More On: btc

Bitcoin mining hash rate increases by 60% despite falling revenue per terra hash

BTC research: Bitcoin's realized price indicates that a bottom may be forming

Bitcoin sell-off causes $20 million in long positions to be liquidated

Daily Crypto Wrapped: BTC short liquidations exceed $9 million, and Ava Labs CEO calls CryptoLeaks allegations a 'conspiracy theory'

Ethereum (ETH) hits $2000 as Merge nears

Tensions between the United States and China over Taiwan combine with market instability and a local high for Bitcoin.

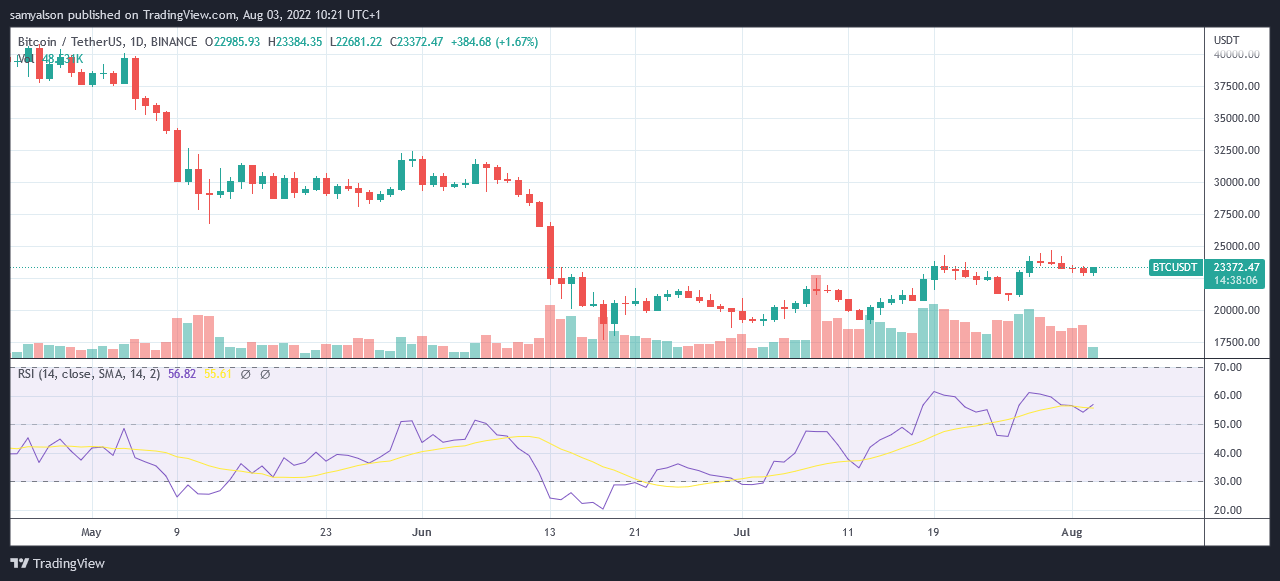

On July 30, Bitcoin (BTC) reached a local high of $24,600 before closing three consecutive daily red candles. The peak-to-trough loss over this time span was $1,800, or 7%.

Today, August 3, there is some relief as buyers provide a 3% upward swing. BTC was trading around $23,300 as of press time, while the rest of the market was trading flat with a little positive tilt.

According to Bloomberg News, recent crypto price activity was influenced by rising tensions between the United States and China over House Speaker Nancy Pelosi's travel to Taiwan.

The Chinese government had told Pelosi to abandon the trip weeks earlier. However, the House Speaker arrived in Taiwan on August 2, escalating geopolitical tensions.

Bitcoin falls short of the $25,000 mark.

Investors fled equities and US share futures as tensions between the two countries grew. Bitcoin also saw a modest sell-off, falling 3% on the day before finishing at $22,900.

BTC has been heading upwards since July 13, after hitting a local low of $18,900. This run crested just short of $25,000 over the weekend, as tensions between the United States and China rose in response to Pelosi's visit to Taiwan. According to Bloomberg, this is Bitcoin's strongest run since October 2021.

As usual, technical experts are divided on what will happen next. BTC closed (marginally) above the 200-day moving average for the first time in five weeks, according to Michael van de Poppe. A long-term uptrend is defined as an asset trading above the 200-day moving average.

For the first time in 5 weeks, $BTC has managed to close above the 200MA again!

— Michaël van de Poppe (@CryptoMichNL) August 1, 2022

We discussed our opinion on the current situation in today's Trade Letter.

By signing up, you'll receive the next 3 Trade Letters for free! Subscribe at: https://t.co/QPrjTMZzNq#tradeletter pic.twitter.com/MIRSM74LhR

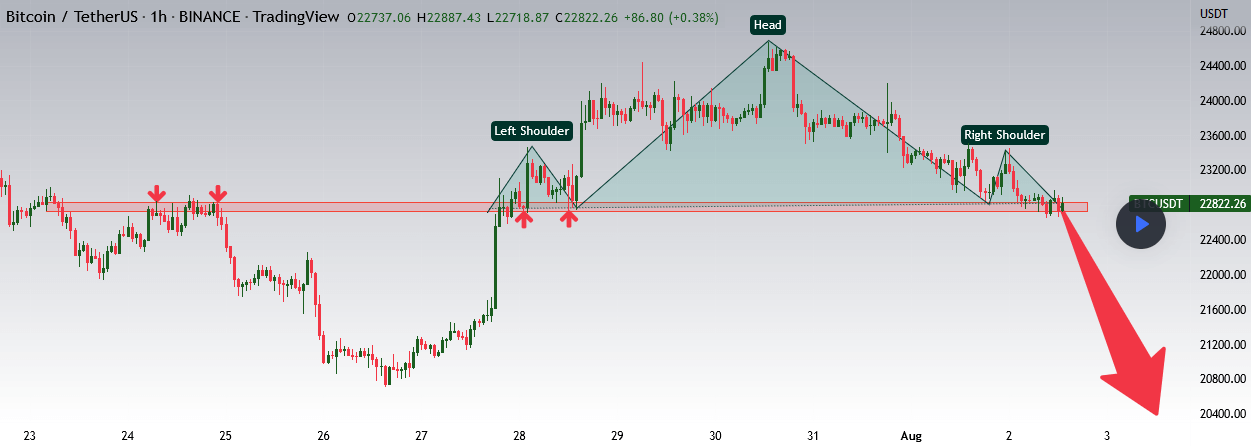

Whereas JoeChampion believes a head and shoulders pattern is forming, which will cause the price to fall more in the short term. He did, however, refrain from predicting a bottom.

US-China relations are rising.

Taiwan is regarded by the Chinese Communist Party as a breakaway country that will one day be reintegrated into the Chinese mainland.

According to ZeroHedge, a phone chat between President Xi and President Biden in the run-up to Pelosi's visit concluded with Xi implying penalties if Pelosi followed forward with her travel to Taiwan.

"Public opinion cannot be ignored." Those who dabble with fire will burn."

In a news conference after landing in Taiwan, House Speaker Paul Ryan claimed it was "unequivocally obvious" from the outset that the US would not "abandon" Taiwan.

"America made a vow 43 years ago to always stand with Taiwan... Today, our group arrived in Taiwan to make it quite clear that we would not forsake our commitment to Taiwan."

In reaction, China has sanctioned Taiwan, prohibiting the export of natural sand and some food goods such as fish and fruits. Natural sand is used in the production of semiconductors.

Military drills with live fire will begin on August 4 near the Taiwan Strait, with some exercises taking place fewer than ten miles from the Taiwanese coast.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.