More On: binance

Binance now has more Bitcoin than Coinbase

French MEP calls Binance regulatory approval 'surprising and alarming'

CZ forecasts bitcoin's two-year decline

Binance's billionaire founder says he's 'poor again' after the Luna holdings: Once worth $1.6 billion, they have plummeted to barely $2,200

Binance's Middle East expansion has been approved by Abu Dhabi, and the CEO promises there will be more to come

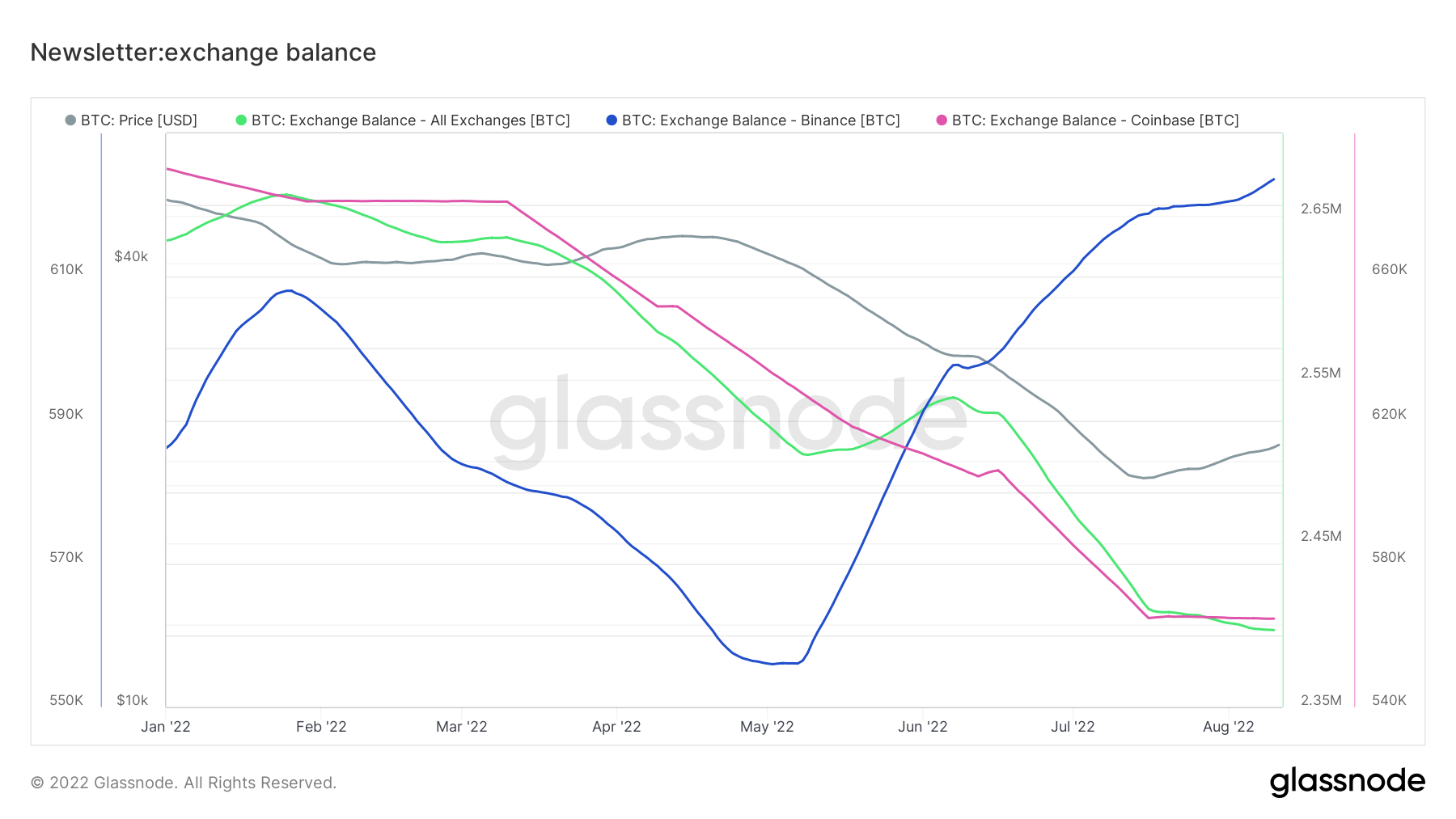

Since the beginning of the year, the quantity of Bitcoin owned by Binance and Coinbase has been declining. Binance's Bitcoin holdings began to rise in May, while Coinbase's continued to shrink.

The quantity of Bitcoin residing on exchanges was on a downward trend for both Coinbase and Binance from January 2022, until Binance's exchange balance abruptly reversed and began to increase in May. It is still rising, despite the fact that both the total and Coinbase exchange balances are declining.

The graph above depicts the cumulative Bitcoin exchange balance, the Bitcoin price, and the exchange balances of both Binance and Coinbase.

Since February, the green line depicting the cumulative exchange balance has been on a severe downward trend. There were around 2,6 million Bitcoins on exchanges at the start of the year. This figure is currently less than 2,4 million, indicating a net outflow of 200,000 Bitcoins.

