More On: Bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

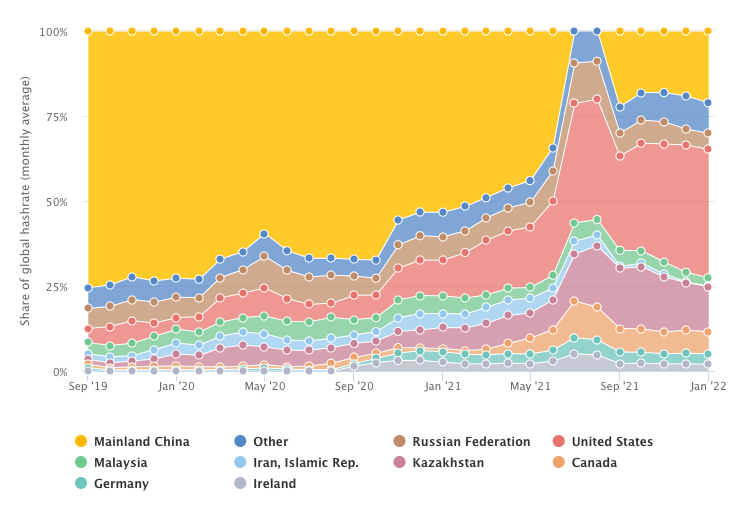

After the Chinese government prohibited all crypto operations last year, the country still has 21% of the worldwide Bitcoin hash rate.

According to a new study, the Chinese government has failed to shut down cryptocurrency operations as part of its crypto ban last year, and China has re-emerged as one of the world's largest Bitcoin (BTC) mining centres.

According to the latest update from the Cambridge Bitcoin Electricity Consumption Index (CBECI) published with Cointelegraph on Tuesday, China became the second-largest Bitcoin hash rate supplier in January 2022, months after the local authorities prohibited all crypto operations in the nation.

According to the data, Chinese bitcoin miners created 21.1 percent of the overall global BTC mining hash rate distribution in early 2022, trailing only the United States, which produced 37.8 percent of the total hash rate in January.

China was previously the world's greatest Bitcoin mining country, with more than 75% of the global BTC hash rate power in 2019. Following a series of crypto mining farm shutdowns throughout the country, the hash rate dropped to 0% in July and August 2021.

Despite the crypto prohibition in September 2021, the hash rate share soared to 22.3 percent in that month and never fell below 18 percent during the study period.

According to CBECI project lead Alexander Neumueller, the new data is sufficient to show that Bitcoin mining is still active in China, stating:

"Our data objectively verifies industry insiders' statements that Bitcoin mining continues in the country." Although China's mining industry is no longer at its peak, it still accounts for roughly one-fifth of the global hash rate."

Russia has dropped out of the top three mining countries

Kazakhstan, the world's third-largest BTC mining hub, sees a modest reduction in hash rate share, according to the latest CBECI data. Kazakhstan's contribution of the BTC hash rate fell from 18 percent in August to 13.2% in January.

Miners are now mining up to 9% of the global BTC hash rate in unspecified places, according to CBECI data. With 6.5 percent and 4.7 percent, respectively, Canada and Russia are the next two largest mining hubs.

Aside from sliding out of the top three countries in terms of BTC hash rate power, Russia's actual hash rate fell from 13.6 EH/s in August to 8.6 EH/s in January.

Georgia, Texas, and Kentucky are the top three states in the United States for BTC hash rate generation.

The new CBECI update provides more detailed information on the hashrate distribution in the largest Bitcoin mining market at the state level.

Georgia, Texas, and Kentucky are the three states with the highest hash rate, accounting for 32 percent, 11.2 percent, and 10.9 percent, respectively, according to the data. Together, these three states account for more than half of the total hash rate in the United States.

According to the data, states like New York, California, North Carolina, and Washington have significant mining activity.

CBECI includes data from four mining pools in its methodology

The Cambridge Digital Assets Programme, a research program hosted by the Cambridge Centre for Alternative Finance, has launched the CBECI.

The data for the research was gathered in partnership with four large mining pools, including BTC.com, Poolin, ViaBTC, and Foundry. Since the introduction of the mining map in 2019, the sample size for the examined mining pool data has varied between 32 percent and 38 percent of Bitcoin's total hash rate, according to the CBECI website.

"We are constantly looking for ways to improve our data in order to improve the accuracy of our estimates." "We would encourage other mining pools to contact out and become involved," the CBECI project lead added.

=====

Related Video:

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.