More On: bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

Over half a billion dollars in losses were incurred in the crypto market following Vladimir Putin's command to attack Ukraine in a

It has been a while since then, but the price of the main digital asset has gone up by 35%, which shows that it can withstand difficult geopolitical market conditions. As an example, many market speculators were curious to see how Bitcoin (BTC) would fare as a safe-haven asset. So far, BTC has been doing well for crypto supporters.

Will Clemente, a lead analyst, said March 28 that "Bitcoin is up 35% since Russia invaded Ukraine."

The crypto analyst also revealed:

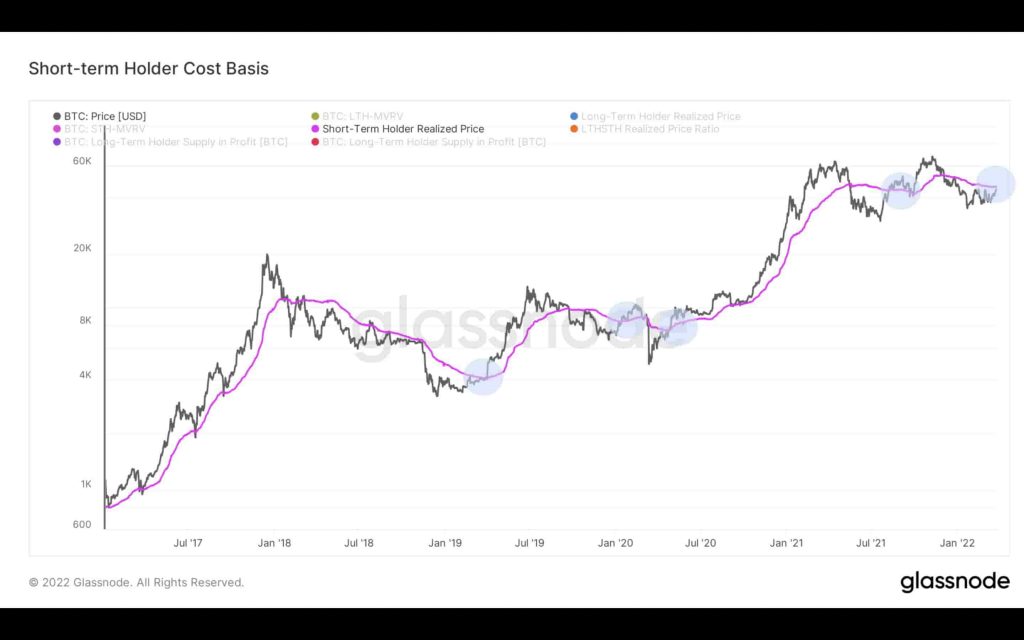

“Bitcoin has closed above the short term holder cost basis for the first time since December 3rd. Hard to be bearish as long as BTC is above.”

Today, Bitcoin is trading at $47,537. It's up 6.40 percent on the day and 15.97 percent over the last week, with a total value of $903 billion.

It went as low as $33,727 on February 24, which was the day of the invasion. Then it started to come back up.

Analysts say that Bitcoin is showing a lot of different strength.

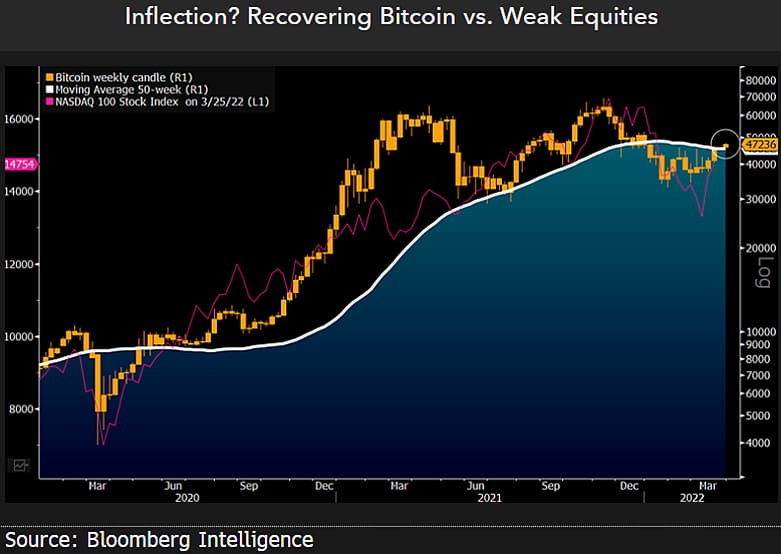

Bloomberg's senior commodities analyst Mike McGlone says that "Bitcoin is showing divergent strength" as a risk asset because the digital asset is doing well in contrast to weak equities. This is because the digital asset is dealing well with the effects of the ongoing war in Ukraine and the highest inflation rate in 40 years.

“Bitcoin Taking Risk-Off Baton? 1Q may be just another blip in the trend of rising risk assets amid the highest inflation in 40 years and war in Europe, yet our bias is that the 2022 endgame isn’t likely to be that easy. Bitcoin — is showing divergent strength.

Previously, McGlone said that 2022 could be a good year for people to get rid of their risk assets and for Bitcoin to reach a new level of maturity.

People are looking for places to keep their money and investments safe because of rising prices in the United States and rising costs for things like oil.

As reported by Finbold, Bitcoin's inflation rate has dropped to 1.7 percent as of March 10 and is now five times lower than the inflation rate of the United States dollar (USD). This makes the popular cryptocurrency a good way to fight inflation.

Another thing that might be happening with bitcoin is that it could become global digital collateral because its losses in 2002 were less than half of those of the Nasdaq 100 index.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.