More On: eth

Who is worse for your wealth, politicians or billionaires?

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

Official death certificate revealed Queen Elizabeth II’s cause of death

After losing, the women's basketball team from Mali gets into a fight

Meghan Markle didn't know how to act around the Crown Jewels

Following the larger market signals, Ethereum, the largest cryptocurrency, enjoyed a strong surge in July. However, the situation for ETH appears to be shifting.

Investors around the Ethereum network are thrilled about the impending Merge. Ethereum has defied all expectations, and FUD with the support of Merge is something to think about.

But one has to question if investors are optimistic on ETH ahead of the much-anticipated switch from PoW to PoS consensus.

Hiccups, mistakes, and more

More than 57,000 dealers have been liquidated in the cryptocurrency market in the previous 24 hours. This has resulted in the liquidation of $150 million in assets in the previous day. The Ethereum liquidations have been the most visible of them.

As ETH traders await the September transfer to the proof-of-stake consensus method, there are still indicators of uncertainty, such as negative mood and Ethereum's share of currencies on exchanges, as emphasized in Santiment's tweet below.

📊 As #Ethereum traders await the September proof-of-stake consensus mechanism transition, there are still hints as to where we go between now & then. Negative sentiment & $ETH shifting to exchanges are a couple things to check out in our latest insight! https://t.co/uOF7h58P3X pic.twitter.com/4RramKIVpW

— Santiment (@santimentfeed) July 26, 2022

Indeed, the increased supply of ETH on exchanges is the main source of concern at the moment. Even the well publicized price increase in July failed to please investors/traders.

As a result, they left their coins in situ, making future sell-offs easier to execute.

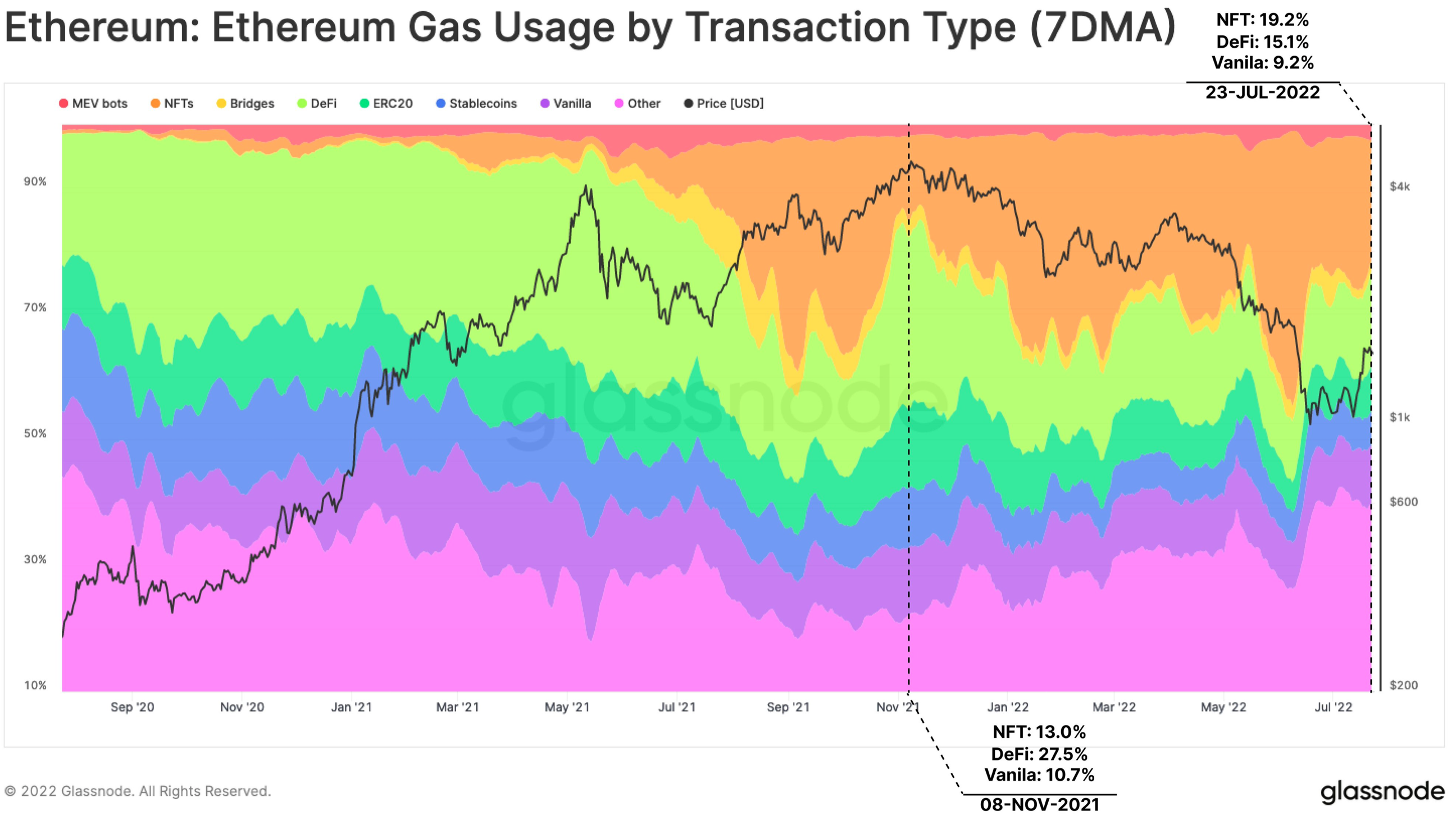

The DeFi domain was another concerning indicator. DeFi apps' dominance has decreased from 27.5 percent to 15.1 percent.

