More On: eth

Who is worse for your wealth, politicians or billionaires?

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

Official death certificate revealed Queen Elizabeth II’s cause of death

After losing, the women's basketball team from Mali gets into a fight

Meghan Markle didn't know how to act around the Crown Jewels

The cryptocurrency market recently experienced a much-needed surge, with the market cap reaching nearly $1 trillion. Following recent developments surrounding the Merge, Ethereum, the world's largest altcoin, led the charge with a 14 percent increase.

Joining the millionaire club, ETH was trading around the $1.35k mark at the time of writing, thanks to renewed interest from enthusiasts. As the analytical firm Santiment pointed out, whale activities only aided this cause. Following this jump, 131 more whales have returned to the network in the last ten weeks.

Check the status of ETH whale supply distribution here -

Santiment added - looking at the aforementioned graph

🐳 #Ethereum has recovered quite well in July, up +29% for the month and +14% alone in the past 24 hours. Additionally, there's an increase in the key 1k to 100k $ETH address tier since early May where 131 new whale addresses have popped up on the network. https://t.co/uGfRQ4dEls pic.twitter.com/ri8MhGIP0o

— Santiment (@santimentfeed) July 17, 2022

Furthermore, the number of addresses holding 1+ ETH reached an all-time high of 1,554,716. So it's not just major buyers who have jumped into this pool.

However, are these holders, whether old or new, profiting? Yes, indeed.

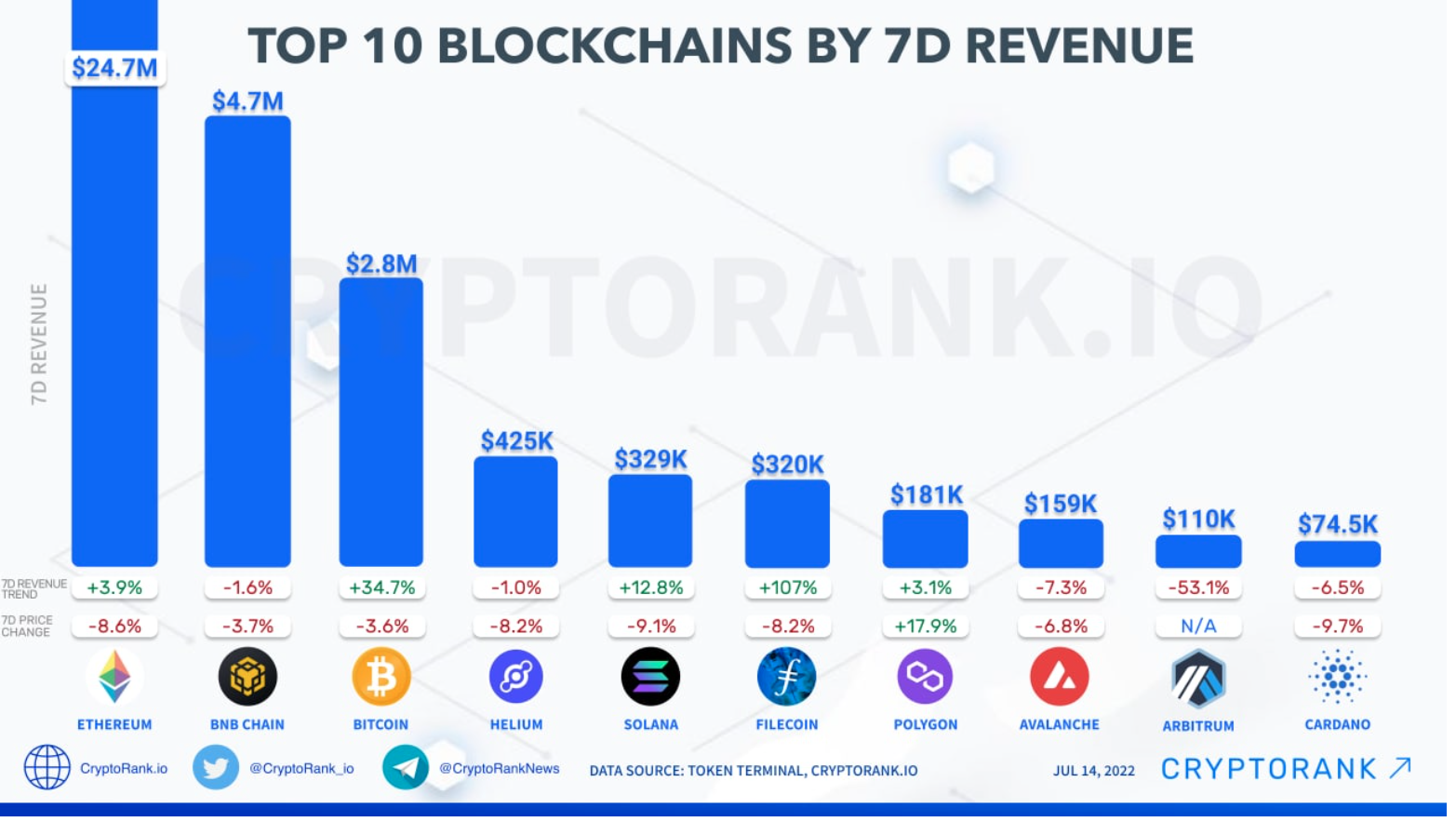

The profitability of the most popular blockchains was assessed by CryptoRank. In seven days, it published a ranking of the top ten blockchains by revenue based on the data.

