More On: Luna

How much 6 popular cryptocurrencies lost in 2022 ?

LUNA Classic invests 70% on erasing the past and revitalizing the chain

Three Arrow Capital has been ordered by the court to be liquidated

New LUNA validators accused of unethical behavior in Validator Wars

LUNA 2.0 falls 77% in 14 days as Do Kwon privatizes Twitter

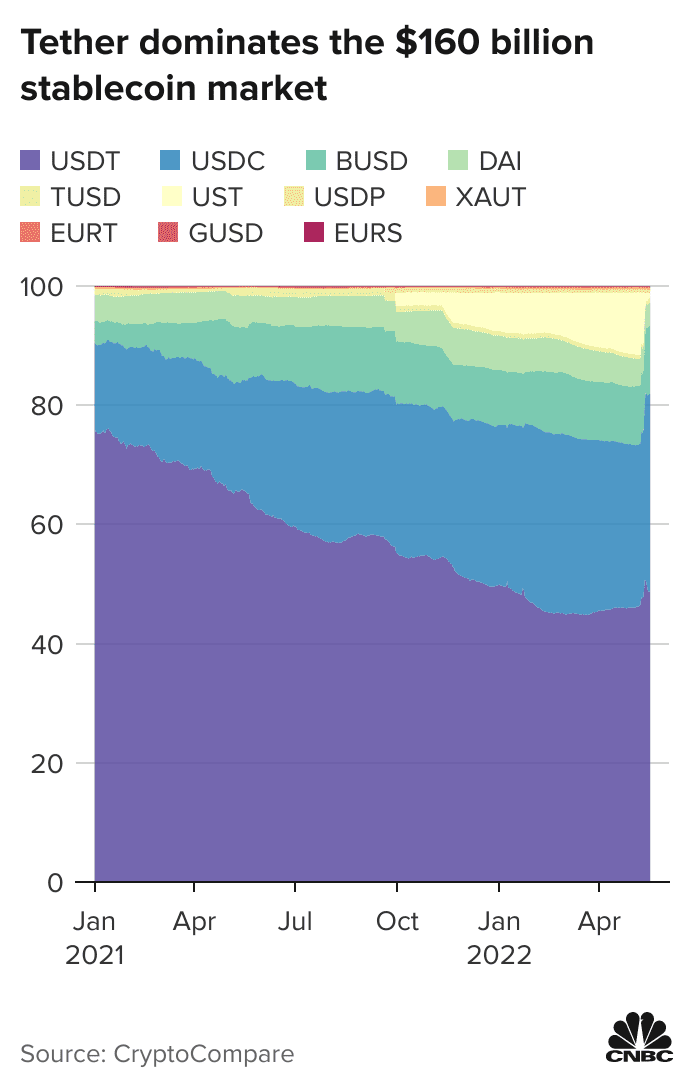

Tether has lost more than $10 billion in value in the last two weeks due to increased regulatory scrutiny on stablecoins.

According to CoinGecko data, Tether, the world's largest stablecoin, has seen its circulating supply drop from a high of $84.2 billion on May 11 to about $73.3 billion as of Monday. Late Friday evening, about $1 billion was withdrawn.

On May 12, the cryptocurrency, which is supposed to be tied to the US dollar, fell as low as 95 cents after another sort of stablecoin, terraUSD — or UST — fell well below $1. This caused a sell-off of UST's linked luna token, wiping out more than $40 billion in value for holders.

The collapse of Terra, the blockchain that underpins UST and luna, sent shockwaves across the crypto market, sending bitcoin and other cryptocurrencies plummeting. Regulators are concerned about this.

"The risk is always that someone will misjudge the situation and overcorrect in a position that isn't advantageous for the entire community writ large," Kathleen Breitman, a co-creator of the Tezos blockchain, told CNBC.

"As much as I enjoy seeing things fail that make no sense, there's always a tinge of, 'Are people going to extrapolate from this that anything that's a stablecoin is unsound?' That's the main concern."

Unlike tether, UST was not backed by a reserve of fiat cash. Instead, it relied on some intricate engineering to maintain price stability by destroying and creating UST and its sister token luna. The promise of 20% savings rates from Anchor, Terra's flagship lending platform, enticed investors, despite the fact that many investors believed the rate was unsustainable.

Do Kwon, the founder of Terra, had amassed billions of dollars in bitcoin and other tokens through his Luna Foundation Guard fund, but the assets were nearly exhausted in a vain attempt to save UST.

Nonetheless, the UST panic has increased attention to other stablecoins, namely tether.

Regulators and economists have long questioned whether Tether's holdings are sufficient to support the stablecoin's ostensible peg to the dollar.

Following a settlement with the New York attorney general, the corporation acknowledged that tether was backed one-to-one by dollars in a bank account, but that it was also utilizing other assets as collateral, including commercial paper (short-term corporate debt) and even digital tokens.

Tether announced last week that it had cut its commercial paper holdings and increased its holdings of US Treasury notes. The British Virgin Islands-based company revealed for the first time that it also carries foreign government debt. Tether did not elaborate on the source of its funds, but said say it is doing a more thorough examination of its reserves.

=====

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.