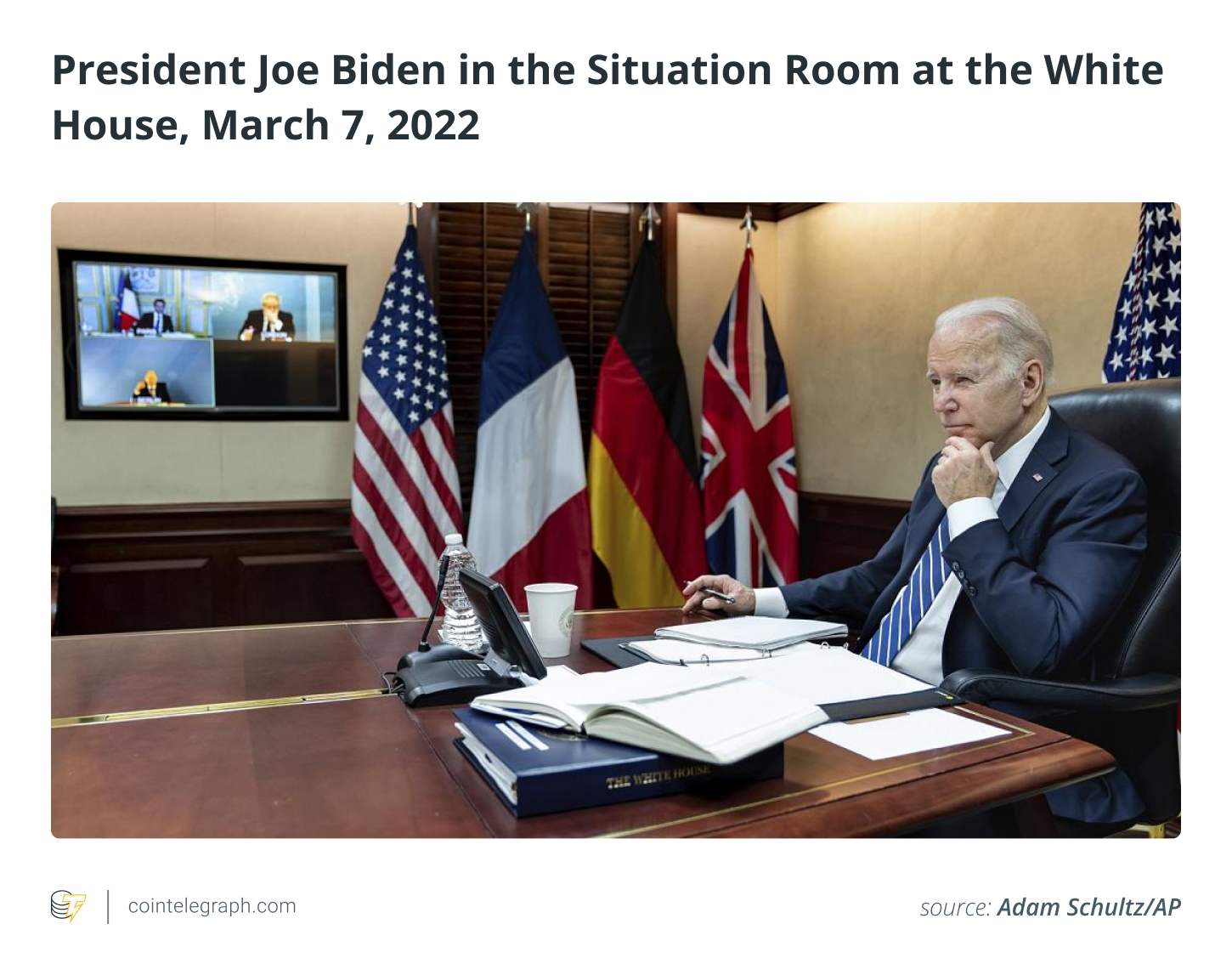

President Joe Biden's executive order on digital assets has launched an interagency mission to promote financial innovation while safeguarding the interests of American consumers. Some critics expect for a crackdown, while many sector executives applaud the collaborative tone. We can't say we blame them.

