More On: bnb

Binance now has more Bitcoin than Coinbase

Price Prediction: $975 in 2025 and $2,488 in 2030 for BNB

Aside from its connection to Bitcoin, Binance Coin benefits from this

Airbnb exec resigned over concerns company shared too much data with China

Airbnb files for IPO, reveals widening losses and falling revenue

The announcement of the $1 billion growth fund was a clear catalyst for the price of Binance Coin to rise, but after nearly a 15% increase, BNB's charts began to smell of stagnation.

Nonetheless, the third-largest altcoin by market cap had 13 percent weekly gains at the time of writing, while BTC's were 11.61 percent, so Binance Coin wasn't in terrible shape.

However, with prices on the shorter time frame consolidating and BNB recording a 1.70 percent drop on a daily basis, there were some interesting patterns that BNB appeared to be presenting.

The relationship between BNB and BTC

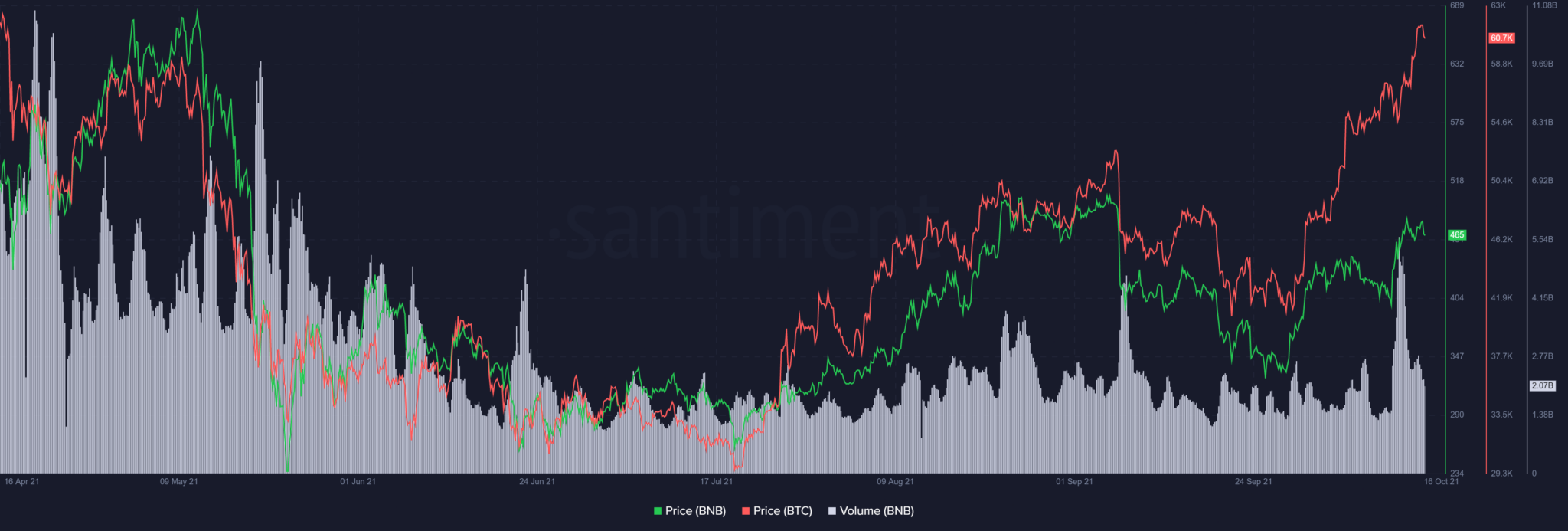

Even though the crypto market as a whole has a strong correlation with Bitcoin in terms of price, this correlation is often stronger for some coins than others. Binance Coin, like the king coin, has a high correlation with it, with a correlation coefficient of 0.8.

Source:Sanbase

The correlation coefficient, which is measured between +1 and 1, provides a statistical measure of the strength of the relationship between the relative movements of two coins. As a result, a higher value indicates that the asset is highly dependent on BTC in terms of price movement.

