More On: Economics

The Economics of Culture and the Arts

Histories demonstrate that high inflation can persist for over a decade

The rate of inflation drops to 7.1%, but it still has a long way to go down

Wall Street wants to raise the target inflation rate above 2%. This is not a surprise

Prices went up a lot in August, which means that earnings went down again

The Federal Reserve has declared that it will begin reducing its balance sheet and boosting interest rates. However, the Fed's actions announced on Wednesday are extremely cautious. The Federal Reserve is significantly behind the curve.

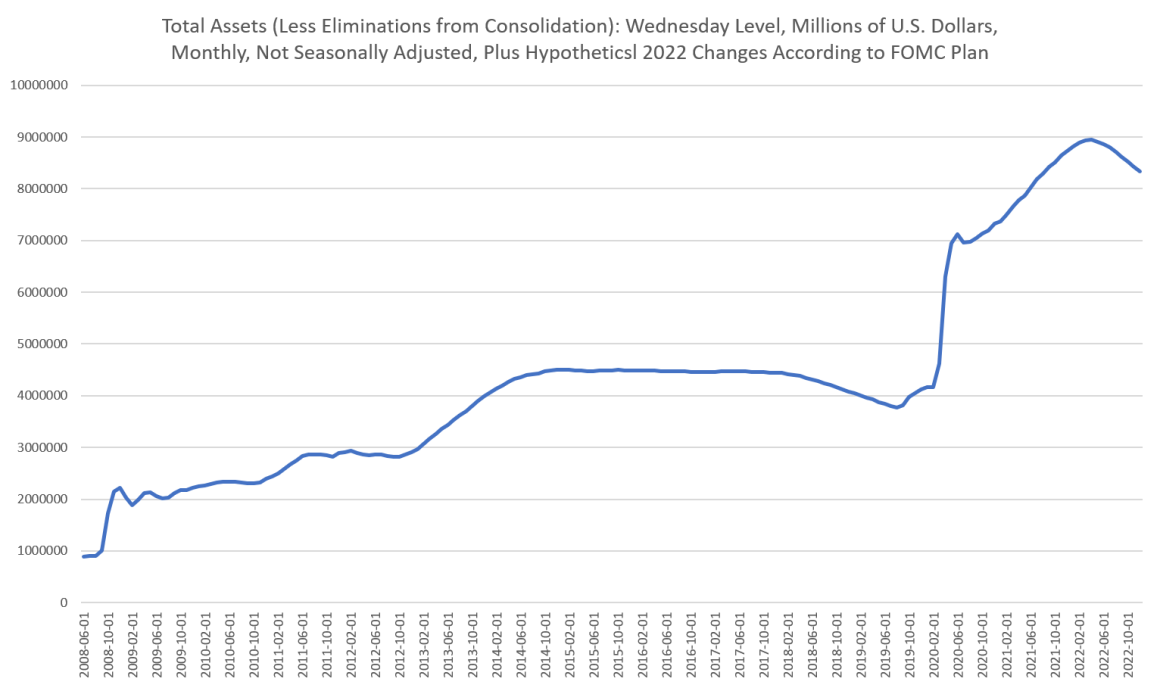

Since 2008, one of the most important aspects of Fed policy has been to acquire mortgage-backed securities and government debt in order to support asset prices while also expanding the money supply. The Fed has purchased roughly $9 trillion in assets throughout this time, increasing demand and raising prices for both government bonds and housing assets. Furthermore, these purchases were done using newly produced money, which contributed significantly to liquidity and the easy-money policies in place since 2009.

Throughout this time, the Fed has consistently maintained that it will "normalize" the balance sheet at some point, presumably by returning the Fed's total assets to levels below $1 trillion, as they were before 2008.

Many doubters of Fed policy asked openly how soon this normalization would occur. It never happened. The only phase that came close to "normalization" was a brief period of moderate cuts in 2019. Of fact, the balance sheet has only grown since 2020, when the Fed went into a buying spree to prop up asset values amid the 2020 economic crises. The Fed also continued to purchase significant quantities of government bonds, driving up bond prices. As the federal government has collected trillions of dollars in new debt over the last two years, this has been essential in keeping interest rates on government bonds low.

The FOMC's New Plan

After more than a decade of massive asset growth, the Fed has announced that it will begin to reduce its holdings. Fed Chairman Jerome Powell announced decreases to the balance sheet will begin in July and accelerate after three months at a post-FOMC press conference on Wednesday.

But here's the rub: the Fed's proposed actions are so little that even six months from now, the total size of the balance sheet will be largely unchanged. Furthermore, if the economy enters a downturn, we expect the Fed to abandon normalization and resume balance sheet expansion.

In other words, the roughly $9 trillion in freshly produced Fed money isn't going anywhere unless the Fed makes some major changes, and the Fed isn't doing anything to reverse the decade's massive monetary inflation.