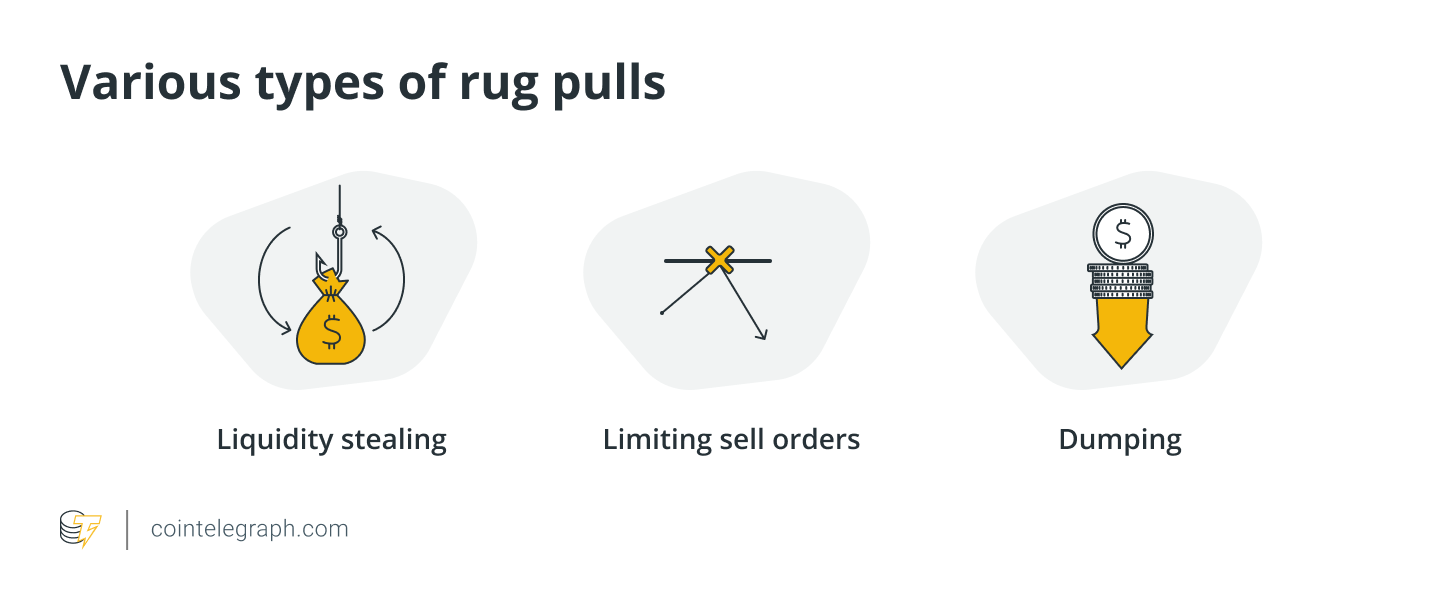

Many cryptocurrency projects hide behind thin decentralized veils. They're sold on the basis of distributing power in public. Leaders control the strings from behind the scenes. A chronic scammer and felon directed a $1 billion treasury in the recent case of Wonderland.

Many projects pay influencers to promote their coins in secret. The cost rises. Insiders are dumping. Investors that are naive lose money. The shills are sometimes celebrities. And, on occasion, those celebs let go the shockingly inexpensive price of their honesty.

