More On: Federal Reserve

The chances that the Fed will cause the next bust are going up

Congress and the Federal Reserve could be putting us on a path to a bad economy

Histories demonstrate that high inflation can persist for over a decade

The rate of inflation drops to 7.1%, but it still has a long way to go down

Wall Street wants to raise the target inflation rate above 2%. This is not a surprise

From last Wednesday: As the Fed 'fights inflation' by increasing interest rates, its actions will not produce the hoped-for 'soft landing,' but rather the hard bust.

The US Federal Reserve (Fed) raised the federal funds rate from almost nothing on March 17, 2022, to between 4.50 and 4.75 percent at the end of January 2023. Inflation in consumer goods prices in the US went from 2.5 percent in January 2022 to 9.1 percent in June 2022. This caused lending rates to go up. Even though inflation fell to 6.4% in January 2023, the Fed keeps telling the markets that it will keep raising rates to lower consumer price inflation.

This is easy to understand. The Fed wants to keep its reputation for fighting inflation. It wants people to believe that it is really determined to get inflation back to 2%. It probably knows that the US dollar's status as the world's reserve currency needs to be protected more than ever, because it gives the US government (and the powerful special interest groups that use it to their own ends) a lot of power both in the US and around the world.

Now, the US dollar needs higher nominal (and real, or adjusted for inflation) interest rates to stay strong. The euro, the Chinese renminbi, the Japanese yen, the British pound, and the Swiss franc are not backed by anything, so these higher interest rates make the dollar look better in comparison. And since other central banks around the world can't or won't keep up with the Fed's rate hike sprint, the US dollar exchange rate is likely to stay strong. This will bring in money from other countries and let the US run a huge trade deficit with the rest of the world.

But there is worry that the Fed's actions could lead to another bust. Why? We know that issuing fiat currency through bank loans that are not backed by real savings creates an artificial upswing (a "boom") that must end in a recession (a "bust") sooner or later. This is because when the supply of bank credit goes up at first, the market interest rate is artificially pushed down below what it would be if bank credit didn't go up. This artificially low market interest rate makes it tempting for consumers and producers to spend more than they can afford. This leads to overspending and bad investments.

All of this ends when new credit and money stop coming in. When that happens, the market interest rate goes up. Spending goes down, savings go up, and investment projects are sold off. Firms go bankrupt, and unemployment rises. During the time when interest rates were artificially low, asset prices, such as stock and real estate prices, went up. Now, those prices are falling. When asset prices go down, it makes it hard for private households, businesses, and banks to get enough equity capital. When interest rates go up, it becomes harder for people to pay back their debts. As the number of loan defaults goes up, banks have to make it harder to get a loan. When credit market conditions get tighter, more defaults happen, which makes credit market conditions even tighter. At its worst, the credit crunch, falling asset prices, and falling output and employment could cause the fiat money system to fall apart.

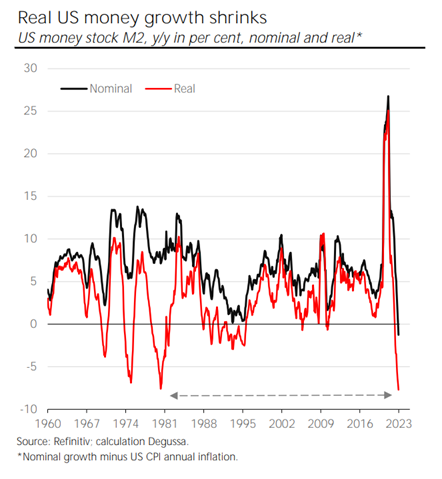

Where exactly are we? By historical standards, the Fed's interest rate of 4.50–4.75 percent is still pretty low. Also, when consumer price inflation is taken into account, the Fed's key interest rate is still 1.8%. But the Fed's most recent series of interest rate hikes have a much bigger effect on the economy than most people think. Most importantly, this is the first time since 1959 that the US money stock M2 is going down. On an annualized scale, it went down by 1.3% in December 2022. (by a hefty 7.3 percent in inflation-adjusted terms).

