More On: COINBASE

Shares of Coinbase fall 11% because of a hot report on inflation

Limit Break's DigiDaigaku NFT collection increases by nearly 100 percent when the company raises $200 million

Binance now has more Bitcoin than Coinbase

ARK Invest sells $75M in Coinbase shares owing to poor performance

$248M stablecoins leave Coinbase as community refutes liquidity worries

Rumors of a liquidity issue at Coinbase have been debunked by the community, since outflows vary in a volatile crypto market.

Rumors circulated Friday night that Coinbase may experience liquidity concerns as a result of stolen emails saying that the company might discontinue its affiliate program. According to Business Insider, they got emails claiming;

“This has not been an easy decision, nor was it made lightly, but, due to crypto market conditions and the outlook for the remainder of 2022, Coinbase is unable to continue supporting incentivized traffic to its platform.”

Some said on Twitter that the move was symptomatic of liquidity issues for the biggest US exchange. Kurt Wuckert Jr of CoinGeek stated that the suspension of the affiliate program, together with other choices taken by Coinbase in recent weeks, indicates a "liquidity crisis" is on the horizon.

In the last month, Coinbase combined their USD and USDC markets, closed Coinbase Pro and turned off their affiliate program.

— Kurt Wuckert Jr | GorillaPool.com 🍌🍌 (@kurtwuckertjr) July 16, 2022

This is after over a year of insiders selling $COIN stock which has absolutely cratered.

I smell a liquidity crisis.