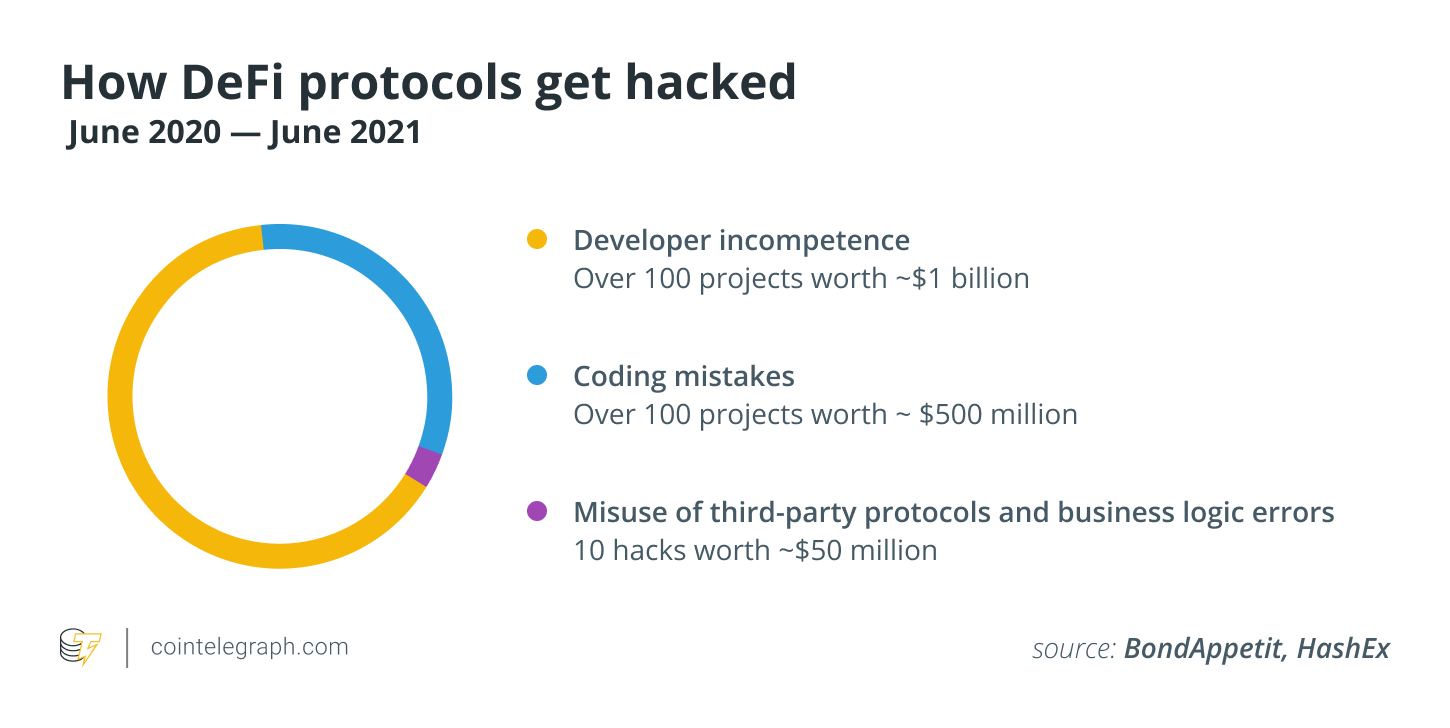

Hundreds of projects are affected by technical flaws. Hackers seem to find hidden software problems every week. Early in February, the third-largest ever occurred, with $326 million — gone. Then there was another $600 million in late March – poof.

Many cryptocurrencies are outright frauds, some of which are openly pyramid-shaped. Exit scams ("rug pulls") and pyramid-shaped enterprises ("Ponzis") are common words used by market participants to describe them.

To the untrained eye, cryptocurrencies resemble tomatoes pasted in Aisle 9 – except more unpleasant, useless, and numerous. Cynics regard the cryptocurrency menu as a proxy most-wanted list. Neither side is totally correct.

One item on the menu, however, stands out. It is perhaps one of the most significant technology breakthroughs since the internet. We don't mind if you buy it or not. But there is one point that we three professors want to convey: Bitcoin (BTC) is unique. It is worthy of investigation and debate.

