More On: bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

On Wednesday, Bitcoin gained 8.8%, reaching a high of $41.9K. Growth above $42K appeared to be problematic for the cryptocurrency's benchmark.

In the early hours of Thursday, we see an equally strong reversal back to $39,000. Consequently, Bitcoin fell by 5.6% in a single day. From 1% (Terra) to 7.2% (Ethereum), the leading altcoins from the top 10 are all in decline (Avalanche).

According to CoinMarketCap, the cryptocurrency market's total capitalization fell by 4.5 percent to $1.75 trillion over the course of the day. From 43.0 percent to 42.7 percent, Bitcoin's Dominance Index fell.

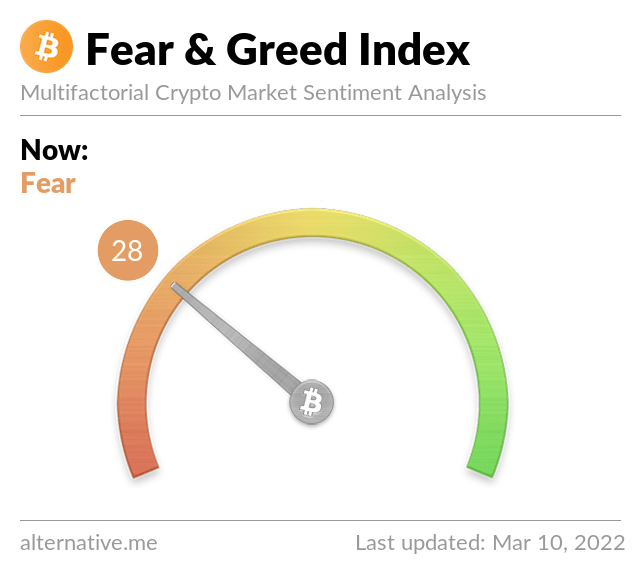

To get to "fear," the Index of Cryptocurrency Fear and Greed increased by six points to 28.

Despite Thursday morning's sell-off in cryptocurrencies, Bitcoin's growth momentum was supported by the positive dynamics of the stock indices.

An announcement from US Treasury Secretary Janet Yellen that did not include strict measures to control the cryptocurrency market sparked a surge in Bitcoin prices. As soon as the statement appeared on the site, it was quickly taken down.

Vice-President Joe Biden signed an executive order to regulate cryptocurrencies in the United States later that evening. As far as I can tell, the document contained only the most general provisions regarding consumer protection and financial stability and the illegal use of cryptocurrencies. Individual federal departments will develop more specific measures to control the digital asset market. The states are, in our opinion, making it clear that they will not allow cryptocurrencies to become a shadow business and be used to evade sanctions, taxes, and other regulations. Centrally-issued fiat money is more difficult to control than this.

Video

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.