More On: bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

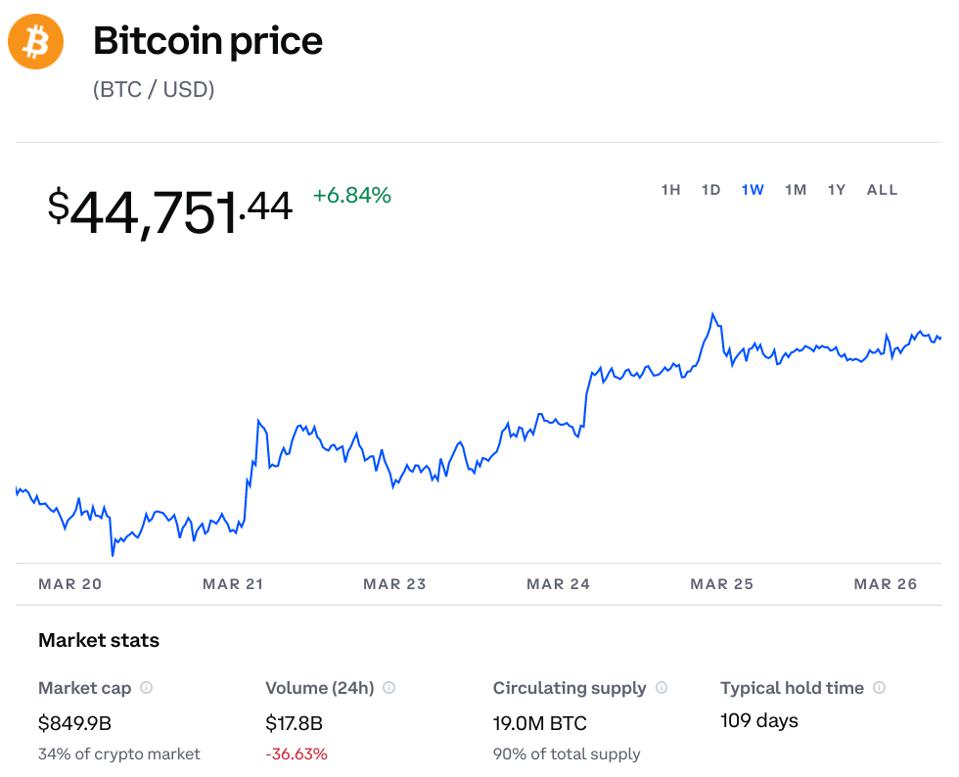

Cryptocurrencies like Bitcoin and Litecoin have risen in value this week, after a wave of positive news for the sector.

There was a big jump in bitcoin prices when an official in Russia said that they would accept bitcoin as payment for their oil and gas, which they sell. Meanwhile, the price of ethereum has kept going up as "enthusiasm" grows ahead of a long-awaited change.

This time, Larry Fink, the CEO of BlackRock, the world's biggest asset manager, has said that his company is "studying" digital currencies because more and more clients are interested in them.

We are looking into digital currencies like stablecoins and the technology behind them to figure out how they can help us better serve our clients, Fink wrote in a letter this week.

Fink has previously said that he doesn't see a lot of demand for crypto. He said this in a CNBC interview last year. In February, Coindesk reported that BlackRock was getting ready to follow other Wall Street giants, like Goldman Sachs, Morgan Stanley, and Citi, into the crypto business. BlackRock is planning to let customers borrow money from BlackRock by pledging crypto assets as collateral.

In the United States, Goldman became the first big bank to trade crypto over the counter. It worked with a crypto merchant bank called Galaxy Digital to offer a bitcoin-linked instrument called a non-deliverable option, which can't be sold.

One of Fink's main points was that Russia's attack on Ukraine and the wide-ranging financial sanctions put on the country five years ago led to mainstream adoption of crypto.

"The war will make countries think about how much they depend on their currencies," Fink said. Before the war, several governments were looking to get more involved in digital currencies and set up rules for how they work.

There has also been a big change in how the world works, says Fink, who thinks that the war in Ukraine will "put an end to the globalization we have seen over the last three decades."

"It has made many communities and people feel isolated and look inside," he said. People have become more polarized and extremist because of this, I think.

Other people in the financial world agree with Fink's statement. They see strict Russia sanctions, which have kept the country's banks from using the SWIFT interbank messaging service and put limits on the country's central bank's foreign exchange reserves, as a shake-up of the system.

Analyst: In March, a Credit Suisse analyst said that the Russian war in Ukraine will lead to a new world financial order, which could help the price of bitcoin and other cryptocurrencies like ethereum.

Bank of America says it's seeing the birth of Bretton Woods III, a new world (monetary) order based on commodity currencies in the East that will likely weaken the Eurodollar system and also make inflation more likely in the West. Zoltan Pozsar, global head of short-term interest rate strategy, wrote in a report.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.