Let’s talk about Bitcoin

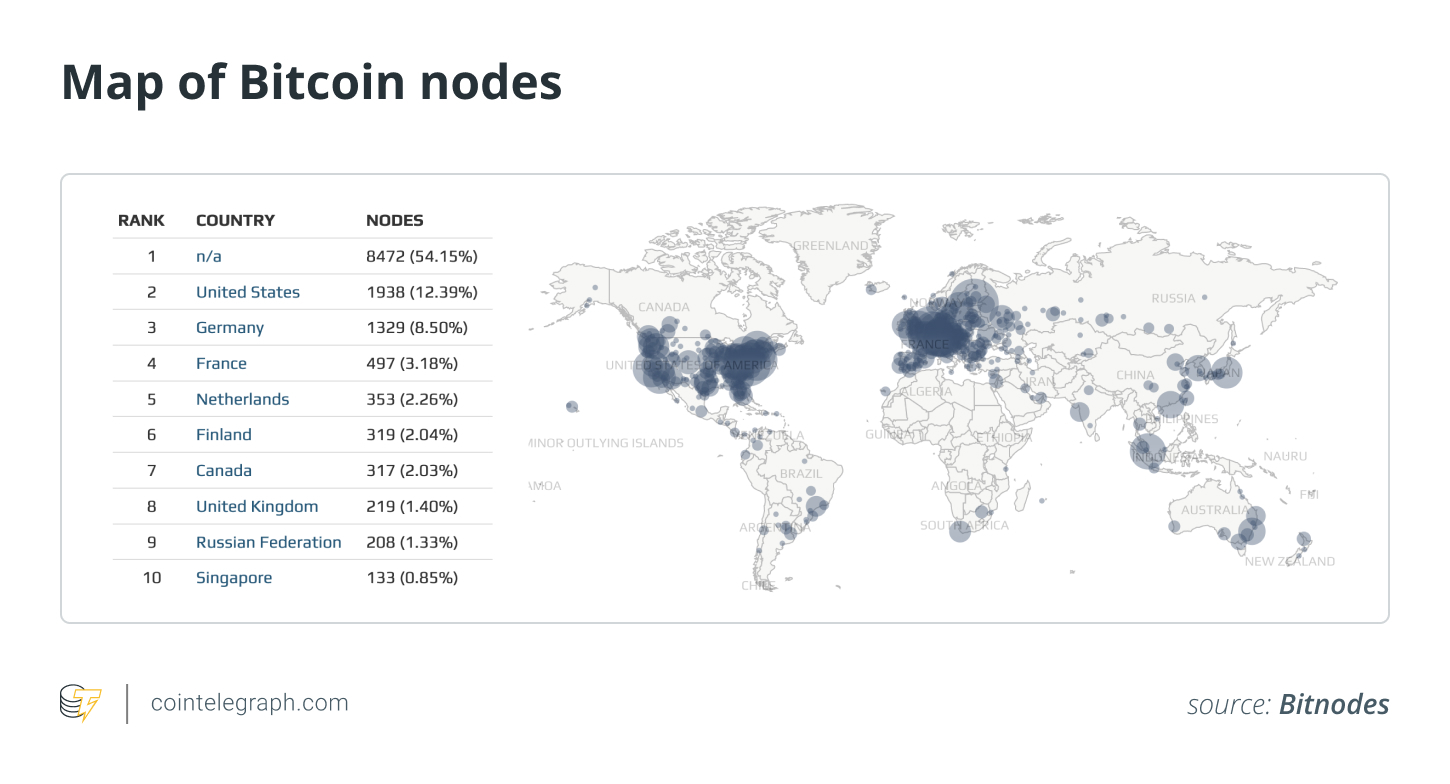

Bitcoin is a truly decentralized currency. Thousands of people run nodes all around the world. Operating a node is simple; with an internet-connected computer and a few hundred gigabytes of storage, you could do so in under an hour. These nodes vetoed a contentious modification to Bitcoin in 2017 that would have increased network centralization by making it more difficult for ordinary individuals to run nodes. They defeated the majority of Bitcoin miners, exchanges, and other powerful legacy players in the process.

