More On: cardano

Despite 'crypto winter,' Cardano is rising

Decentralized Twitter might be built by Cardano's Charles Hoskinson

Cardano Price Prediction in 2022 and Beyond

Price Prediction for Cryptocurrencies: SOL, DOT, ADA — Asian Wrap 08 April

Cardano NEWS: ADA Crypto Network Expands ADA adds over 450,000 wallets in Q1 2022 with New Fund and Research Initiative

As the altcoin's price continues to rise, it faces a big obstacle. ADA will require a major increase in bullish momentum to surpass it, unlike any other obstacle before it.

Conclusion

- After a 38%t rise, the price of Cardano is close to a major resistance barrier at $1.20.

- Transaction data suggests that a further rise in prices isn't likely without a dip first.

- Close below $0.857 on a daily candlestick will end the bullish theory.

Take a break: The price of Cardano needs to slow down a little.

Cardano's price has risen about 53% in the last two weeks, going from $0.776 to almost re-entering the $1.20 resistance level. This huge rise in prices comes because BTC has become more bullish in a shorter period of time, allowing altcoins to soar.

Regardless, Cardano's price has broken through the $1 psychological level and is now back at the $1.20 weekly hurdle, which is very hard to get over. To make things even worse, the Momentum Reversal Indicator (MRI) gave a red "one" sell signal on the daily chart four days ago. This move comes right after that.

Even though this signal was wrong, the rally that came after seems to be running out of gas, so a retracement is likely. The $1.10 level is where ADA might stop before another uptrend starts.

In some cases, the price of Cardano might go back to the $1 level before the next rally reaches the $1.30 level for the year's start.

