More On: BITCOIN

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

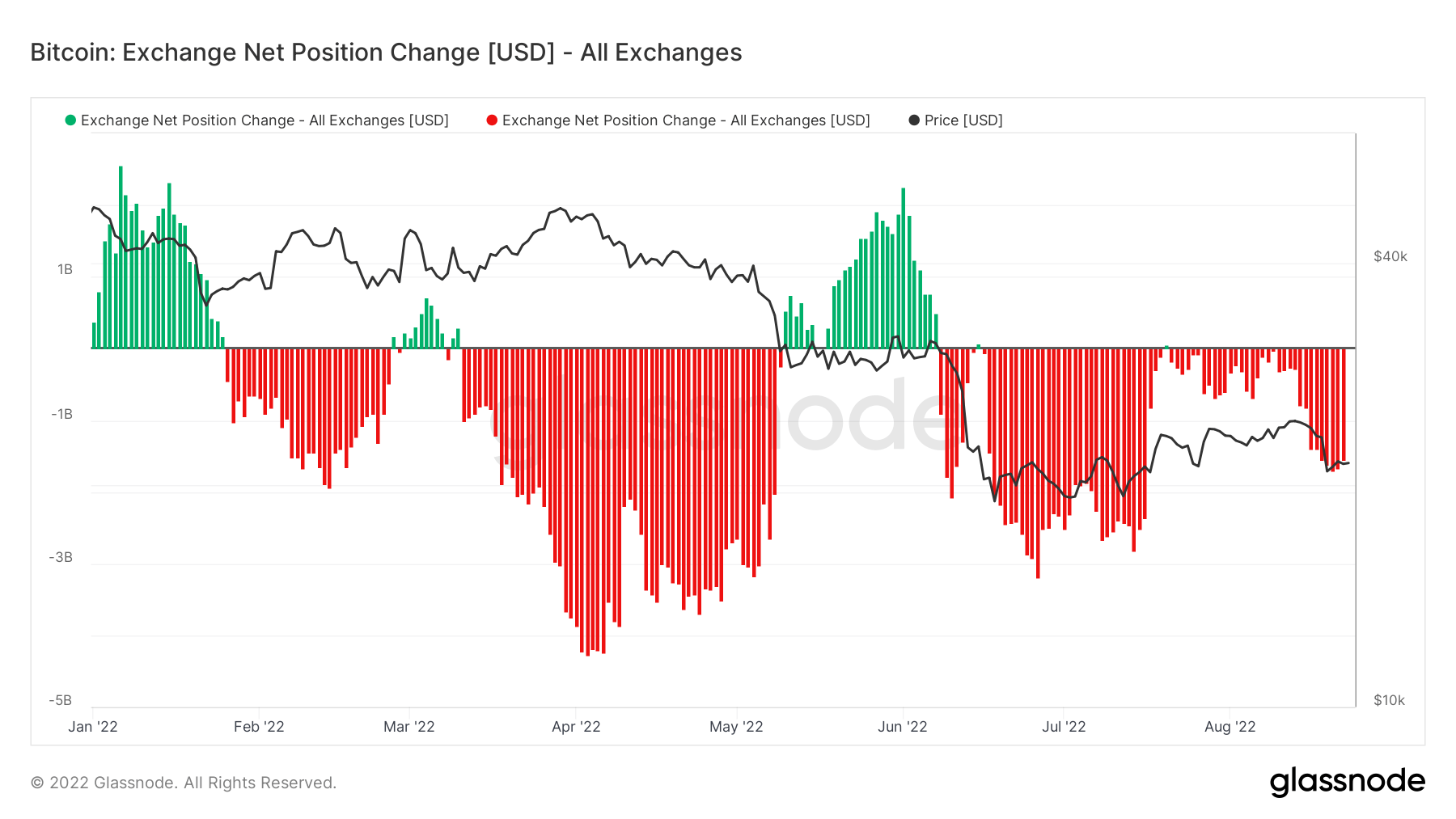

Exchange Net Position Change charts for Bitcoin and Ethereum reveal differing activity, indicating that investors favor BTC over ETH.

Analysis of Bitcoin and Ethereum trade flows indicated diametrically opposed behavior for the top two tokens, with the market leader establishing clear dominance in terms of long-term ownership.

The number of tokens deposited or withdrawn into or out of an exchange wallet is referred to as exchange flows. Exchange Net Position Change is a prominent on-chain statistic for assessing this.