This suggests that the supply of Bitcoin has been withdrawn from exchanges, indicating a long-term positive holding tendency.

Coinbase

Coinbase's total balance has followed the similar pattern. The exchange had approximately 690,000 Bitcoins at the start of the year, but it had dropped below 560,000 in eight months.

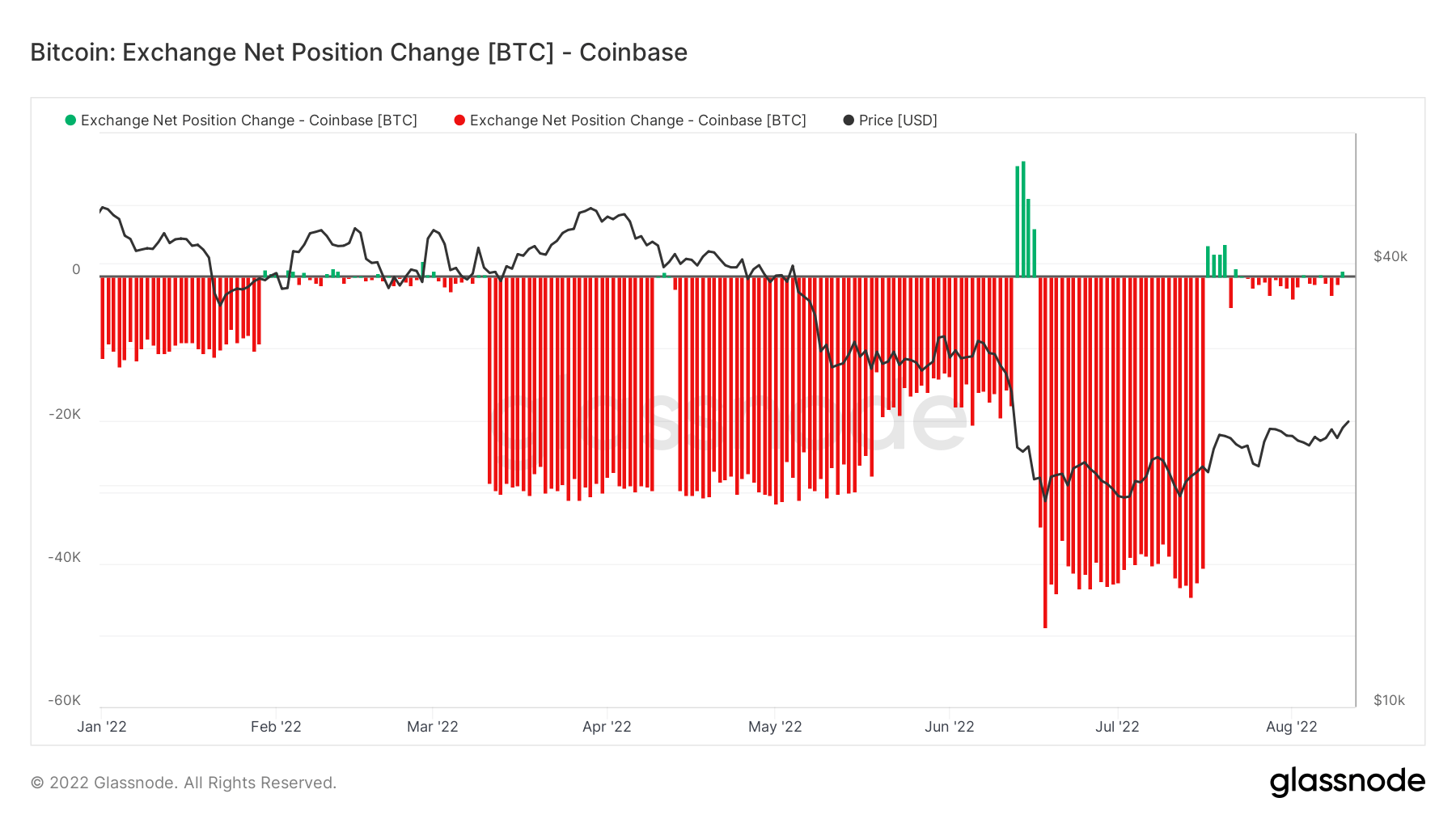

The above graph depicts the movement of currencies on Coinbase. The red lines represent Bitcoins leaving the exchange, and the green lines represent entering balances. Since the beginning of the year, Coinbase has seen a significant quantity of Bitcoin removed. Furthermore, the sums taken out more than doubled twice between March and May, and again in July.

The fact that US institutions favor Coinbase may have influenced these transactions. In a down market, institutions are more likely to buy and keep, which may have prompted them to withdraw their Bitcoins from Coinbase.

