More On: bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

A continuation of Monday's rally in Bitcoin (BTC) was seen on Tuesday, with the cryptocurrency further separating itself from riskier assets.

What We Learned Is

- A 2.9 percent increase in the price of Bitcoin (BTC) on Tuesday consolidated Monday's breakout.

- Bitcoin's breakout on Monday continued to decouple it from the NASDAQ 100 and the global equity markets.

- Bitcoin's price action on Tuesday also helped to reinforce its status as a "go-to" investment.

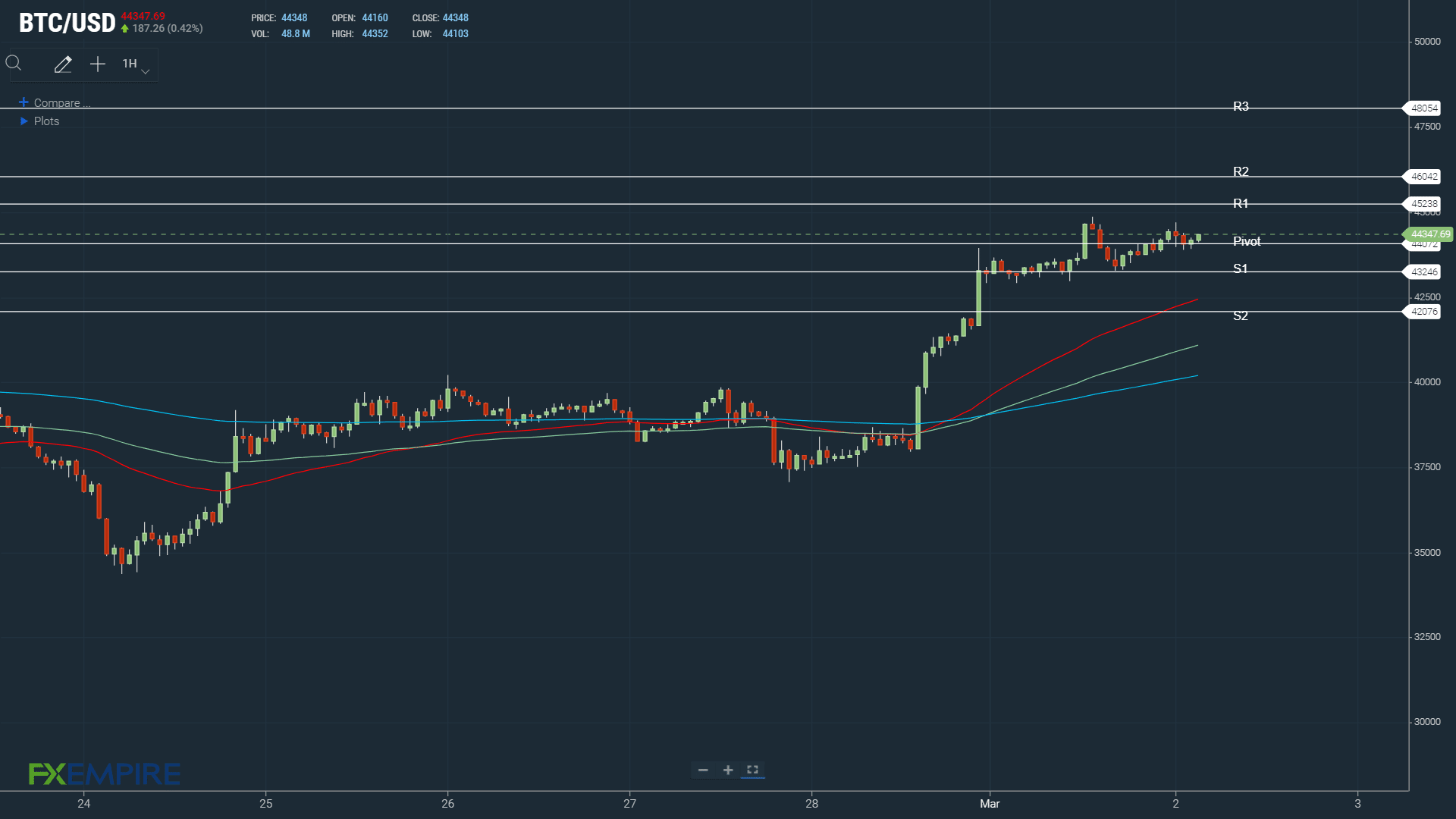

On Tuesday, Bitcoin (BTC) had another strong day. In the morning, Bitcoin fell to $42,894, but rebounded to $44,883 in the afternoon. Bitcoin's price fell back to the previous day's lows after hitting resistance at $45,000.

On Tuesday, Bitcoin gained 2.87 percent to $44,428 after gaining 14.51 percent on Monday.

The rest of the top 10 cryptos had a mixed day.

SOL and LUNA were both down by 1.89 percent and 1.06 percent on the day, respectively, bucking the overall market trend.

Although BNB (3.31%), AVAX (2.84%), and ETH (+1.87%) all gained, XRP (0.32%) remained in the red.

Fear and Greed Index for Bitcoin continues to rise.