Bitcoin is fair because of its decentralization. No foundation owns a trademark or has control over its financial policy. This is in stark contrast to more centralized cryptocurrencies, as well as the Federal Reserve. Three Federal Reserve officials have resigned in the last year after a string of, shall we say, well-timed deals. There have never been any officials in Bitcoin who have resigned in disgrace. These jobs are automated by the network.

Bitcoin is secure due of its decentralization. The majority of money is digital, and it is controlled by third parties such as banks and payment processors. However, innocent Russian and Canadian residents remind us that third parties, especially when under state coercion, can freeze and take their balances. Reliance on external parties puts money at risk. Bitcoin users can keep their own private keys and so save and send money without the involvement of third parties. Other cryptocurrencies pale in comparison to Bitcoin. Bitcoin's unrivaled level of decentralization makes it the safe sanctuary against government and corporate encroachment in the digital era.

Bitcoin, unlike most other cryptocurrencies, never had a secret token sale to venture capitalists or an initial coin offering (ICO) to benefit insiders. The most extensively used digital asset is bitcoin. It has no insiders in the sense that it only has early adopters.

Satoshi Nakamoto, the most prominent early adopter, mined over a million Bitcoins (5 percent of the maximum supply). Satoshi's assets are totally transparent, and he has never spent a penny. Most other cryptocurrencies reward the wealthy, sometimes in secret, and give them more control over the network. This isn't the case with Bitcoin.

While some initiatives advance quickly and cause problems, Bitcoin moves slowly but steadily. Bugs are uncommon. Granted, this cautious approach has drawbacks. Upgrades are almost as uncommon as bugs. Bitcoin is also less flexible than other platforms. Countries and corporations, on the other hand, feel safe with Bitcoin on their financial sheets.