Consider the balance sheet at the conclusion of current calendar year, provided everything goes according to the Fed's plan.

First, here’s the plan. According to the Fed’s press release this week:

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps. …

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

These cuts amount to very small changes.

The balance sheet as of May 2022 is $8.9 trillion, as shown in the first graph. A hypothetical balance sheet is also depicted in the graph till the end of the year. If the Fed starts making the cutbacks in June as planned, the balance sheet will shrink by 37.5 billion in the first three months and 95 billion in the following three months. So, by December, the balance sheet should be around $8.3 trillion. That was the state of the financial sheet in August 2021. And, under this approach, how long would it take to get back to the balance sheet that existed before the Fed started its covid buying spree? Approximately 46 months (four years).

Of course, if experience is any guide at all, there is approximately a 0 percent chance that the Fed will stick to a quantitative tightening plan that lasts 46 months. Even the odds of doing it for the rest of this calendar year are very small, given that the economy contracted in the first quarter and the signs of a weakening economy are everywhere.

Also expect the political needs of the regime to take over if tax revenues begin to slip. As we’ve shown here on mises.org before, the Fed’s bond purchases play an important role in keeping the federal government's debt service payments low. The Fed has been able to back off on this role in recent months as inflation-fueled tax collections have surged. But if we see tax revenues begin to fall, expect the federal government to demand the Fed once again facilitate deficit financing by buying government bonds.

As a result, both economic and political considerations work against any meaningful quantitative tightening.

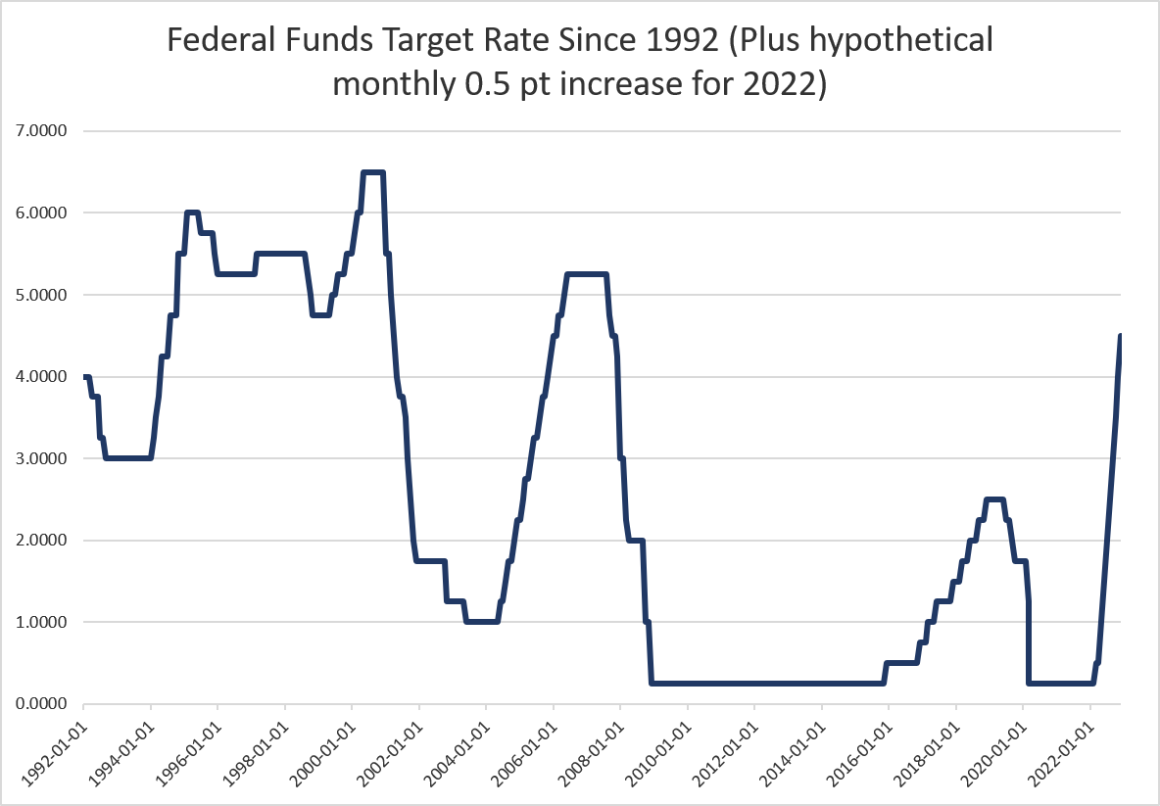

When we consider interest rate policy, we can see how unlikely quantitative tightening (QT) is. The Federal Reserve raised the target federal funds rate by fifty basis points on Wednesday. The aggregate target rate now stands at 1.0 percent. The Fed also hinted that it might keep raising rates by 50 basis points throughout the year. Powell also noted that no 75-basis-point hikes were being considered at this time.