The index rose to 52/100 this morning following Tuesday's surge to 51/100 following Bitcoin's Monday breakout.

The index must return to 54/100 for the Bitcoin bulls to be able to bring $50,000 levels back into play. It would take a fall to below 20/100 to bring the price down below $30,000. The NASDAQ 100 has become increasingly independent of Bitcoin's price movement. In comparison to European equity markets, the NASDAQ 100 fell by 1.59 percent on Tuesday, which was a relatively small percentage loss. On the day, the CAC40 index fell by 3.94 percent.

The sharp rise in Bitcoin interest correlated with a surge in demand for the dollar in the major currency pairs. EUR/GBP and commodity currencies struggled, while the US Dollar Spot Index rose by 0.73%.

The market's appetite for risk has been severely impacted by Russia's invasion of Ukraine and its response to Western sanctions. To join the likes of the Dollar, Japanese currency, and gold, Bitcoin is establishing itself as an asset of choice. A 1.37 percent increase in the spot price of gold was recorded on Tuesday.

The response of governments and regulators will have a significant impact on Bitcoin, as a global regulatory framework is currently being developed. While both could have a significant impact on the crypto industry, governments are trying to keep Russia from evading current sanctions.

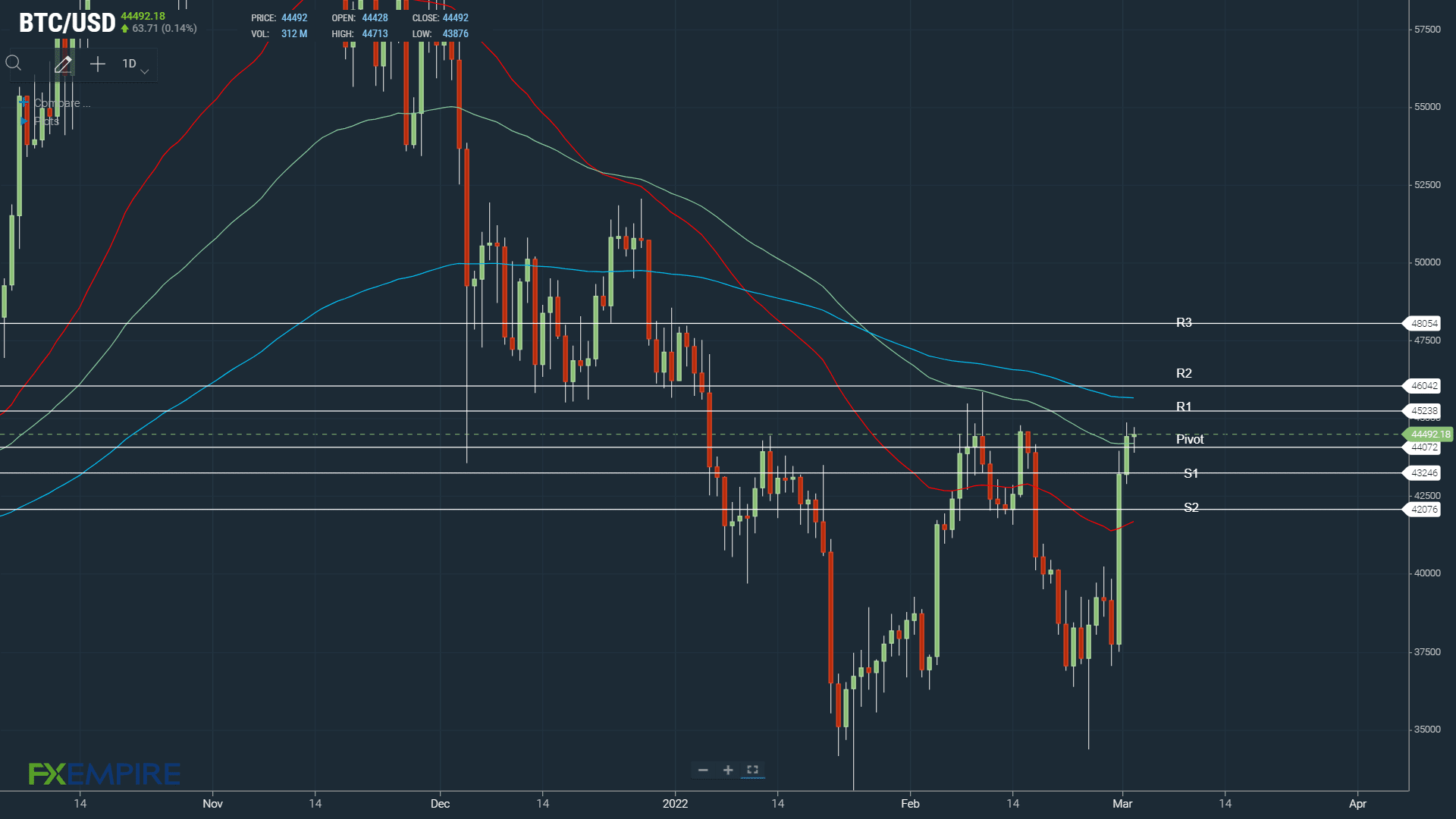

Bitcoin Price Action

At the time of writing, Bitcoin was up by 0.14% to $44,492.

