More On: bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

While financial scams are common in today's world, the cryptocurrency industry appeared to be making a name for itself recently

The financial authorities in the United States have been keeping a close eye on cryptocurrency businesses and investments. In fact, they have issued another alarming update to the industry.

The Treasury Department's Financial Crimes Enforcement Network [FinCEN] reported $5.2 billion in Bitcoin transactions that could be linked to ransomware. The analysis enabled FinCEN to track the flow of Bitcoin ransomware payments in order to identify the exchanges and services used by ransomware actors to launder their proceeds.

The data set contained 2,184 Special Activity Reports [SARs] filed between January 1, 2011 and June 30, 2021. It discovered 177 convertible virtual currency wallet addresses associated with ransomware variants that were used in ransomware operations.

The agency also identified 68 active ransomware variants, the most commonly reported of which were REvil/Sodinokibi, Conti, DarkSide, Avaddon, and Phobos.

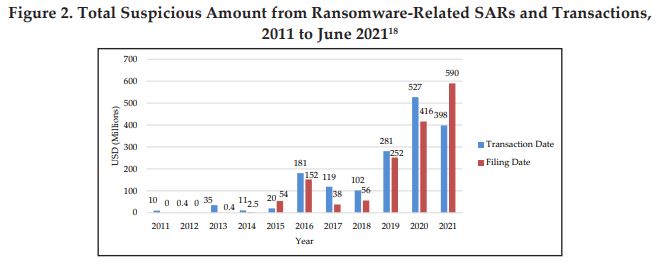

According to data, the agency reported $590 million in ransomware-related SARs, a 42 percent increase over 2020. It was stated,

“FinCEN identified $590 million in ransomware-related SARs, a 42 percent increase compared to a total of $416 million for all of 2020. If current trends continue, SARs filed in 2021 are projected to have a higher ransomware-related transaction value than SARs filed in the previous 10 years combined, which would represent a continuing trend of substantial increases in reported year-over-year ransomware activity.”

This report came on the heels of a recent Treasury Department ban on people engaging in any way with the SUEX crypto exchange due to allegations of laundering ransomware payments to criminals. According to their findings, 40 percent of the exchange's known transaction history is linked to illegal actors.

Aside from Bitcoin, another cryptocurrency mentioned in the FinCEN report was Monero. It was labeled as an anonymity-enhanced Cryptocurrency that had grown in popularity for privacy.

The Treasury has planned to take strong measures against such cyberattacks, but this will have an impact on the regulations if they are implemented. Given the increasing use of cryptocurrency in ransomware attacks, the agency also wanted blockchain companies to collaborate with them in preventing such actions.