Where’s the money, @coinbase? pic.twitter.com/DuoQcwkjsH

Outflows from Coinbase

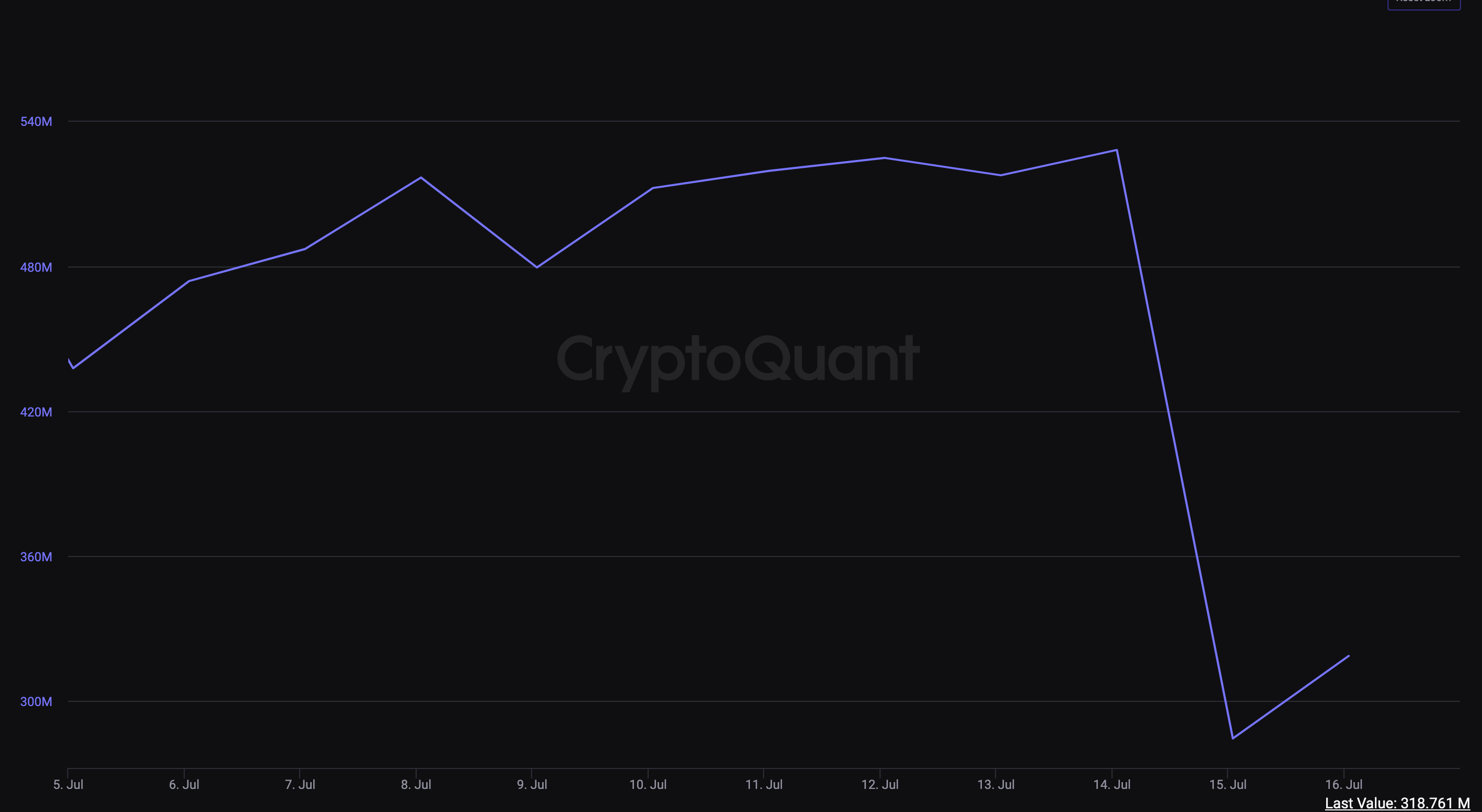

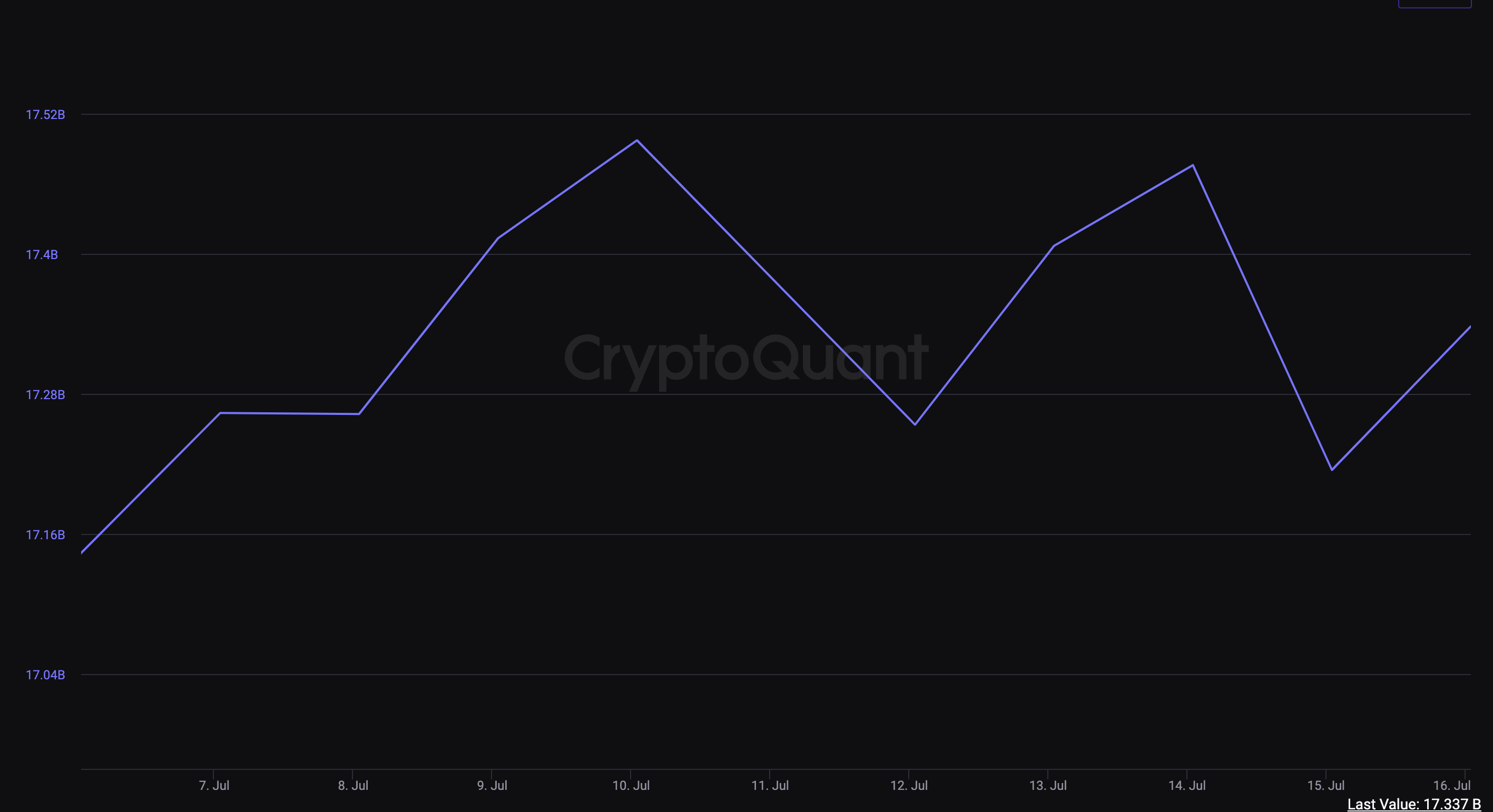

According to on-chain statistics from CryptoQuant, roughly 50% of stablecoins on Coinbase Pro departed the exchange on July 15; the entire value was around $248 million. The percentage of stablecoin outflow on Coinbase was substantially greater than on other exchanges like as Binance. Only over 