More On: btc

Bitcoin mining hash rate increases by 60% despite falling revenue per terra hash

BTC research: Bitcoin's realized price indicates that a bottom may be forming

Bitcoin sell-off causes $20 million in long positions to be liquidated

Daily Crypto Wrapped: BTC short liquidations exceed $9 million, and Ava Labs CEO calls CryptoLeaks allegations a 'conspiracy theory'

Ethereum (ETH) hits $2000 as Merge nears

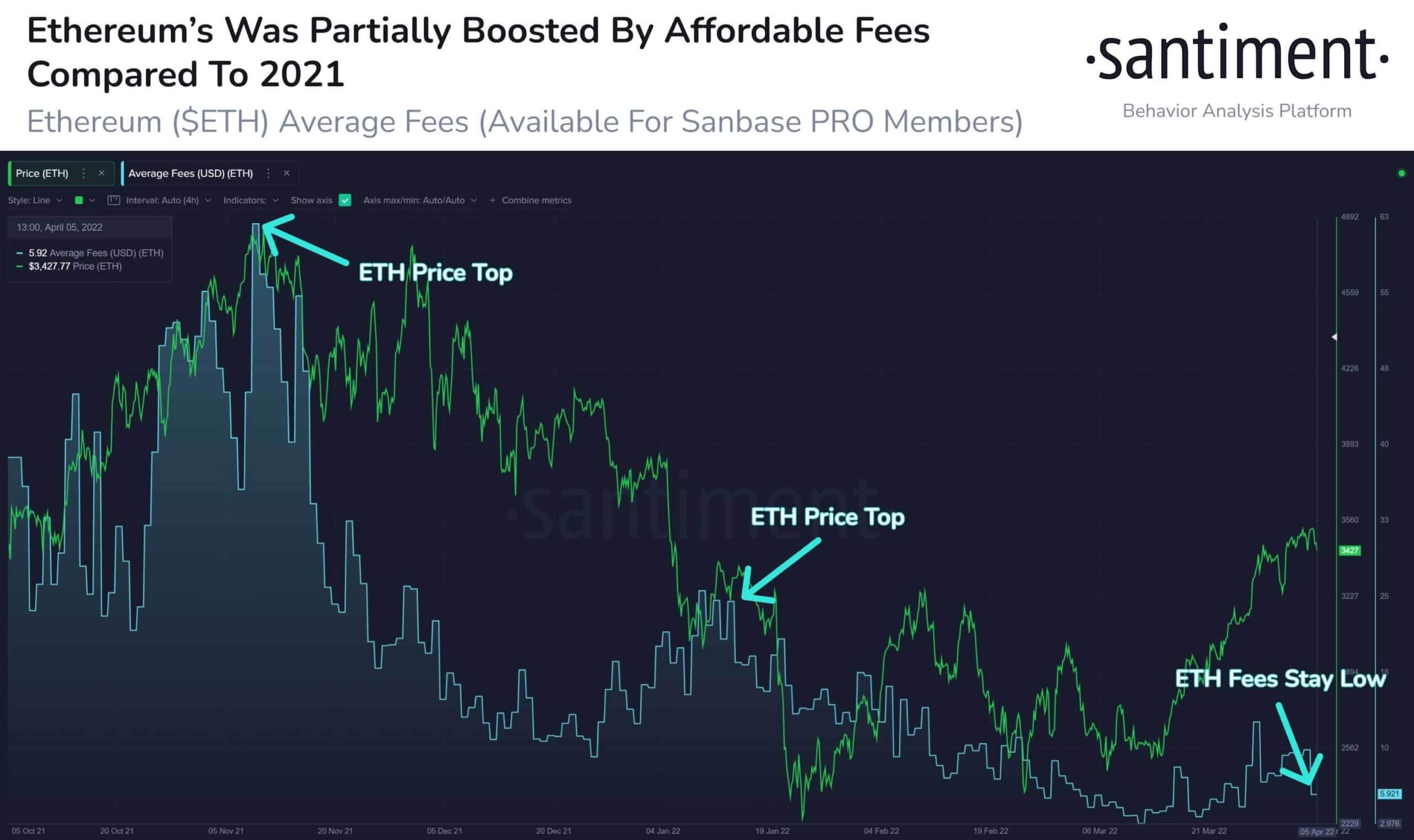

The transaction costs for the two biggest cryptocurrencies by market capitalization have just decreased to historic lows, according to recent statistics

As data from On-chain data provider, Santiment, has revealed, Ethereum competitors can no longer use the network's high transaction costs against it.

The average gas price on the network is presently $5.81. On May 11, 2021, the average charge was $69.57, and on November 8, 2021, it was $62.85.

As data from On-chain data provider, Santiment, has revealed, Ethereum competitors can no longer use the network's high transaction costs against it.

The average gas price on the network is presently $5.81. On May 11, 2021, the average charge was $69.57, and on November 8, 2021, it was $62.85.

What's behind the drop in gas prices?

Generally speaking, a decrease in the value of Ethereum indicates a decrease in the Gwei-based gas cost that is charged. Since its all-time high, Ethereum has seen a considerable drop in value, but it has rebounded recently, closing close on the $3,000 level.

The decline in gas fees is also due to a decrease in demand for DeFi and Non-fungible tokens. Even while Ethereum has lost some market share to rival smart contract networks, it remains the most popular platform. Both areas have seen a dramatic drop in interest in recent months.

The number of NFT transactions, which have accounted for the majority of Ethereum activity in the previous several months, has decreased significantly. As of March, trade volumes in the area had dwindled from a high of over $5 billion in January.

Due to the lower volume of transactions, buyers may avoid paying large fees to miners to have their transactions authorized instantly, resulting in lower costs for the miners.

The burning mechanism in EIP-1559 has also played an important role in reducing costs, as Ethereum nears the point where it will be entirely converted to a Proof of Stake consensus network.

In addition, the fees associated with using Bitcoin are quite minimal.

Not only are Ethereum gas prices at historic lows, but so too are Bitcoin gas fees. Alex Thorn claims that the bull run in Fall 2021 will be the first time when transaction costs have not increased.

#bitcoin fees are at all-time lows. the craziest thing? fall 2021 was the first bull run not accompanied by a major spike in fees.

— Alex Thorn (@intangiblecoins) April 5, 2022

how is that possible? what does it mean? here's a thread explaining the most confounding (and awesome) chart in bitcoin. (remember june 2021) pic.twitter.com/gnWssTckX2

Bitcoin transaction costs are at an all-time low as measured in Satoshis per byte. It's the lowest monetary value since spring 2020.

Thorn argues that the blocks haven't been full since June 2021, which is the main cause behind this. The previous nine months have been the first time that Bitcoin blocks have not been filled. But the lack of activity isn't the only reason why blocks don't fill up. A lot of this is due to user and segwit behavior.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.