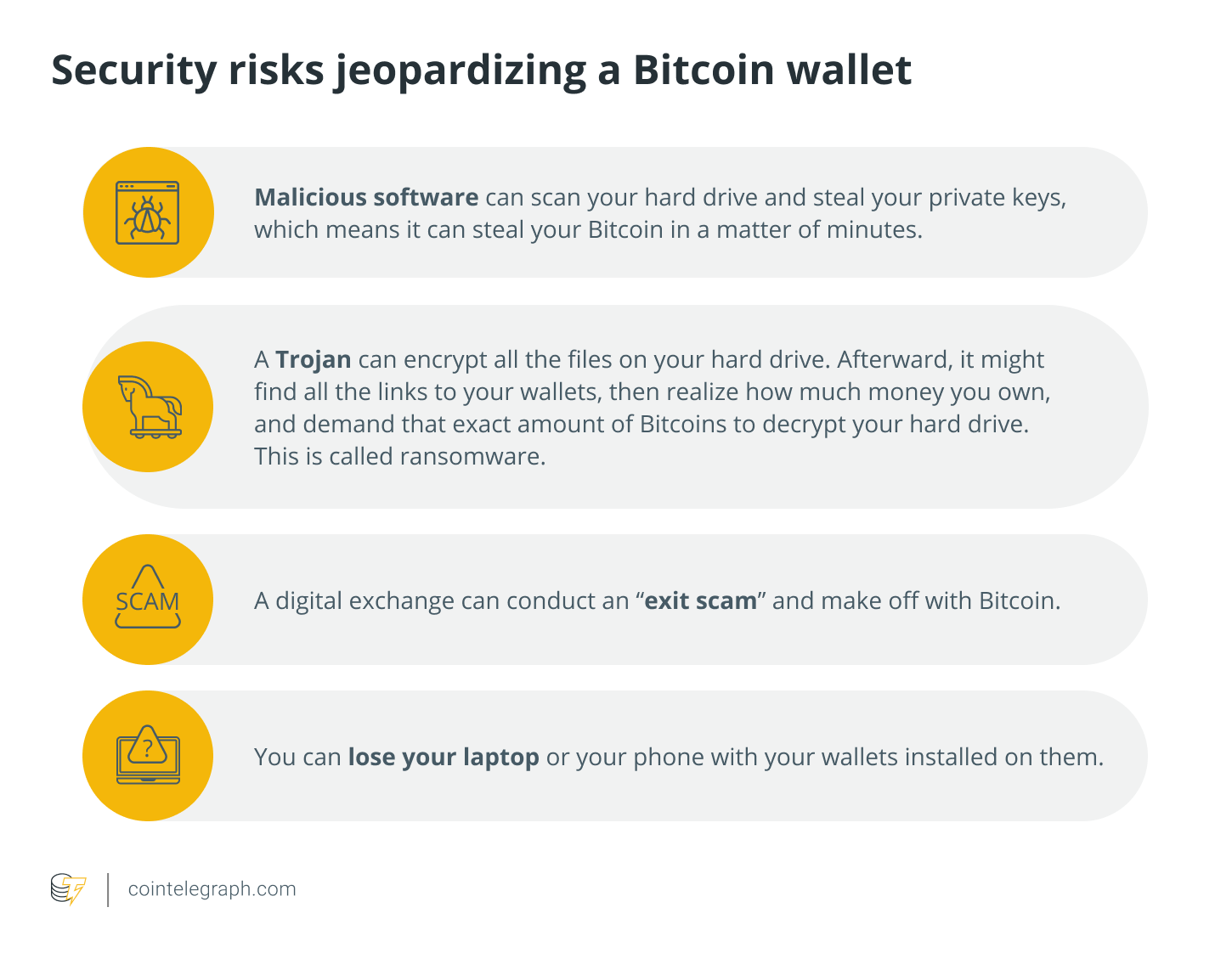

You've probably heard of hacking and Bitcoin theft. These instances do not involve Bitcoin's own flaws. Instead, they show the dangers of storing keys insecurely or relying on third-party custodians.

Finally, Bitcoin is a genuine currency. It, like the US dollar or other digital assets, can surely be exploited in scams. However, just as the Federal Reserve System does with the US currency, the Bitcoin network offers final settlement of its native asset. The Bitcoin price is subject to wild speculation. This is how early-stage invention works. Even as rich Westerners speculate, people all across the world require it.

To be sure, there are tradeoffs in Bitcoin's design. Privacy is difficult, but not impossible, because to its public ledger. It requires energy to maintain its safety. Price volatility is caused by the fixed supply. Despite this, Bitcoin has evolved into a unique monetary system that is independent of government authority. Ideologues will scoff as they search for the perfect — but ephemeral — monetary system. Wise and pragmatic policymakers, on the other hand, will aim to improve the world through Bitcoin.

Here’s what that means for public policy

To begin with, we should not presume that cryptocurrencies have more in common than they do. Bitcoin is the most popular because no one else is. The policy must start with a foundation of knowledge — not of cryptocurrencies in general, but of Bitcoin specifically. Digital assets are here to stay, as President Biden's executive order indicates. Bitcoin itself isn't going anywhere, so the category as a whole isn't going anywhere. It deserves special consideration. Bitcoin first, not only Bitcoin.

Second, because the network has no leader, Bitcoin is considered neutral. As a result, the United States can use and support Bitcoin without having to "choose winners and losers." Bitcoin has already proven itself to be a globally impartial monetary network. Nurturing the Bitcoin network, utilizing Bitcoin as a reserve asset, and accepting Bitcoin payments would be similar to deploying gold within the monetary system – except digital, more portable, more divisible, and easier to audit and verify.

President Biden deserves praise for realizing the importance of digital assets. To promote innovation and nurture what's already here, we'll need all hands on deck, including computer scientists, economists, philosophers, lawyers, political scientists, and others.

=====

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.