Exchange inflows are often regarded as negative since the major purpose for transferring tokens to an exchange is to sell the token. In contrast, exchange outflows are often regarded positive since tokens are typically withdrawn with the intention of retaining for the long term.

The movement of tokens into and out of exchanges may be used to identify whether investors are bearish or bullish.

Changes in the Bitcoin Exchange's Net Position

Following severe price losses caused by the Terra controversy and subsequent industry-wide de-leveraging, Bitcoin reached a low of $17,600 on June 18. The figure below depicts persistent exchange BTC outflows since the bottom, with daily outflows above $1 billion on average.

Despite Bitcoin falling to as low as $20,800 on August 19, the exchange outflow rate has grown dramatically in the recent week. This indicates that investors believe there is value in the present price range.

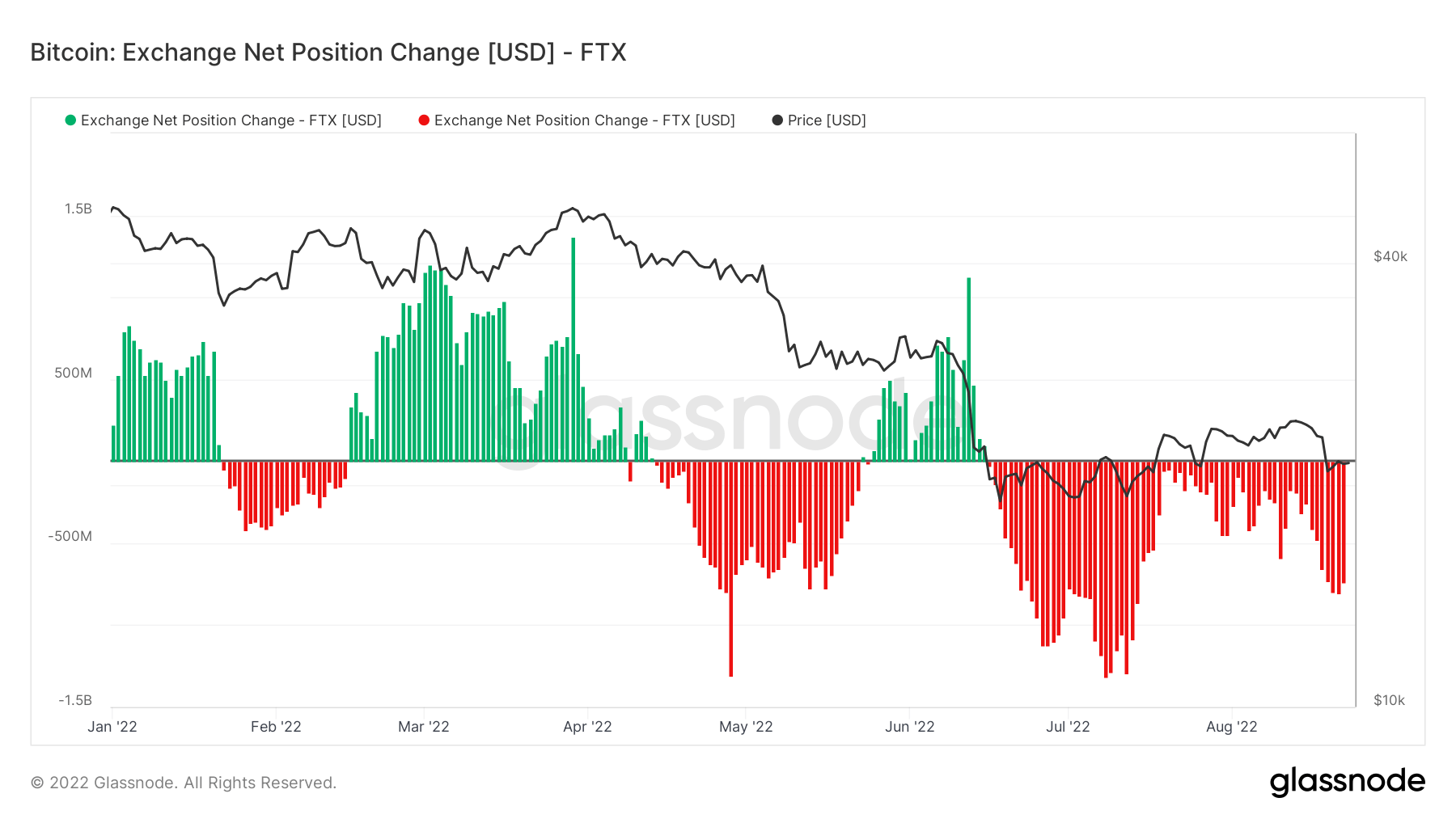

The FTX exchange accounted for more than half of all outflows in the previous week. This event has no evident basic causes. However, "leaked documents" revealed on August 20 that FTX increased its income by almost 1,000%, from $90 million in 2020 to $1 billion in 2021.