So, even if the Fed raises the target rate by 50 basis points every month until the end of the year, the rate will only reach 4.5 percent.

What are the chances of that occurring? The possibilities are extremely slim. Yes, the Fed's decision to raise the target rate by 50 basis points is impressive. That hadn't been done since the year 2000 until this week. But what are the chances of another seven 50-basis-point hikes before the end of the year? That's practically unheard of, and you'd have to go back to Paul Volcker's era to see something like.

Why Have They Not Acted Until Now?

Some people who believe in the Fed as an institution could speculate that Powell is the new Volcker, and the Fed will take dramatic action to reduce inflation. But this begs the question: if Powell is the new Volcker, why hasn't he done anything yet?

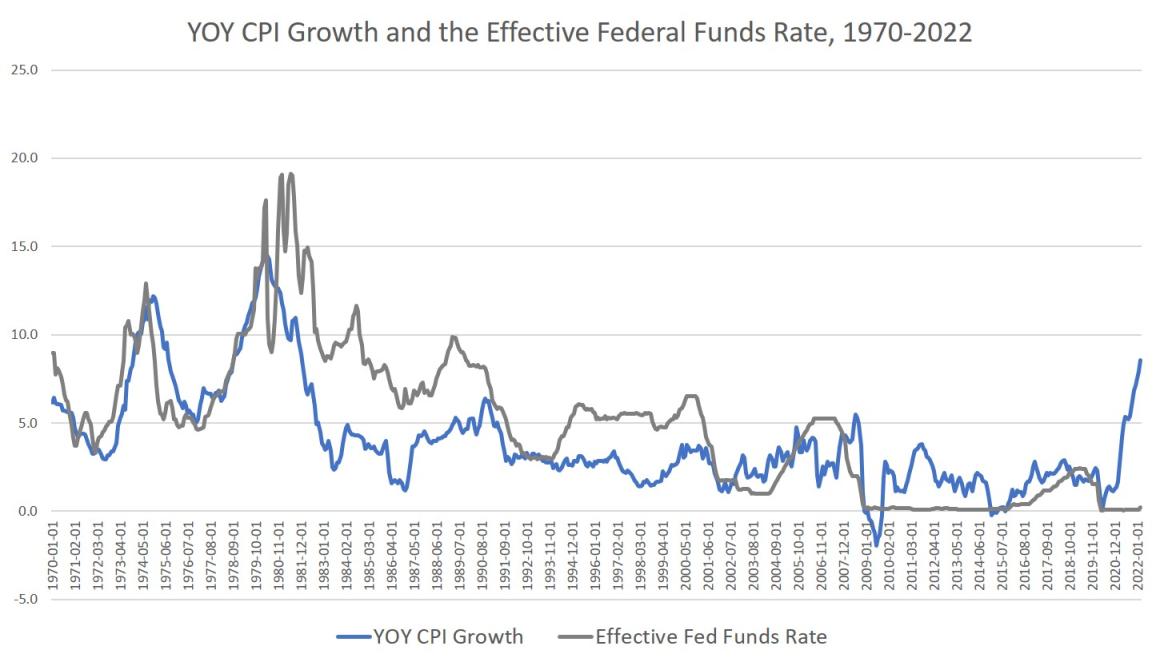

Since the spring of 2021, inflation has been on the rise, and Powell's Fed has done nothing but repeat bromides about inflation being temporary. The Federal Reserve didn't raise the target rate to 0.5 percent until last month. Throughout it all, the Fed's balance sheet grew larger because it failed to undertake anything approximating quantitative tightening. So, why should we expect the Fed to act now since it has done nothing in the last year?

Indeed, we may look at inflation increase vs the target federal funds rate to get a sense of how far behind the Fed is on this. Even when Volcker began his tightening frenzy in the late 1970s, the target rate was still keeping pace with year-over-year inflation rates. Meanwhile, the goal rate is practically steady in 2021 and 2022, while inflation is at a four-decade high. This is not a group of central bankers with a strategy or the courage to carry it out.

Powell, it appears, understands this. Powell's tone in the Q&A session following his prepared speech yesterday was one of caution and skepticism that Fed policy will actually rein in inflation. Powell skirted the topic when asked by Rachel Siegel of the Washington Post when people will start to notice the effects of tightening on inflation, instead simply saying that the process of bringing inflation down will be unpleasant.

Furthermore, when questioned if the Fed's policies are likely to cause a recession, Powell responded that he is still hoping for a "softish" landing.

To put it another way, the entire process is a guessing game for the Fed. Powell also refused to say what he thinks a neutral interest rate would be right now during the Q&A, and he made it clear that the entire plan is based on "conditions evolving with expectations." That is, all bets are off if anything unexpected occurs. Then, in the midst of economic weakness and forty-year inflation highs, we might expect a new round of aggressive inflationary policy.

This is the Federal Reserve in 2022. The entire "strategy" is to try some minor tightening and hope for the best.

=====

Related Video: