More On: Bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

Staking is hard, but understanding the truth behind these four myths will aid in the widespread adoption of liquid staking.

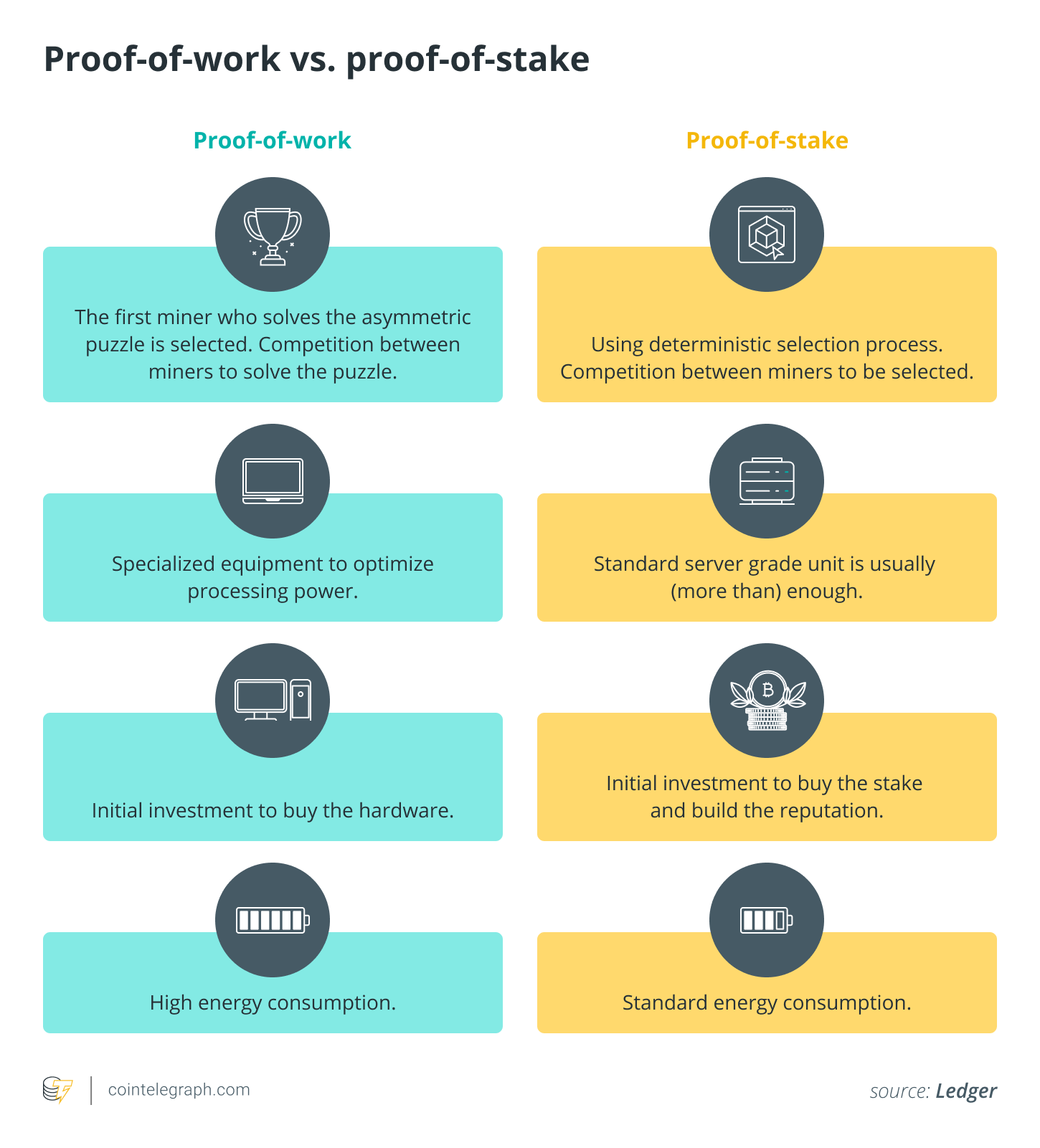

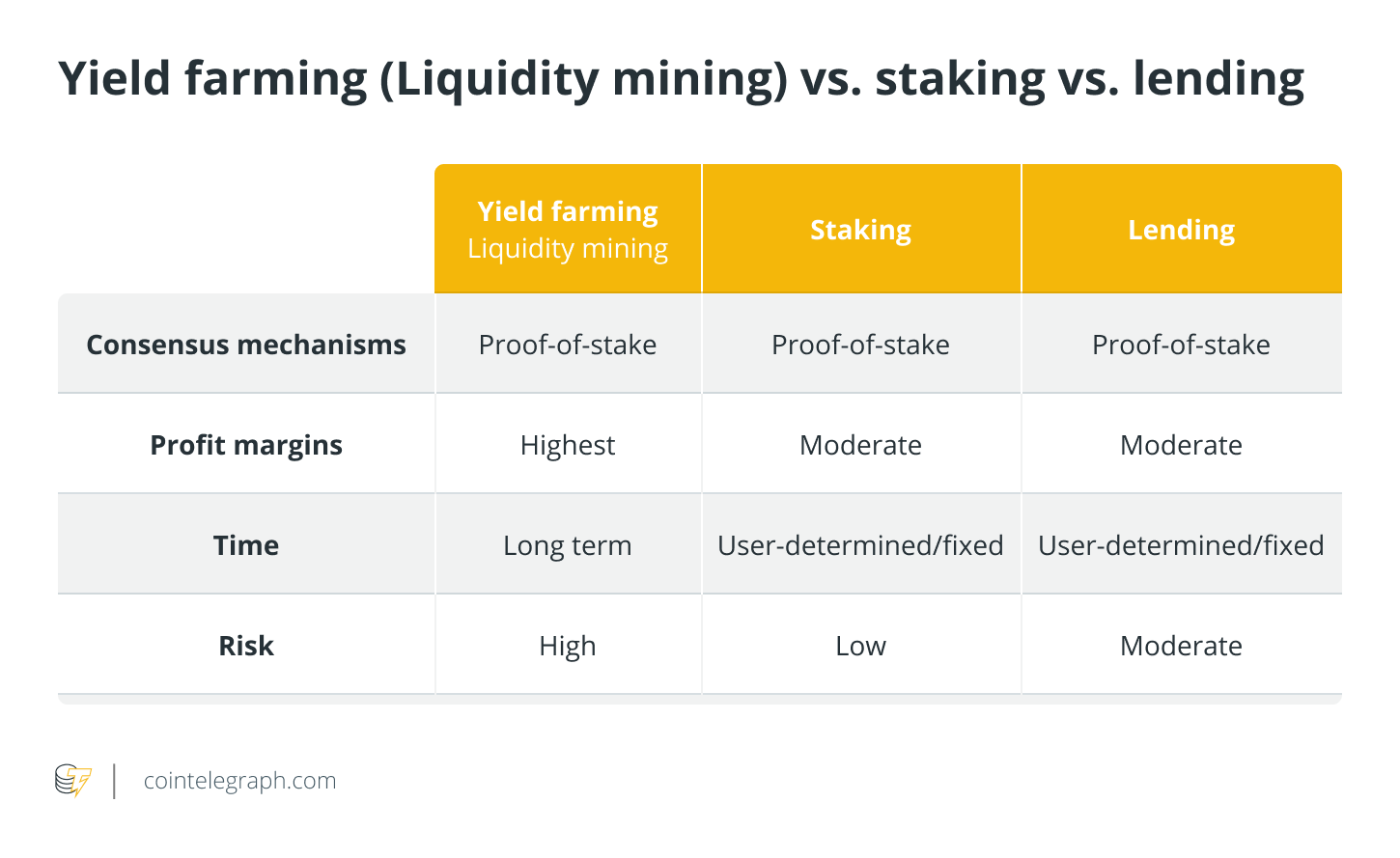

Since their conception, blockchains have relied on proof-of-work (PoW) validation. However, the PoW consensus became unsustainable due to its high energy consumption and requirement for fast, powerful hardware, which created high entry hurdles. That's why blockchains are embracing proof-of-stake consensus algorithms (PoS), in which individuals who want to earn rewards don't have to compete with other miners; instead, they may stake a portion of their crypto in exchange for a chance to be picked as a validator — and reap the benefits.

Everyone who owns crypto on PoS blockchains must want to take advantage of the opportunities staking provides, right? Actually, according to our report, while 56 percent of those polled had staked before, many of those who hadn't or wouldn't stake again had similar reservations: they don't want their assets locked up in staking when they could be put to better use elsewhere. As a result, liquid staking offers the best of both worlds. During lock-up, it allows investors to stake their assets while also allowing them to utilise them in other projects.

Despite the fact that this innovation can lessen staking barriers, there is still a lot of misunderstanding regarding what liquid staking is and what it can offer the crypto community. Here are some common misconceptions regarding liquid staking, as well as the facts about this new opportunity.

What is liquid staking?

The way blockchains work is changing thanks to staking. It improves blockchain validation's energy efficiency, gives hardware more flexibility, and speeds up transaction frequency. However, despite its advantages, one of the main drawbacks — and what keeps many people from staking — is the lock-up time. While assets are being staked, they are inaccessible to their owners, and they cannot do anything with them, such as invest in decentralized finance (DeFi). Many people are afraid to stake because of this sacrifice.

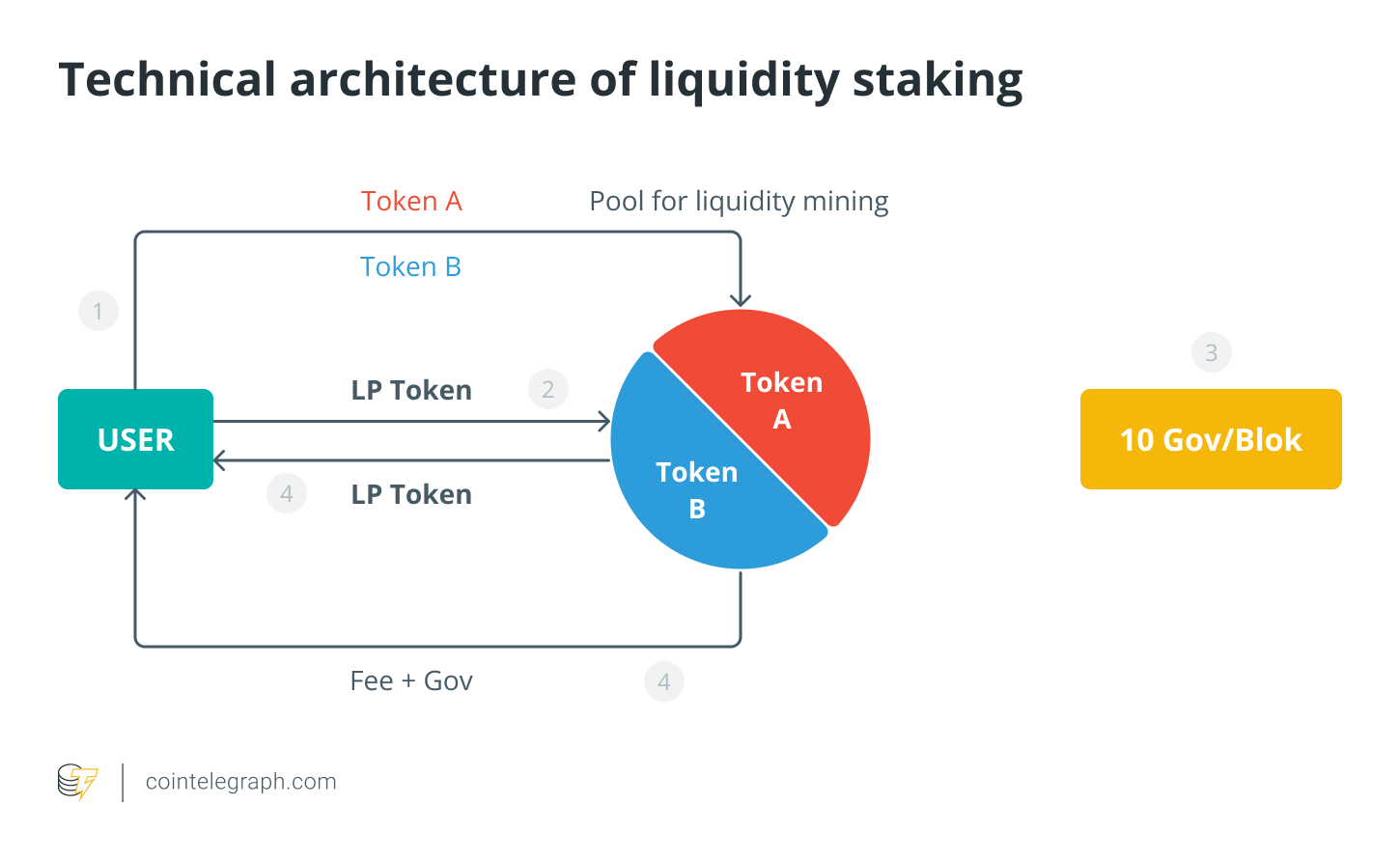

Liquid staking, on the other hand, solves this problem. Holders of staked assets can gain liquidity in the form of a derivative token that they can use in DeFi using liquid staking protocols, all while the staked assets continue to earn rewards. It's a method to get the best of both worlds while maximizing earning potential.

PoS is becoming increasingly popular. Over half of crypto's total market cap, $594 billion, is accounted for by PoS methods. As Ethereum transitions to PoS in the next months, the chances will only grow. However, staking accounts for only 24% of the overall market capitalization of staking platforms, indicating that many people have the ability to stake but do not.

Four misconceptions of liquid staking

Despite the benefits of liquid staking, there’s still confusion about how it functions. Here are four common misconceptions, and how you should be thinking about liquid staking instead.