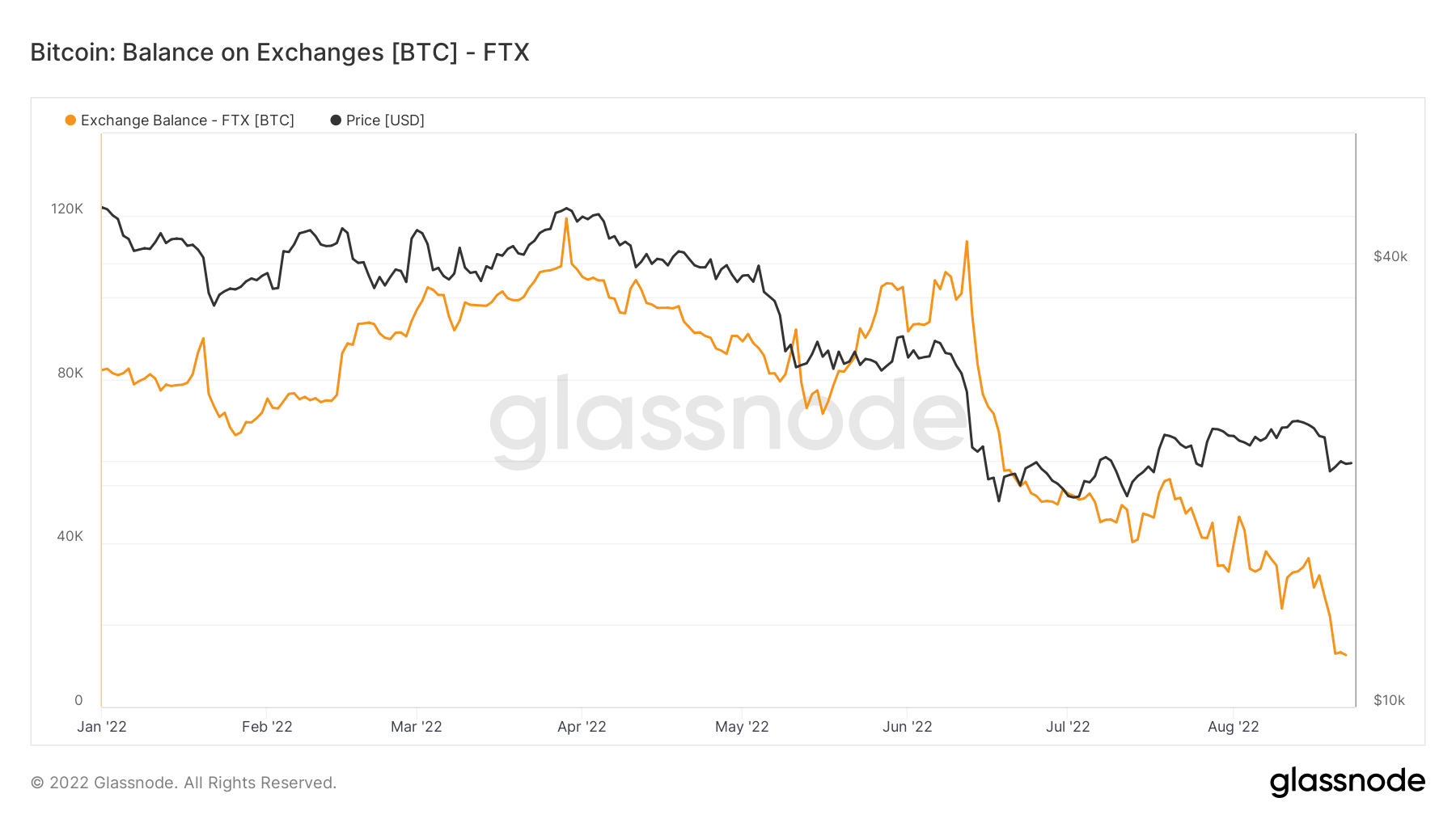

Further examination of FTX's BTC reserves reveals a considerable decrease in holdings. The business had around 120,000 BTC in March. However, this has now plummeted to just 13,000 tokens, with the period from June showing the steepest reduction, resulting to a gradual drop of BTC held.