Ethereum is the undisputed king in this space. Ethereum is the market leader, followed by BNB Chain, Bitcoin, and Helium.

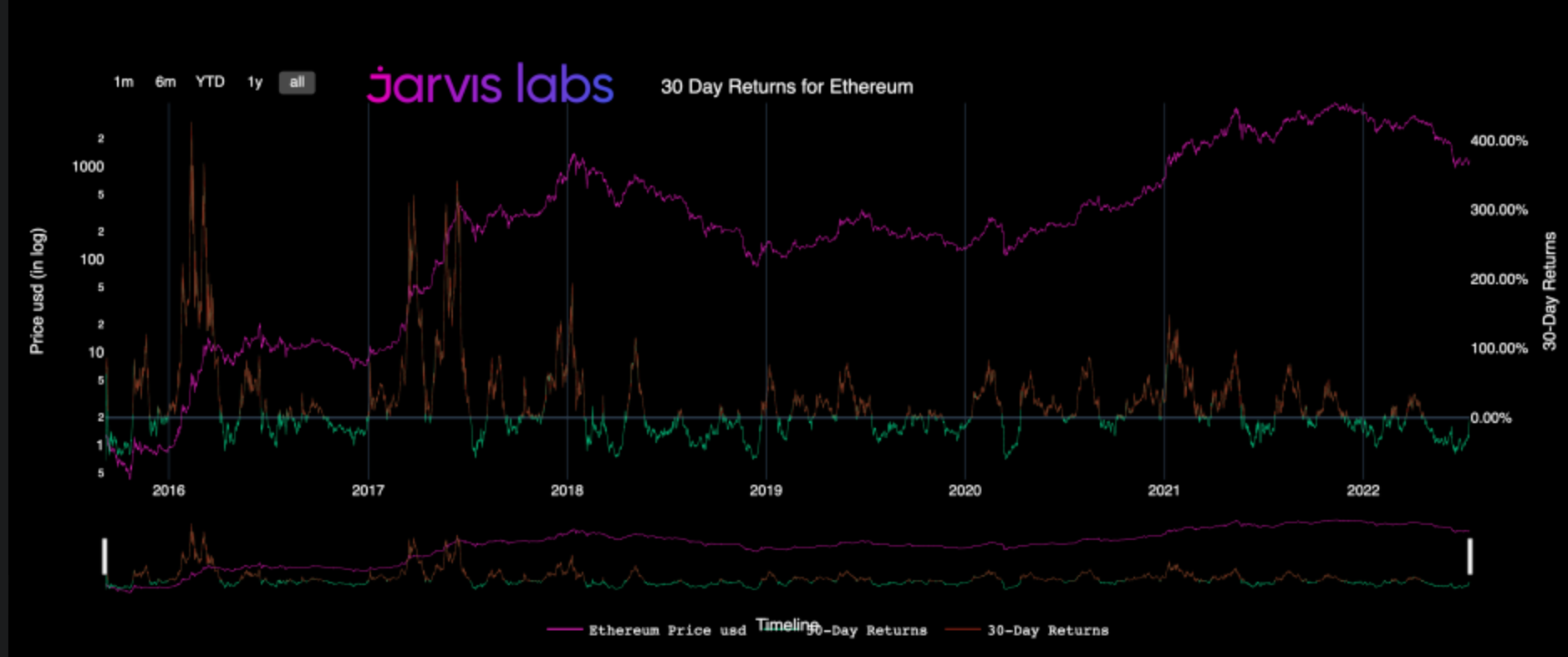

Furthermore, according to research firm Jarvis Labs, the 30-day returns for Ether painted a positive picture. The 30d returns in this case measure the aggregated market's short-term profit and loss at a given time.

According to the graph, Ether's 30-day returns are now "moving towards 0 percent after being deeply negative since April." This could be an indication that the market is turning bullish as the Merge approaches.

When the 30-day return falls below 0% during a bull market, this indicates "prime buying opportunities." During bear markets, on the other hand, "flips above 0 percent are ideal selling opportunities."

Is it a good day, or is it...?

Various traders and analysts have painted a bullish picture for the altcoin. According to Michael van de Poppe, Ethereum could experience a "significant run" after breaking through a key level.

Crucial zones for #Ethereum to watch.

— Michaël van de Poppe (@CryptoMichNL) July 12, 2022

Currently bouncing, while also the $EUR / $USD is showing some slight relief.

If we crack $1,140, I'm assuming we'll continue and have a significant run towards $1,400-1,500 for $ETH. pic.twitter.com/0IDB6j5fEg

However, given the previous correction that this major altcoin has experienced, caution is advised. The flagship cryptocurrency traded above $3,000 before the crypto-markets experienced a severe downtrend, causing its value to plummet.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.