1% of Binance's stablecoin reserves departed during the same time span, but the tokens had a similar worth of slightly under $300 million.

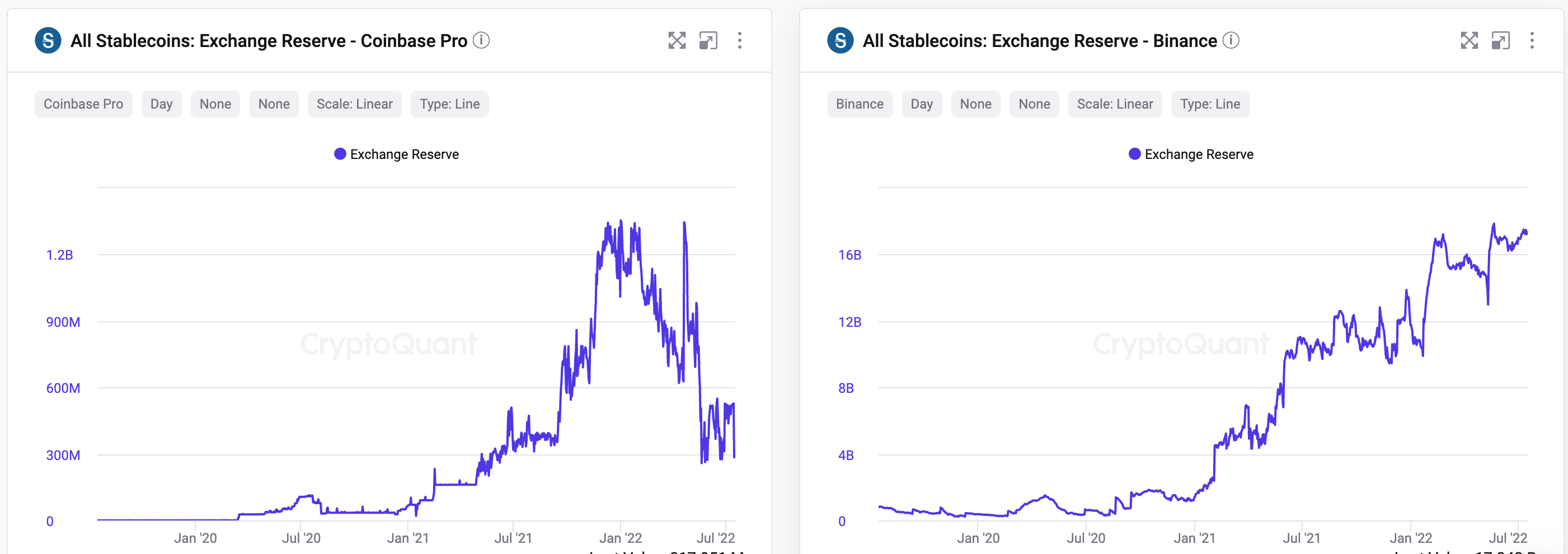

When the value of stablecoins on the two exchanges is examined, Coinbase's decrease contrasts with Binance. Stablecoins peaked at roughly $1.2 billion on Coinbase in January 2022, but are currently worth around $284 million. Since 2019, the value on Binance has been increasing.

