More On: bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

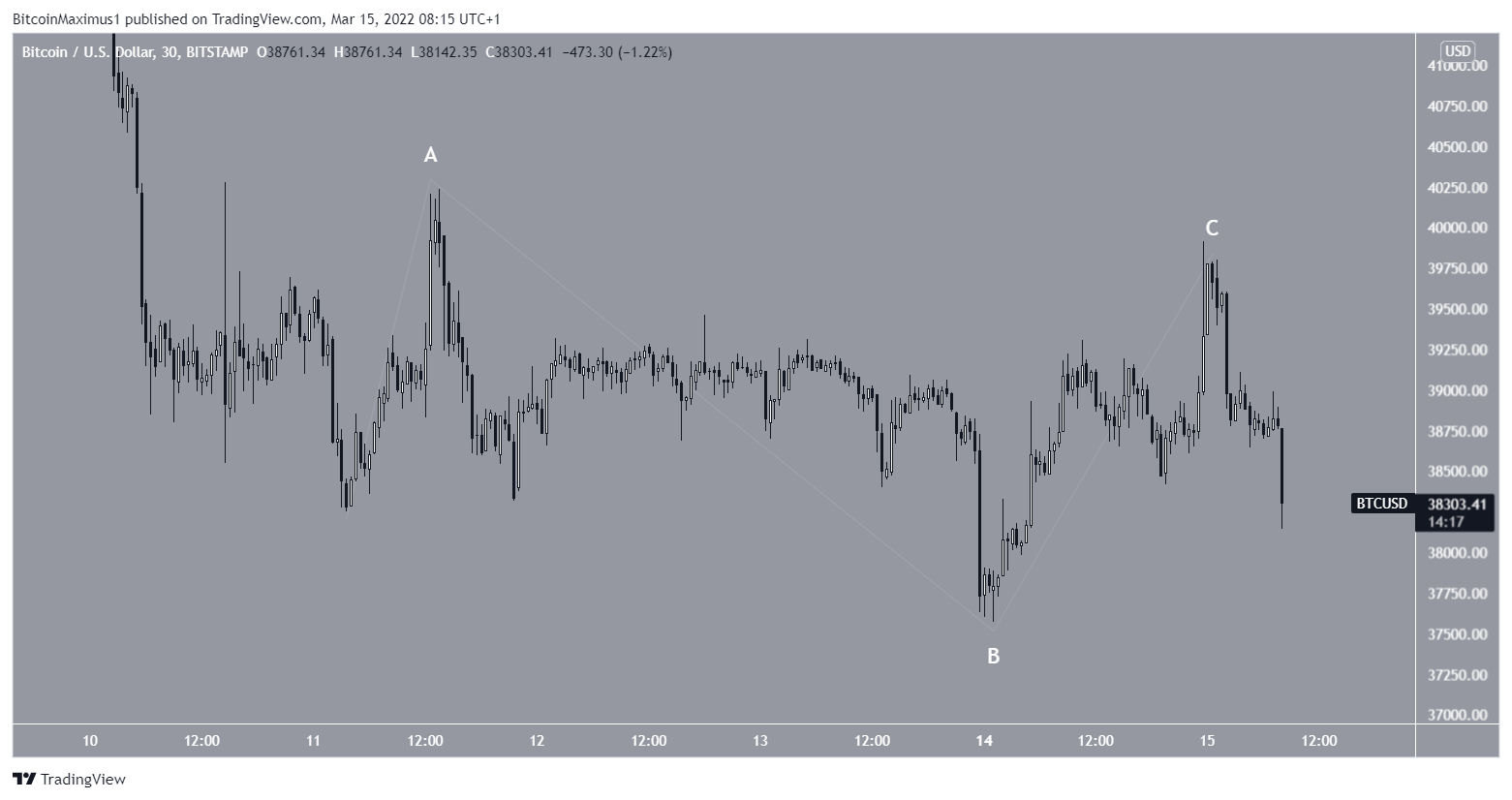

As of this writing, Bitcoin (BTC) is currently consolidating below $40,000 and has yet to display any clear signals that would indicate the trend's direction

Conclusion

- An ascending support line has been breached by Bitcoin prices.

- The price of bitcoin continues to cling to resistance above $37,700.

- The current state of the technical indicators is unfavorable.

