More On: Bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

The Bank of England began drafting Britain's first regulatory framework for cryptoassets on Thursday, warning that while the sector is now small, its rapid expansion could pose a risk to financial stability if left uncontrolled in the future.

Concerns that cryptoassets could be used to avoid financial restrictions placed on Russia since its invasion of Ukraine have prompted regulatory scrutiny.

"While cryptoassets are unlikely to provide a feasible way to circumvent sanctions at scale at this time," the Bank of England's Financial Policy Committee (FPC) said in a statement on Thursday, "the possibility of such behavior underscores the importance of ensuring that innovation in cryptoassets is accompanied by effective public policy frameworks to... maintain broader trust and integrity in the financial system."

Cryptoassets such as bitcoin and ether are mainly unregulated because they fall outside the regulatory 'perimeter,' and bringing them under the full scope of UK securities rules would require a change of law, which Britain's finance minister is considering.

"This would almost certainly necessitate an increase of the function of existing macro and microprudential, conduct, and market integrity authorities, as well as close coordination among them," according to the FPC.

Direct risks to financial stability from crypto are presently low, according to the FPC, but there will be hazards in the future if the current rate of expansion is sustained.

Between early 2020 and November 2021, the cryptoasset market surged tenfold, reaching $1.7 trillion, or 0.4 percent of global financial assets, with over 17,000 different cryptoasset tokens in circulation.

The FPC stated that the sector's regulation should be based on "equivalence," which means that crypto-related financial services that fulfill a similar function to existing financial services should be governed by the same laws.

Until cryptoassets are fully regulated, the Bank of England is concentrating on ensuring that risks from crypto are managed in the banking sector. The Financial Conduct Authority said on Thursday that businesses must properly explain the hazards of uncontrolled cryptocurrency to consumers.

Regulators from all over the world are attempting to understand cryptoassets and its offshoots.

STABLECOIN CONDITIONS

On Thursday, Deputy Governor Sam Woods of the Bank of England wrote to lenders, citing increased interest in the sector from banks and financial businesses.

Bank boards should "examine completely" the risks posed by cryptocurrency, and they will most likely need to alter their existing risk management procedures and systems, according to Woods.

"We would also expect firms to talk to their supervisors about the planned prudential treatment of cryptoasset exposures," Woods added, referring to the amount of capital required to cover potential losses.

The Bank of England has initiated a study of banks' current and future crypto exposures, with a June 3 deadline for responses.

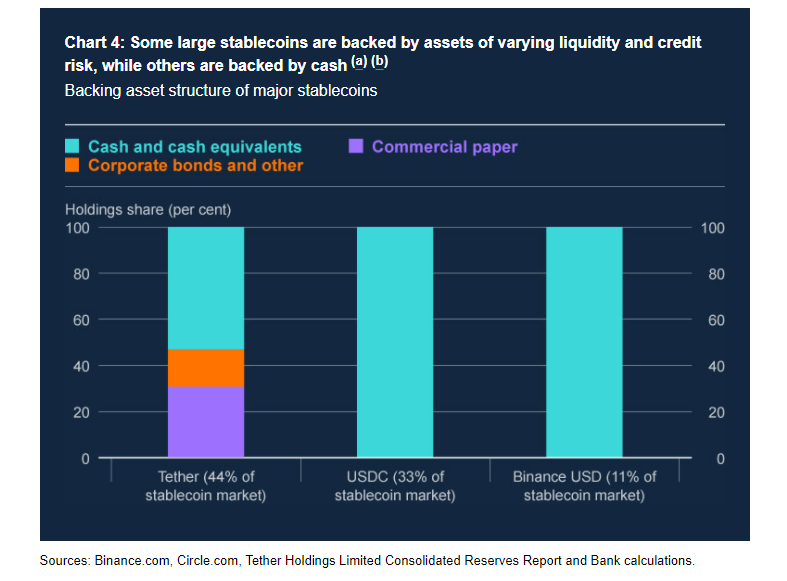

Stablecoins, which are backed by assets or cash, would need to be backed by high-quality, liquid assets and loss-absorbing capital equivalent to that held by banks if they were systemically important, according to the FPC.

If done on a large scale, using commercial bank deposits to underpin stablecoins would pose major financial stability risks, according to the FPC.

In 2023, the Bank of England and the Financial Conduct Authority will continue to work on stablecoin rules and consult on a regulatory "model" for systemic stablecoins, according to the FPC.

=====

Related Video:

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.