More On: Bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

Earlier this year, Glauber Contessoto took a large bet on dogecoin, a meme-inspired cryptocurrency that started as a joke.

Contessoto claims to have invested over $250,000 in dogecoin on February 5 when it was priced at roughly 4.5 cents using his savings and borrowed monies. He claims to have become a dogecoin millionaire on paper two months later, on April 15.

Despite dogecoin's ups and downs, Contessoto has refused to sell. He intends to purchase more of the digital coin in the future and "hodl" for the long term.

Contessoto believes in dogecoin so much that he now asks to be compensated in it anytime he works on social media advertisements for crypto companies.

According to CNBC Make It, Contessoto will receive a total of $25,000 for an anticipated agreement between his YouTube channel and blockchain firm Acria Network. When it came time to close the sale, the company inquired if he preferred to be paid in US dollars or in cryptocurrency.

He says, "Of course, I said dogecoin." "With other words, they paid me in dogecoin." They paid half up front and the rest after I delivered the video."

One thing about me is I’ma walk that talk baby. #dogecoin #buythedip pic.twitter.com/SNuOBm7SBR

— SlumDOGE Millionaire (@ProTheDoge) July 6, 2021

Contessoto abandoned his day job at a music studio in Los Angeles in June to focus on his expanding "dogecoin billionaire" reputation online. He admits, "I had no notion how I was going to make money going ahead."

He makes some money by selling items on his website, but his major focus is on growing his social media following.

He earned $28,000 in one month from social media ads and promotions, the majority of which was paid in dogecoin. Contessoto explains, "That's around six months salary at my prior position."

Contessoto intends to continue investing as much as he can in dogecoin after paying all of his expenditures, including rent, food, and other living expenses. "[I'm] all invested in doge," Contessoto says, despite experts' warnings. "Doge is where I keep my money."

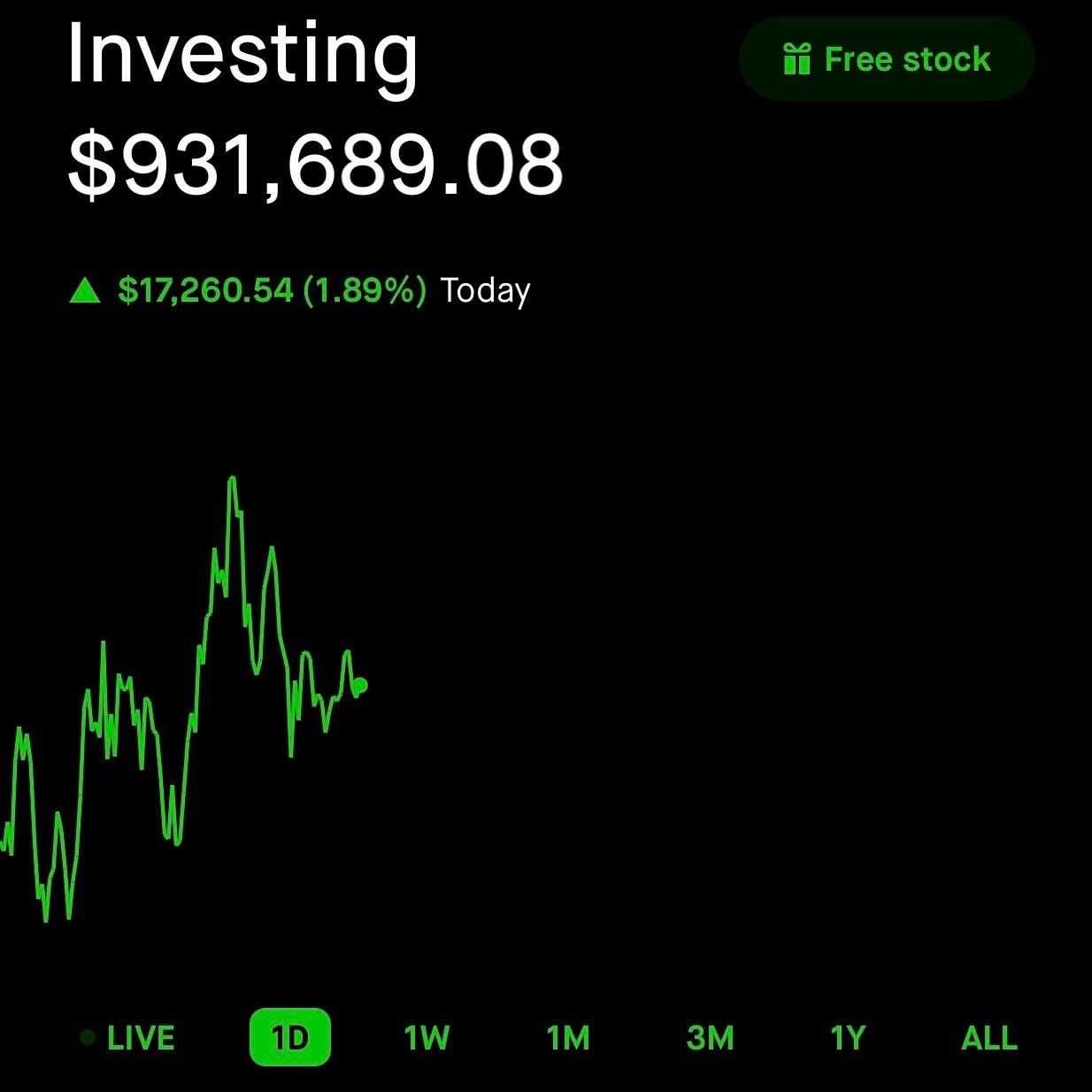

His dogecoin assets are valued roughly $931,689 as of around 12:00 p.m. EST on Tuesday.

Financial professionals, on the other hand, are wary of dogecoin and other cryptocurrencies. Experts warn that it's a risky, speculative investment because of its tremendous volatility.

And some warn that investment in dogecoin in particular should be approached with caution, as it lacks the scarcity and technological progress that bitcoin, for example, possesses. Investors should only invest what they can afford to lose in order to avoid being burned.

"You risk losing almost all of your money," James Ledbetter, publisher of the fintech newsletter FIN and a CNBC contributor, told CNBC Make It before. "It has no intrinsic value, and it could go down in price just as readily as it might go up."

Nonetheless, Contessoto's dogecoin prognosis is quite positive. He believes the price could grow depending on what occurs in the next months. He is optimistic that it will reach $1 by the end of the year.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.