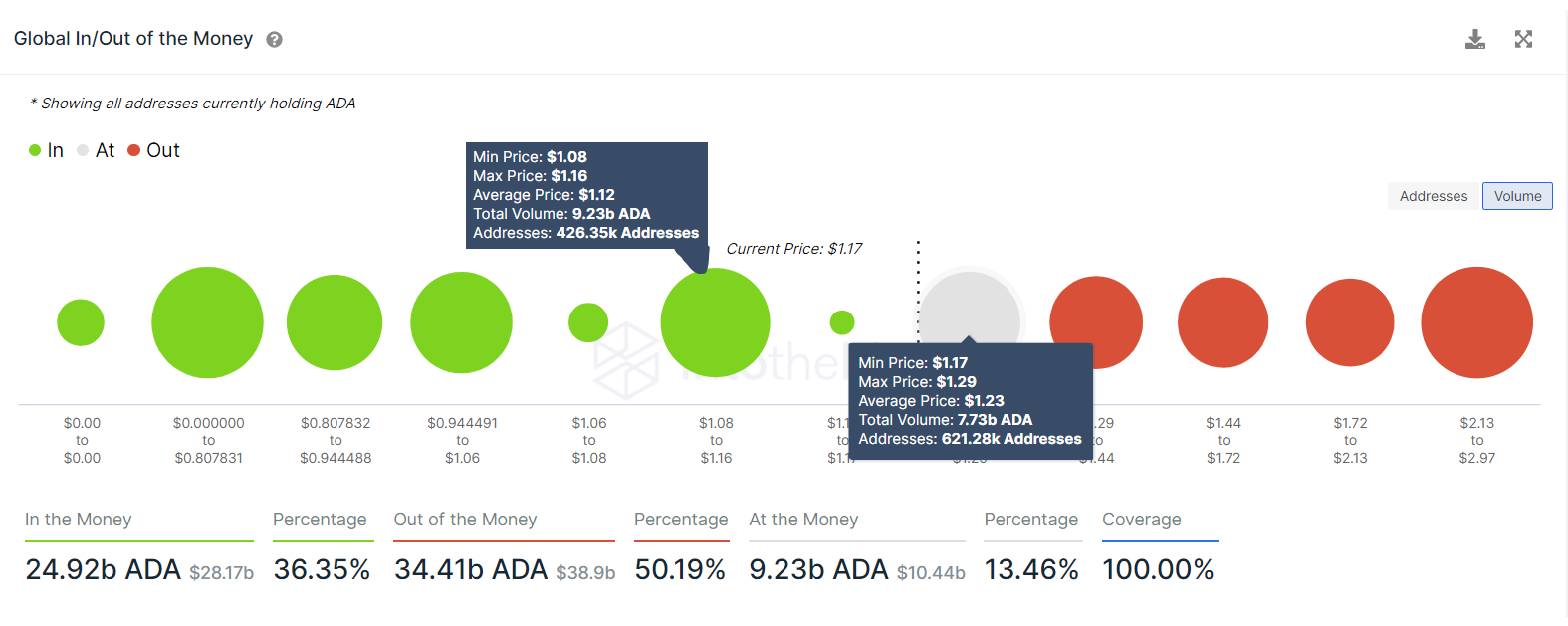

The Global In/Out of the Money model from IntoTheBlock shows that Cardano's price won't go any higher because there are a lot of people who aren't making any money. About 620,000 addresses bought almost 7.8 billion ADA at an average price of $1.23. They are "Out of the Money."

Similar barriers are set up beyond $1.20, which means that bulls need a lot of momentum to get past these barriers. Furthermore, the immediate support level isn't very strong, which adds more weight to the retracement theory.

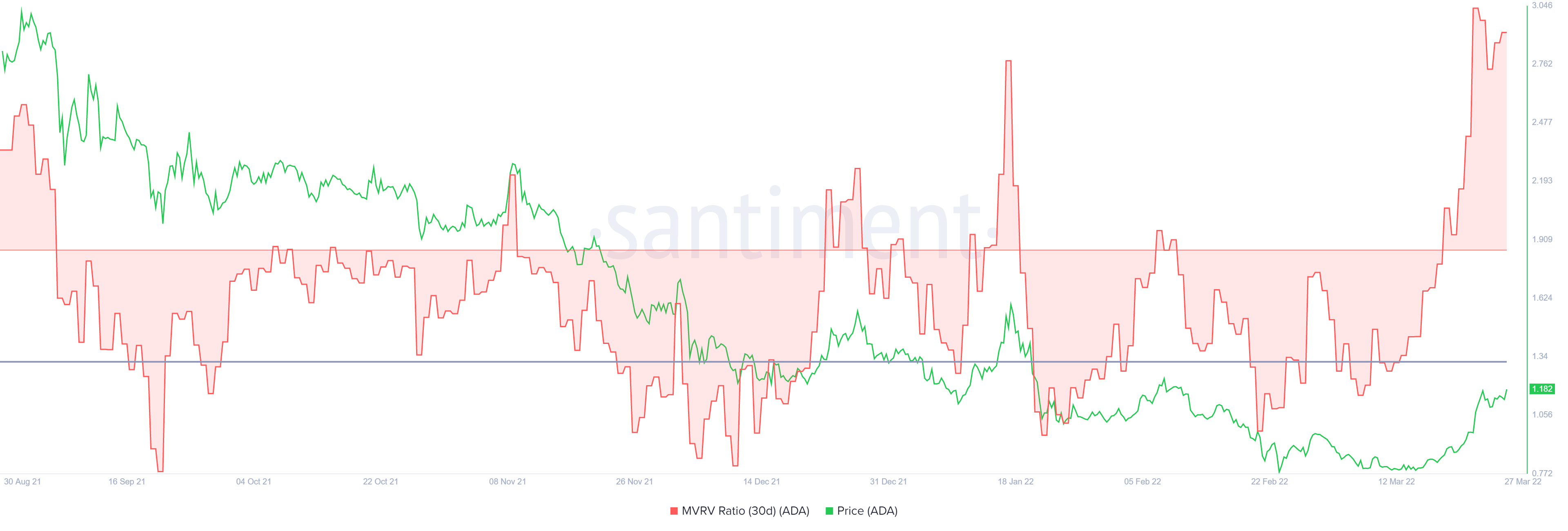

Adding to Cardano's decline in price is the 30-day Market Value to Realized Value (MVRV) model, which shows how much the price has dropped. This on-chain metric is used to figure out how much money each person who bought ADA made or lost over the last month.

Currently, the 30-day MVRV is around 22.5%, which means that many short-term investors are making money and are likely to sell to get their money. Thus, a rise in selling pressure is likely to cause a retracement, as explained from a technical point of view.

After a daily candlestick closes below $0.857, Cardano's price will no longer be seen as going up. This will open the door to retest even lower lows. This means that ADA might come back to the $0.776 level, where buyers might come back and try again to get the uptrend going again.

Related Video

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.