Binance

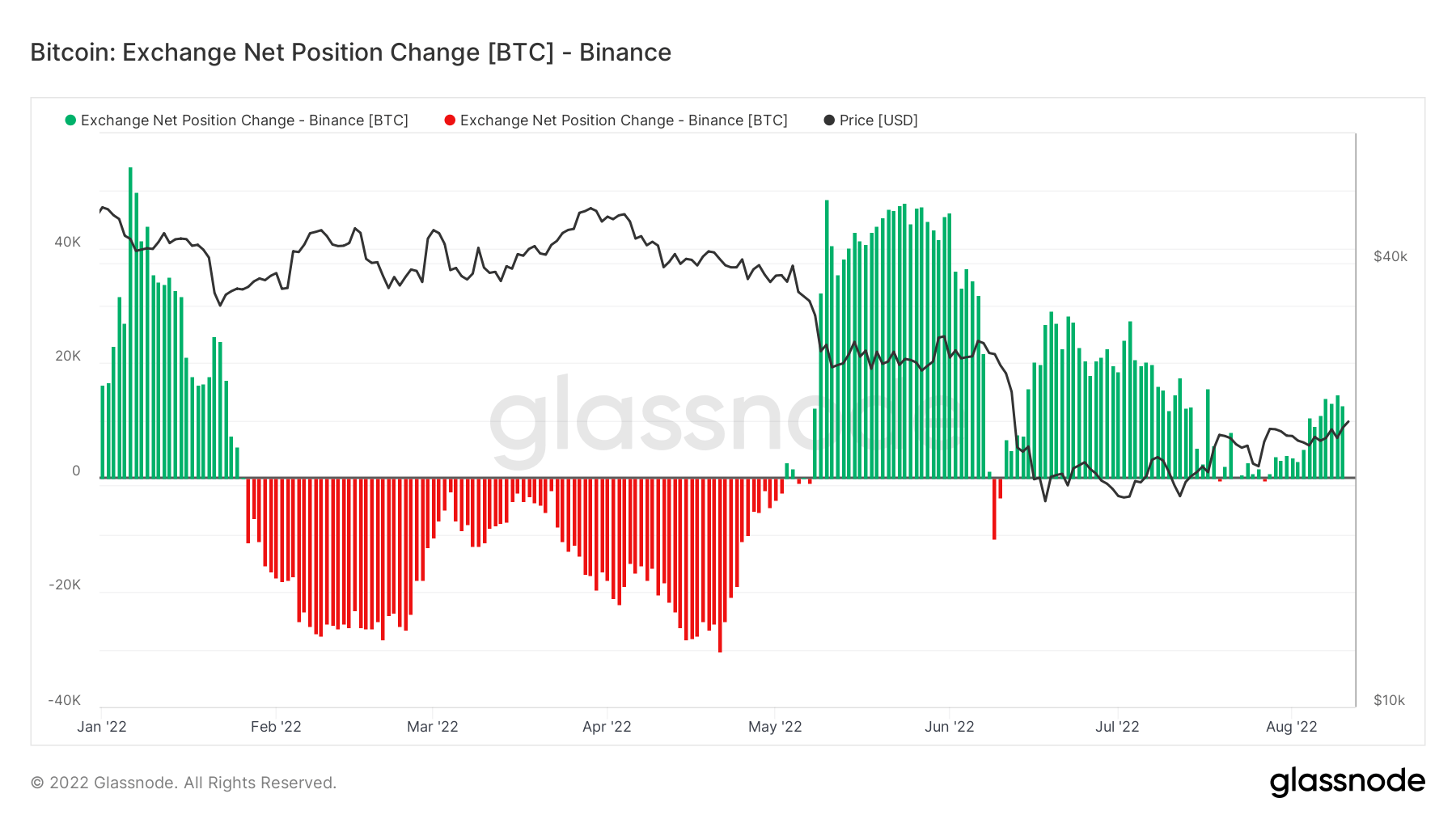

Despite being trapped in the same downturn at the start of the year, Binance finished up with more Bitcoins than in January. The exchange began the year with 586,000 Bitcoins, dipped below 560,000 until May, and concluded the year with 623,000 Bitcoins.

The figure above depicts the decline in Bitcoin reserves between February and May, which subsequently reverses.

Binance and Coinbase are in a bear market.

According to recent headlines, Binance and Coinbase are treating the winter market differently. While Binance is unfazed by the severe winter circumstances and continues to prioritize its consumers, Coinbase is dealing with layoffs, litigation, and bankruptcy rumors.

Binance

Binance U.S. was valued at $4.5 billion in a seed investment round before the coldest winter in crypto history began, and the exchange made the first step toward growing in Abu Dhabi. Binance kept investing and hiring even after the winter arrived. Changpeng Zhao, CEO of Binance, even stated that the firm is in a very affluent position and would begin purchasing other companies soon.

Coinbase

Coinbase, on the other hand, has been dealing with the bankruptcy language in its quarterly report since just before the winter season began. Soon after, Coinbase users reported that they had lost their Wormhole Lunas when attempting to transmit them to the exchange, which Coinbase declined to assist with at the time. The exchange was then sued by its customers as well as Craig Wright. In addition to dealing with them, the SEC has opened an inquiry into Coinbase's staking program.

Meanwhile, due to market conditions, the exchange unhired fresh candidates and lay off 1,100 staff following a petition against executives. Finally, according to Goldman Sachs, Coinbase's income might drop by 61% owing to the cold weather, and the firm may need to lay off additional employees to stay afloat.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.