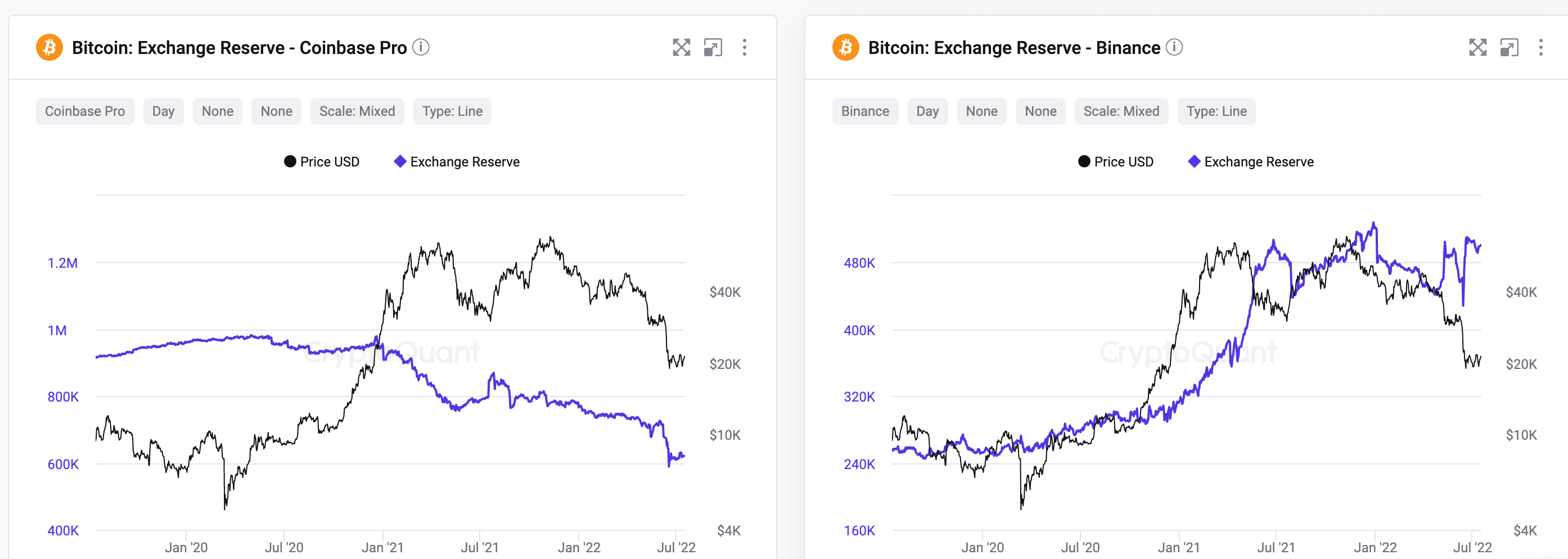

When comparing the Bitcoin held on each exchange, the data reveals a less dramatic but still concerning picture. Coinbase's Bitcoin holdings have been steadily declining, whilst Binance's have been expanding within the same time period.

When all CryptoQuant exchanges are included, the Coinbase graph looks to follow the general industry trend. The decline of Bitcoin kept on Coinbase may simply be a result of the growing popularity of storing cryptocurrency in non-custodial (unhosted) wallets.

The Coinbase community defends it.

Several industry insiders have slammed people who claim Coinbase is in peril amid speculations of a crisis. "Coinbase does not have a liquidity issue," tweeted Kraken's Dan Held, while the developer in charge of the Coinbase affiliate program, NJ Skobene, affirmed the program's withdrawal was not a warning sign.

As the guy that literally set up the affiliate program in 2019, shutting it down has nothing to do with liquidity.

— NJ skoberne (@howdoyousaynejc) July 16, 2022

Jungle Inc, a cryptocurrency YouTuber, also stated that Coinbase had "$6 billion in cash" and significant crypto reserves. His confidence, however, began and ended in the same tweet, when he stated he had taken all cash from the exchange. After Voyager and Celsius declared bankruptcy earlier this year, the danger of holding on exchanges appears to have increased.

Coinbase has 6 billion in cash + large crypto reserves. They will be fine!

— Jungle Inc 💥Steady Lads💥 #MMG (@jungleincxrp) July 16, 2022

With that being said I just transferred everything off. 🍾🍾🍾

On July 12, Coinbase Co-Founder Brian Armstrong tweeted that the firm is "still adapting" to the success it achieved in 2021. Will this expansion spell the end of one of the world's most reputable exchanges? If it does, it will surely have an impact on the rest of the industry. Given the dip in the price of Bitcoin since January, Coinbase's cost-cutting tactics may not appear severe at the moment.

Coinbase grew a ton in 2021 and we're still adjusting to that growth. One of the crazy parts about our industry is that in any given year we might be growing 300-500% or -50%. It makes it incredibly challenging to plan and culturally to absorb so many people during up periods.

— Brian Armstrong - barmstrong.eth (@brian_armstrong) July 12, 2022

Related video

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.