Indicators of Technical Quality

For Bitcoin to break through the $45,238 First Major Resistance Level, it must avoid the $44,072 pivot. The $45,000 level will only be reached with the support of a much larger market.

The Second Major Resistance Level at $46,042 would come into play if there was another long-term rally. $48,054 is the third major level of resistance.

If the pivot is breached, the First Major Support Level of $43,246 will come into play. Unless there is a massive sell-off during the day, Bitcoin should not fall below $40,000. Support at $42,076 should serve as a ceiling for further declines.

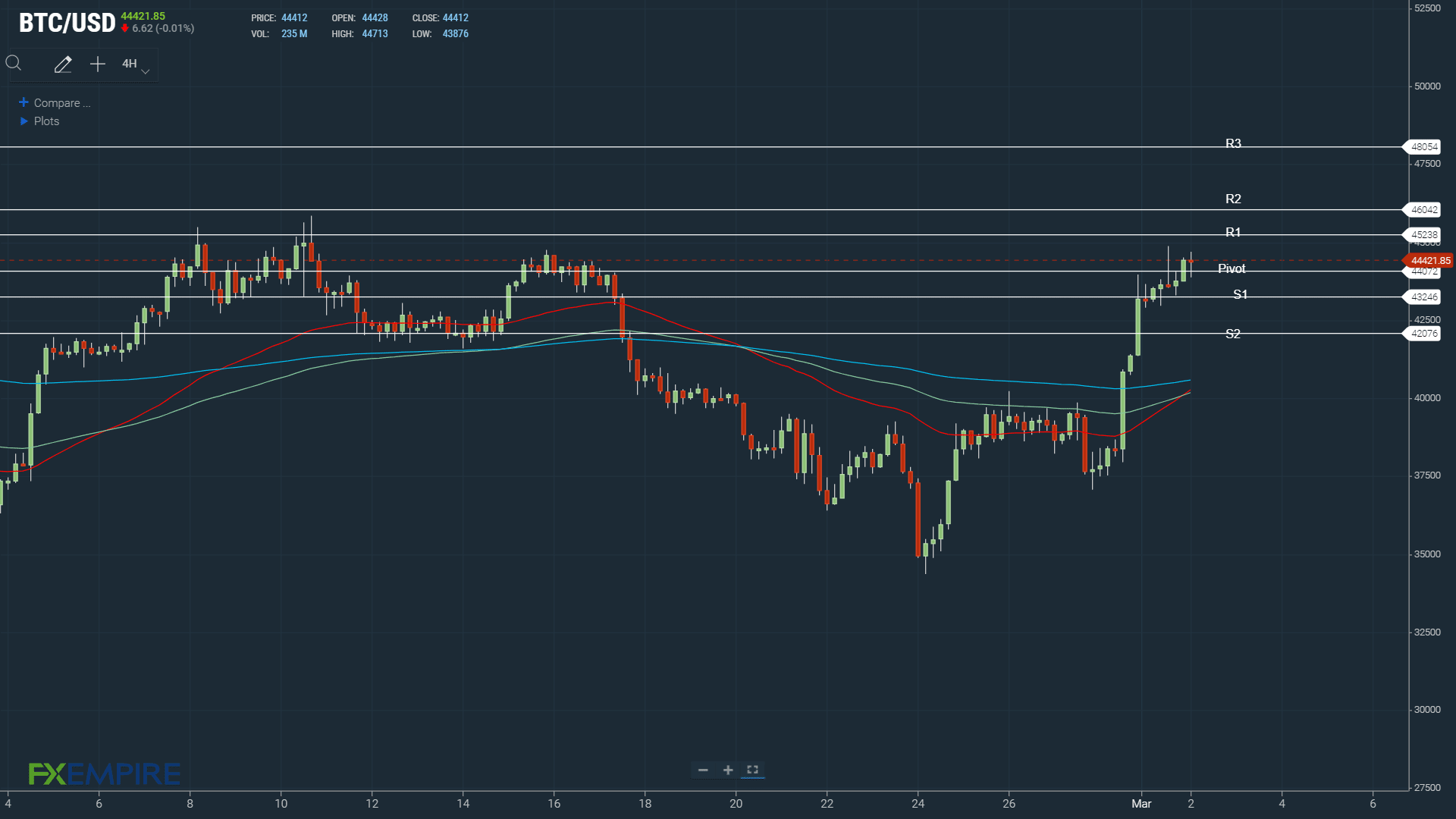

On the 4-hourly candlestick chart (below), we see a bullish signal from the exponential moving averages (EMAs). The 200-day EMA is still well above Bitcoin. After the overnight bullish cross of the 50-day EMA through the 100-day EMA, the 50-day EMA has narrowed to the 200-day EMA. A bullish cross of the 50-day EMA through the 200-day EMA would open up the $50,000 and the Major Resistance levels.

The 200-day EMA currently stands at $40,600, which would support further gains if it were to be avoided.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.