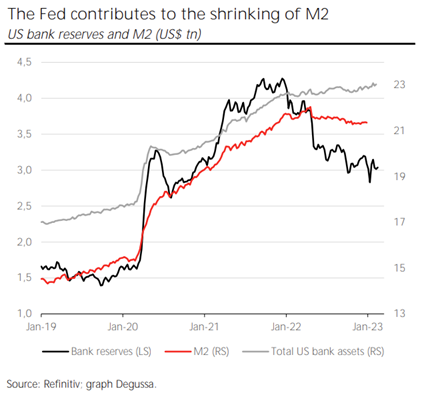

![Thorsten1]() The drop in nominal M2 right now is not caused by a drop in bank lending. The Fed is taking the money from the central banks out of the system. This is done in two ways. The first way is by not putting the money it gets back into its portfolio of bonds. The second way is through so-called "reverse repo" operations, in which "eligible counterparties" (those who are allowed to do business with the Fed) can leave their cash with the Fed overnight and get an interest rate close to the federal funds rate.

The drop in nominal M2 right now is not caused by a drop in bank lending. The Fed is taking the money from the central banks out of the system. This is done in two ways. The first way is by not putting the money it gets back into its portfolio of bonds. The second way is through so-called "reverse repo" operations, in which "eligible counterparties" (those who are allowed to do business with the Fed) can leave their cash with the Fed overnight and get an interest rate close to the federal funds rate.

The Fed does business with both banks and companies that are not banks (such as asset management firms). When nonbanks move their deposits from banks and/or clients to the Fed, both the central bank and commercial banks lose money. So, the money stock M2 goes down. The Fed is taking money out of the financial system, which will at least slow the rate at which prices of goods go up in the economy. It might even be deflationary, which means it would cause prices of all goods to go down.

![Thorsten2]() The Fed has said that it will keep raising interest rates and will also keep shrinking its balance sheet and soaking up central bank money. In this situation, it's worrying that Fed chairman Jerome H. Powell, and probably the rest of his team, doesn't really pay attention to changes in monetary aggregates when making policy decisions. This, in turn, means that there is a real chance that the Fed will overtighten, or reduce the amount of money even more.

The Fed has said that it will keep raising interest rates and will also keep shrinking its balance sheet and soaking up central bank money. In this situation, it's worrying that Fed chairman Jerome H. Powell, and probably the rest of his team, doesn't really pay attention to changes in monetary aggregates when making policy decisions. This, in turn, means that there is a real chance that the Fed will overtighten, or reduce the amount of money even more.

When making policy, it looks like the Fed is taking inflation into account. But it's fair to say that monetary expansion in the past or present is the main cause of future inflation. And since the nominal (and real) money supply is now shrinking, not just in the US but in many other currency areas as well, a deflationary shock is building up. This would be a big problem if the money supply keeps shrinking and bank credit starts to dry up. It's a sure way to mess up (aka the next bust).

Recent market stress indicators show that the financial markets have stayed fairly optimistic. For example, credit spreads are stable and stock prices have been slowly going up since their recent low in October 2022. Maybe the markets are sure that the Fed will set up a "soft landing" that will bring down sky-high inflation without sending the economy into a recession and the financial markets into chaos. Or, they bet that if the credit pyramid really starts to fall apart, the Fed will stop tightening and save the system, as it has done many times before, no matter how high inflation gets.

In fact, Murray N. Rothbard, who lived from 1926 to 1995, saw this coming a long time ago. In his book America's Great Depression, he wrote, "The American economy will have to choose between a massive deflationary depression like 1929 or a massive inflationary bailout by the Federal Reserve." Taking into account the politics of his time, he said, "We can therefore look forward, not to a 1929-style depression, but to a huge inflationary depression."

Rothbard's conclusion, that markets are right to bet on a Fed bailout when things are bad, but that they grossly underestimate how bad it would be for the economy and how much it would cause inflation, is something I'm very sure about.