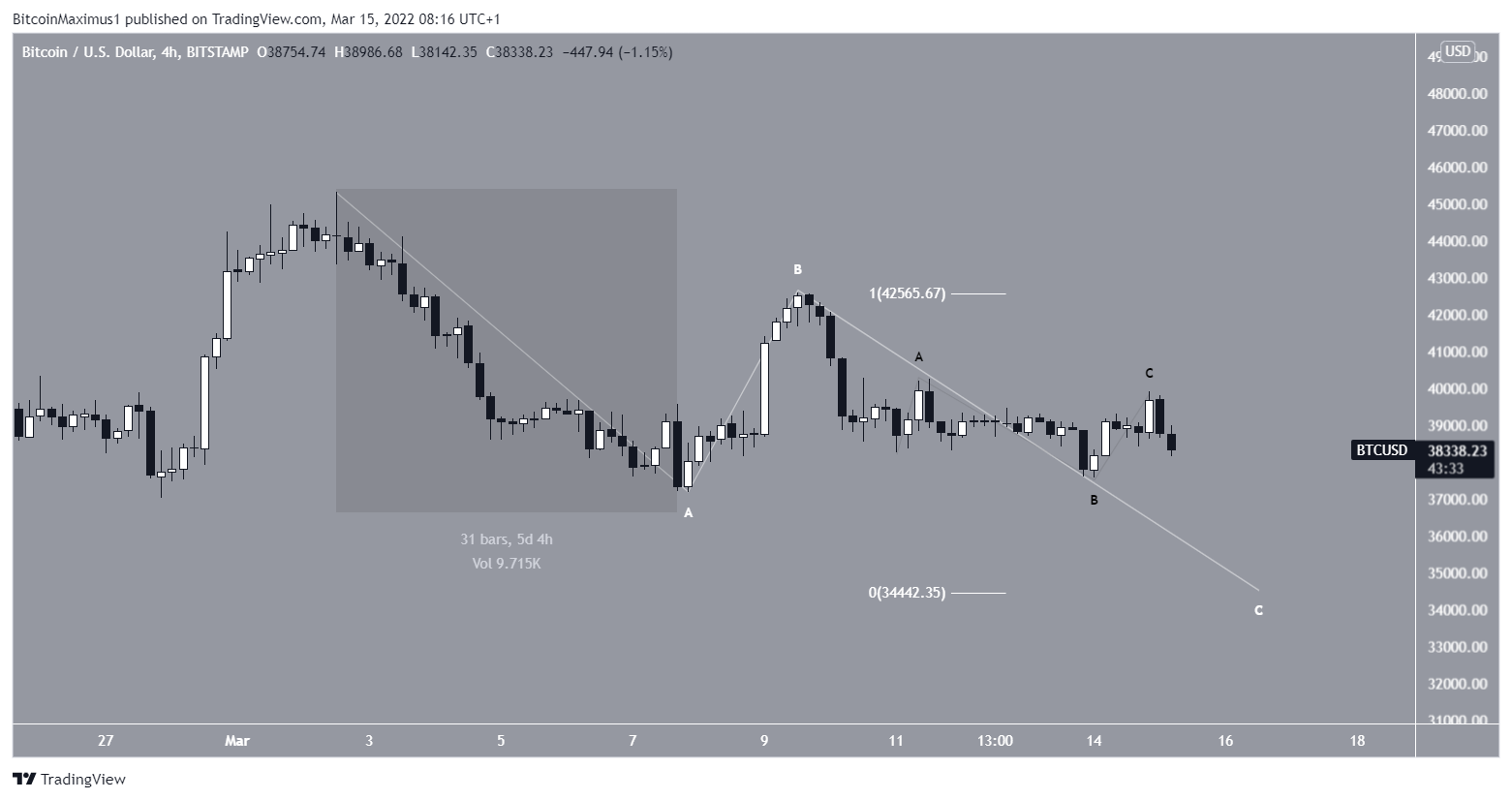

Since the 22nd of January, Bitcoin has been trading along an upward support line. Until now, the line has been proven to be correct. A bearish engulfing candlestick was formed the next day as the price appeared to break below the line on March 13, but it was quickly regained (highlighted).

Using the bullish engulfing candlestick, a huge bullish candlestick engulfs the previous day's decline. This indicates that there is a good chance that prices will rise in the future.

BTC is bouncing off of its support level.

A look at the six-hour chart indicates that BTC has been trading above the $37,700 horizontal support region since February 28th. On March 14, the region received its most current validation (green symbols).

As of March 1, the price has been following a shorter-term falling resistance line that now contacts the price at $40,500.

The direction of the next move is likely to be determined by whether BTC breaks down from the horizontal support region or breaks out above the resistance line.

Most technical indicators are stable in the majority of time periods. In particular, the RSI and MACD are close to 50 and zero, respectively, indicating a strong trend. These numbers are seen as indicating a lack of direction.

Analyzing the number of waves

In the near term, the most likely wave count indicates that BTC has completed a reversal A-B-C pattern.

That means it has started a fresh downtrend that will lead it to its February lows at $34,000, if that is the case.

The longer-term waves A and C would have a 1:1 ratio if the price drops to $34,400, which is frequent in such formations.

The longer-term wave count still remains unclear.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.