More On: cardano

Despite 'crypto winter,' Cardano is rising

Decentralized Twitter might be built by Cardano's Charles Hoskinson

Cardano Price Prediction in 2022 and Beyond

Price Prediction for Cryptocurrencies: SOL, DOT, ADA — Asian Wrap 08 April

Cardano NEWS: ADA Crypto Network Expands ADA adds over 450,000 wallets in Q1 2022 with New Fund and Research Initiative

Large-scale transactions on the Cardano blockchain have surged dramatically, as reported by IntoTheBlock.

This suggests an increase in demand from financial institutions. Whale sightings have also increased, according to Santiment. More over half of the addresses on the network, on the other hand, are in the red, which means they are losing money on ADA. What does this mean for the price of Cardano in the next weeks?

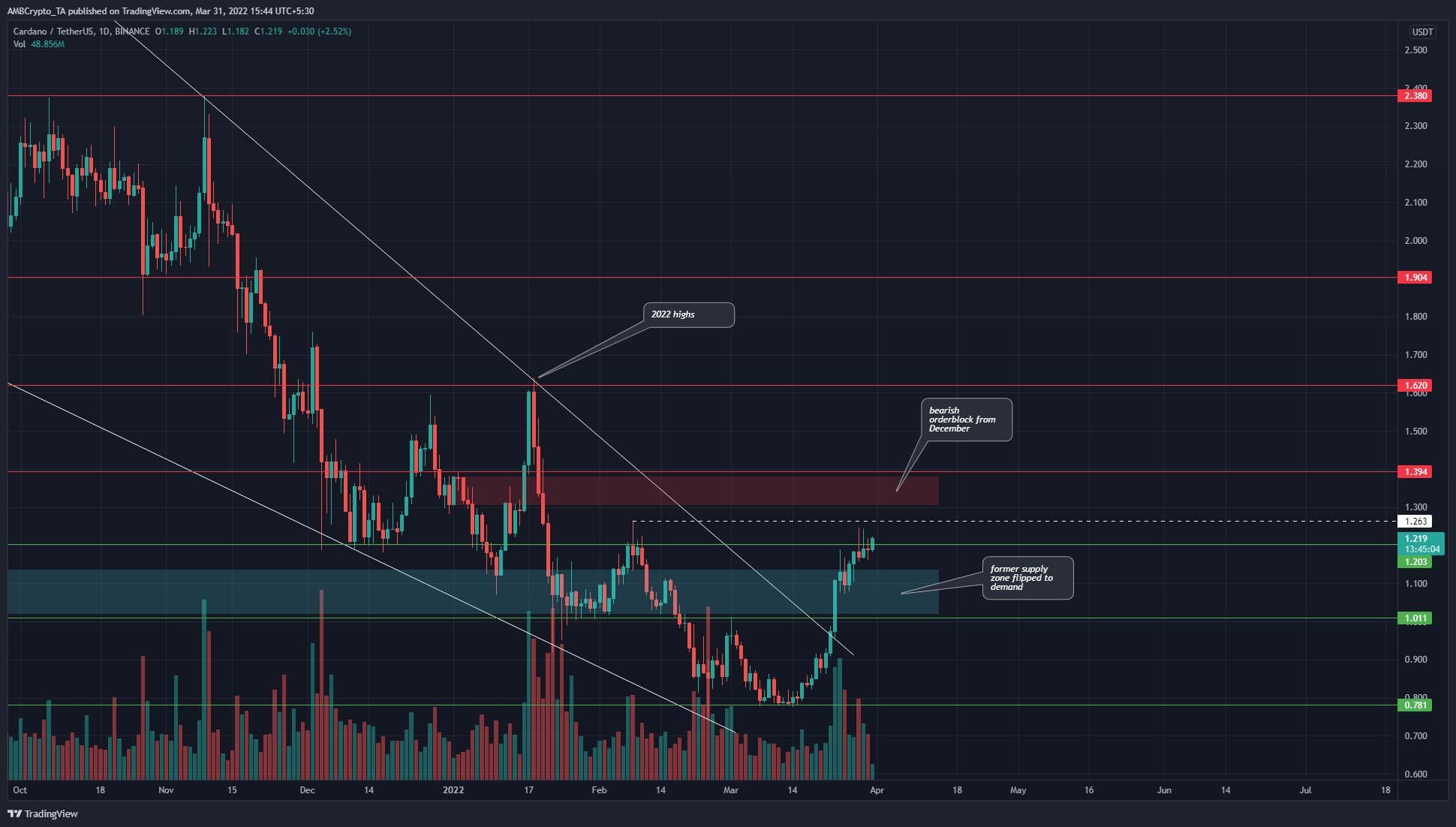

ADA daily chart

ADA's long-term market structure was bearish from September until early March, when it was in a significant downturn. Bitcoin's price has surged beyond $1 in recent weeks, breaking out of a descending wedge formation (white). In the past, the $1 level has served as both a technical and psychological barrier.

However, the bulls were able to break through this resistance, retest it, and go toward $1.26. By late December, the price had fallen to a bearish order block around $1.38 (seen in red).

If ADA is able to get over $1.26 and $1.4, the next target would be $1.6-$1.62 in the north.

Rationale

ADA Volume

Bullish trend and good demand have been reflected in recent weeks' indications. The RSI climbed to 73, but there was no sign of a bearish divergence on longer timeframes. Even more impressive was the rise in the Awesome Oscillator's value over the zero line. Bullish momentum was evident in both cases.

With a Chaikin Money Flow of 0.17, it was clear that demand had increased over the previous month. This has been accompanied by a spike in the OBV over the last few weeks. But this was not enough to break through the orange level, which was the OBV's most recent lower high.

Conclusion

Cardano's indicators indicated that there was room for more gains. It's also possible that huge market participants will quit the markets in the $1.26-$1.4 range just as retail enters on a wave of new enthusiasm. Long-term investors should be aware of the possibility that this is the exit point for a large decline.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.