This is easy to understand. The Fed wants to keep its reputation for fighting inflation. It wants people to believe that it is really determined to get inflation back to 2%. It probably knows that the US dollar's status as the world's reserve currency needs to be protected more than ever, because it gives the US government (and the powerful special interest groups that use it to their own ends) a lot of power both in the US and around the world.

Now, the US dollar needs higher nominal (and real, or adjusted for inflation) interest rates to stay strong. The euro, the Chinese renminbi, the Japanese yen, the British pound, and the Swiss franc are not backed by anything, so these higher interest rates make the dollar look better in comparison. And since other central banks around the world can't or won't keep up with the Fed's rate hike sprint, the US dollar exchange rate is likely to stay strong. This will bring in money from other countries and let the US run a huge trade deficit with the rest of the world.

But there is worry that the Fed's actions could lead to another bust. Why? We know that issuing fiat currency through bank loans that are not backed by real savings creates an artificial upswing (a "boom") that must end in a recession (a "bust") sooner or later. This is because when the supply of bank credit goes up at first, the market interest rate is artificially pushed down below what it would be if bank credit didn't go up. This artificially low market interest rate makes it tempting for consumers and producers to spend more than they can afford. This leads to overspending and bad investments.

All of this ends when new credit and money stop coming in. When that happens, the market interest rate goes up. Spending goes down, savings go up, and investment projects are sold off. Firms go bankrupt, and unemployment rises. During the time when interest rates were artificially low, asset prices, such as stock and real estate prices, went up. Now, those prices are falling. When asset prices go down, it makes it hard for private households, businesses, and banks to get enough equity capital. When interest rates go up, it becomes harder for people to pay back their debts. As the number of loan defaults goes up, banks have to make it harder to get a loan. When credit market conditions get tighter, more defaults happen, which makes credit market conditions even tighter. At its worst, the credit crunch, falling asset prices, and falling output and employment could cause the fiat money system to fall apart.

Where exactly are we? By historical standards, the Fed's interest rate of 4.50–4.75 percent is still pretty low. Also, when consumer price inflation is taken into account, the Fed's key interest rate is still 1.8%. But the Fed's most recent series of interest rate hikes have a much bigger effect on the economy than most people think. Most importantly, this is the first time since 1959 that the US money stock M2 is going down. On an annualized scale, it went down by 1.3% in December 2022. (by a hefty 7.3 percent in inflation-adjusted terms).

The Fed does business with both banks and companies that are not banks (such as asset management firms). When nonbanks move their deposits from banks and/or clients to the Fed, both the central bank and commercial banks lose money. So, the money stock M2 goes down. The Fed is taking money out of the financial system, which will at least slow the rate at which prices of goods go up in the economy. It might even be deflationary, which means it would cause prices of all goods to go down.

When making policy, it looks like the Fed is taking inflation into account. But it's fair to say that monetary expansion in the past or present is the main cause of future inflation. And since the nominal (and real) money supply is now shrinking, not just in the US but in many other currency areas as well, a deflationary shock is building up. This would be a big problem if the money supply keeps shrinking and bank credit starts to dry up. It's a sure way to mess up (aka the next bust).

Recent market stress indicators show that the financial markets have stayed fairly optimistic. For example, credit spreads are stable and stock prices have been slowly going up since their recent low in October 2022. Maybe the markets are sure that the Fed will set up a "soft landing" that will bring down sky-high inflation without sending the economy into a recession and the financial markets into chaos. Or, they bet that if the credit pyramid really starts to fall apart, the Fed will stop tightening and save the system, as it has done many times before, no matter how high inflation gets.

In fact, Murray N. Rothbard, who lived from 1926 to 1995, saw this coming a long time ago. In his book America's Great Depression, he wrote, "The American economy will have to choose between a massive deflationary depression like 1929 or a massive inflationary bailout by the Federal Reserve." Taking into account the politics of his time, he said, "We can therefore look forward, not to a 1929-style depression, but to a huge inflationary depression."

Rothbard's conclusion, that markets are right to bet on a Fed bailout when things are bad, but that they grossly underestimate how bad it would be for the economy and how much it would cause inflation, is something I'm very sure about.