Notably, the trajectories of BTC and BNB have been strikingly similar throughout the year. What's interesting is that in the past, when BTC fell, BNB reacted strongly in terms of losses, but failed to recover those losses despite BTC scaling back up. Especially since October 13, 2021, BNB has not followed BTC's upward trend, and while it has seen some gains, they have not been as impressive as BTC's.

According to Macroaxis data, Bitcoin is expected to generate 0.9 times more return on investment than Binance Coin over a 90-day trading horizon. In addition, BTC is 1.11 times less risky than Binance Coin. As a result, it appears that while BNB is following in the footsteps of BTC in terms of price, this may not be beneficial to the alt in the long run.

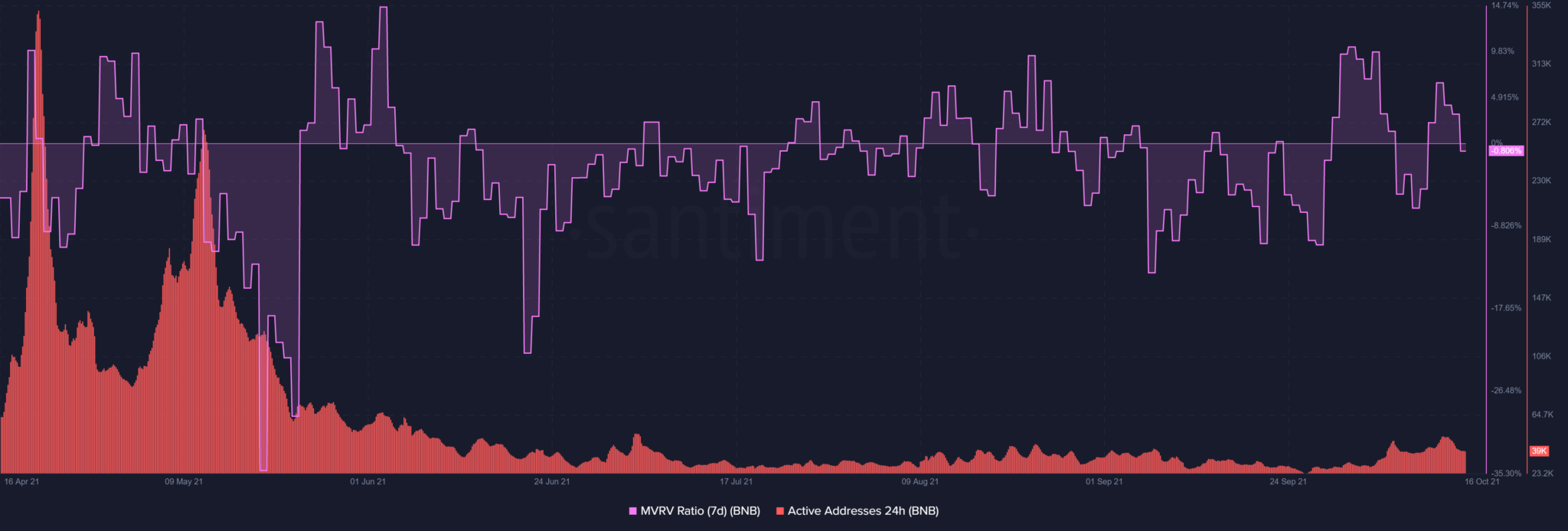

Metrics also paint a bleak picture

At the time of writing, BNB's MVRV ratio was once again in the negative territory as prices on lower time frames consolidated. Furthermore, its active addressees had remained low throughout the year, which was a concerning statistic for the altcoin.

Nonetheless, because BNB's velocity was relatively higher, it indicated that coins were circulating quickly within the network.

BNB's hopes are still alive and well.

While the price of BNB appeared to be in decline, Binance Smart Chain continued to grow. In fact, over the last week, the number of active BSC addresses has remained consistent at 1.5 million wallets per day, exceeding the ATH.

Clearly, the fund announcement triggered prices, and overall, despite the consolidation at the time of writing, it sent a strong message that Binance is setting aside such large sums of money to further explore and rip apart the Metaverse and Virtual Reality, as Analyst Scott Melker highlighted.