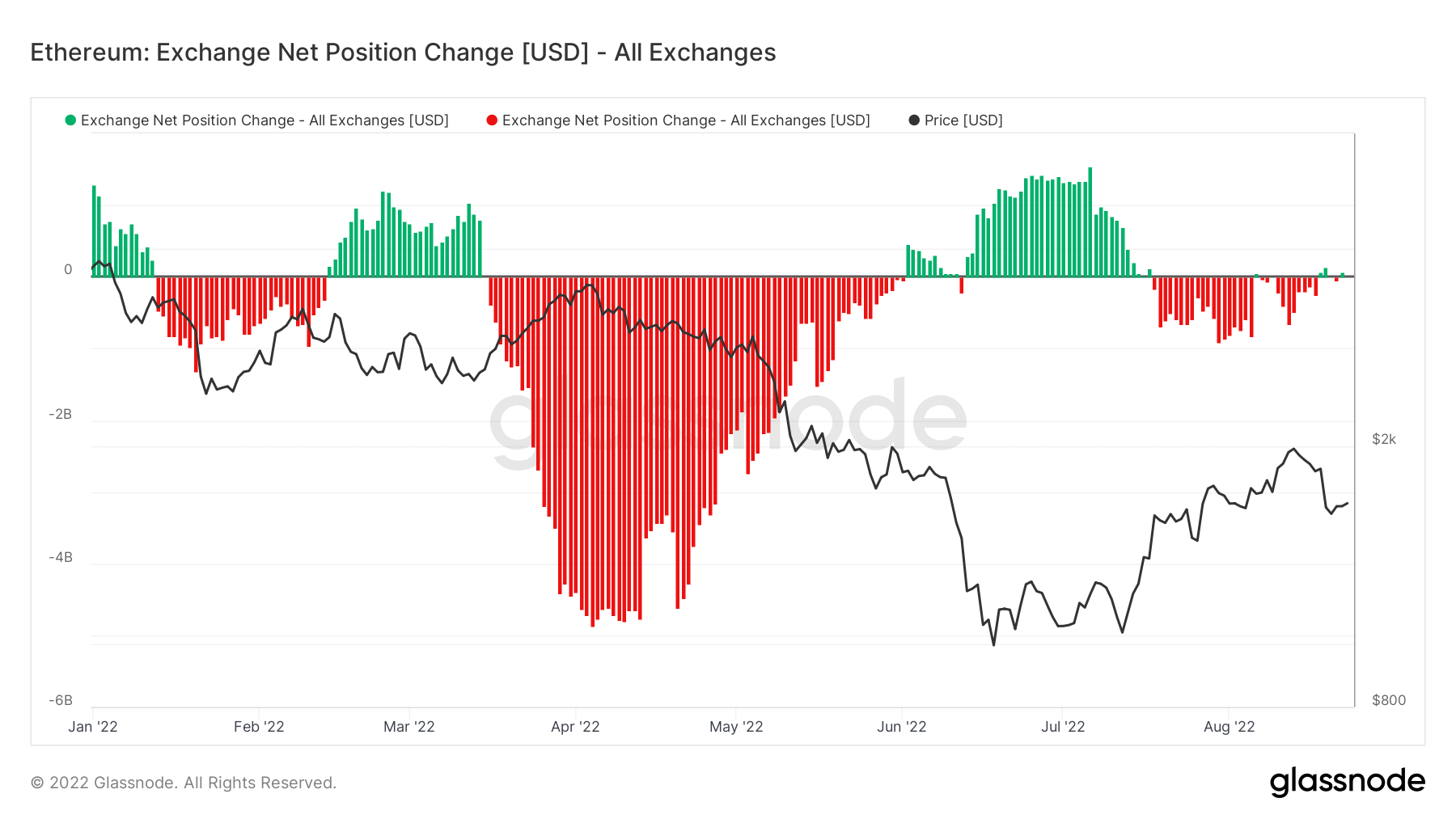

Change in the Net Position of the Ethereum Exchange

In comparison, Ethereum's Net Position Change reveals that, despite large outflows beginning in mid-March, the quantity of tokens leaving exchanges has reverted to around zero.

This is a bad indication, especially when the Merge is approaching. It suggests that investors believe the switch to Proof-of-Stake (PoS) is a case of "buy the rumor, sell the news."

The divergence in activity between Bitcoin and Ethereum may imply that investors see BTC, rather than ETH, as the long-term hedge against macroeconomic risks such as inflation or escalation of geopolitical tensions.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.