The analytical platform Glassnode revealed this scenario in the graph below.

To put this in context, Ethereum had a 100 percent market share of DeFi TVL at the start of 2021. However, by the end of the year, that percentage had decreased by more than 65 percent. Well, 2022 was not kind to the bulls.

There is only a 6% probability of sunlight.

However, the NFT arena did have a welcoming sign for ETH aficionados. Since November, ETH's proportional gas consumption domination by NFT operations has increased by 6.2 percent. As a result, the market continues to favour NFT transactions.

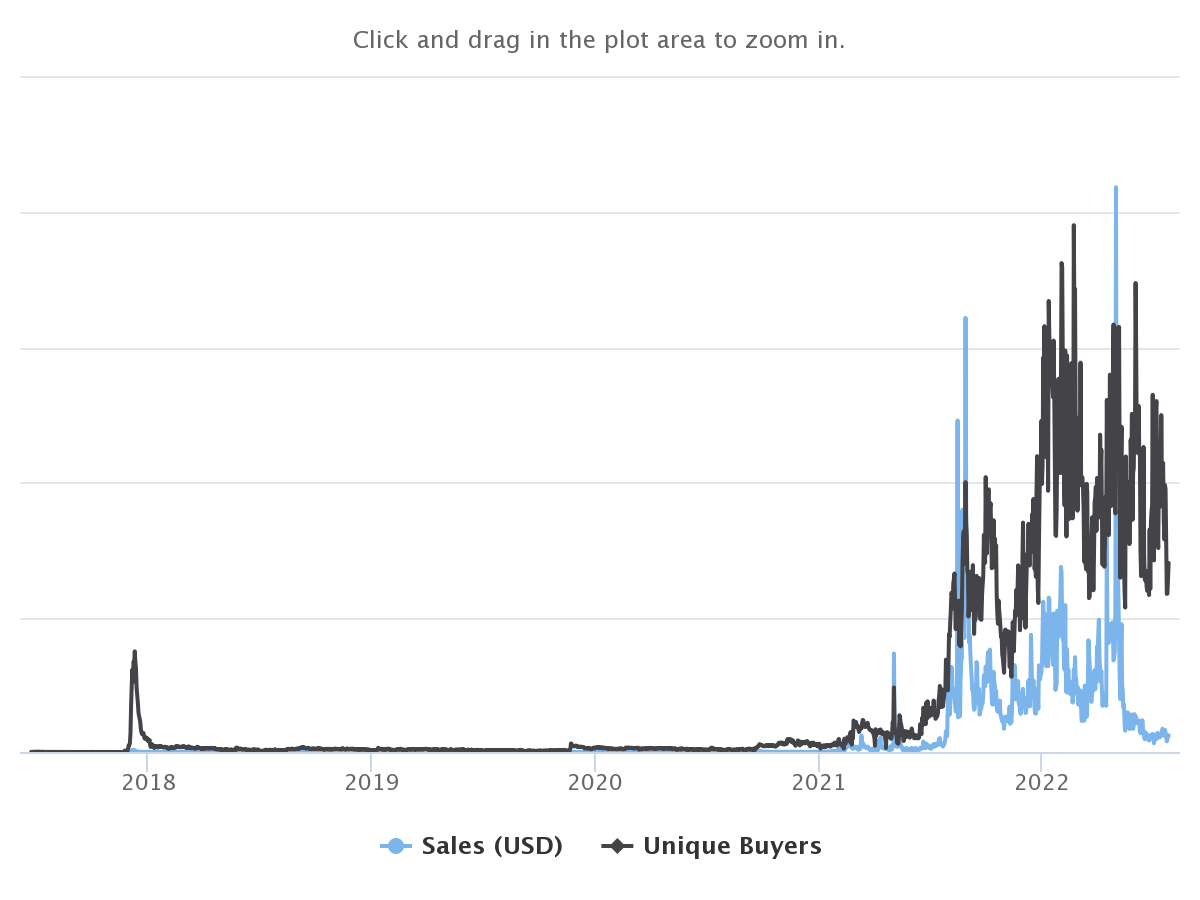

Furthermore, according to CryptoSlam statistics, the average sale price for an Ethereum NFT dropped by 71% from $2,463 in May to $440 at press time. As the crypto bear market persists, NFTs are becoming more affordable.

The aforementioned developments had an effect on the price of ETH. At the time of writing, ETH had taken another 8% hit and was trading around the $1.4k mark. Even holders of ETH (0.1+ coins) hit an all-time low of 6,892,910.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.