Misconception 1: Only one player or protocol will exist. One of the misconceptions about liquid staking is that only one player will exist through which investors can gain liquidity. It may seem that way since it’s still so early in the liquid staking space, but in the future, multiple liquid staking protocols will coexist. There may also be no capping to the number of liquid staking protocols that can coexist, either. In fact, the more the number of protocols, the better it is for the network, as it can reduce instances of stake centralization and fears of a single point of failure.

Misconception 2: It’s only limited to liquidity. Liquid staking isn’t just a way to get liquidity. While liquid staking does help PoS networks acquire staked capital that secures the network, it is not just limited to that. It’s also a way to get composability because you can use your derivative in multiple places, which you can’t do with an exchange. The synthetic derivatives that are issued as part of liquid staking and used in supported DeFi protocols for generating more yield actually help in constructing monetary building blocks across the ecosystem.

Misconception 3: Liquid staking is solved at the protocol level. People think liquid staking will be solved at the protocol level itself. But liquid staking isn’t just about enabling functionality at a protocol level. It’s about coordinating with other protocols, bringing more use cases, more features and more usability. A liquid staking protocol is solely focused on developing the architecture that will facilitate the creation of synthetic derivatives and ensuring that there are DeFi protocols with which those derivatives can be integrated.

Misconception 4: Liquid staking defeats the purpose of staking overall. Some say liquid staking defeats the purpose of staking or locking up assets, but we’ve seen that’s not true. Liquid staking not only increases network security but also helps achieve a crucial objective of the PoS network, which is staking. If there is a solution that issues derivatives for staked capital within the network, then not only is the staked capital ensuring that the PoS network is secure, but it is also creating an enhanced experience for the user by enabling capital efficiency.

The future of PoS

Liquid staking not only solves an issue for crypto enthusiasts who want to stake by issuing tokens that can be used in DeFi while their assets are staked, but it also solves a problem for cryptocurrency exchanges. The blockchain becomes more safe as more people stake their assets, which is made easier by making liquid staking available. Investors will help staking to actually become an innovative new technique for blockchains to establish agreement by knowing the truth about popular myths.

=====

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.