More On: michael saylor

MicroStrategy Q2 loss $918M, Saylor becomes Chairman

Saylor makes new Bitcoin bet despite losses

Saylor's belief in Bitcoin remains unshaken as MicroStrategy purchases another 480 BTC

Michael Saylor, CEO of MicroStrategy, slams everything but Bitcoin

According to Michael Saylor, investing in MicroStrategy is the closest thing to a bitcoin spot ETF

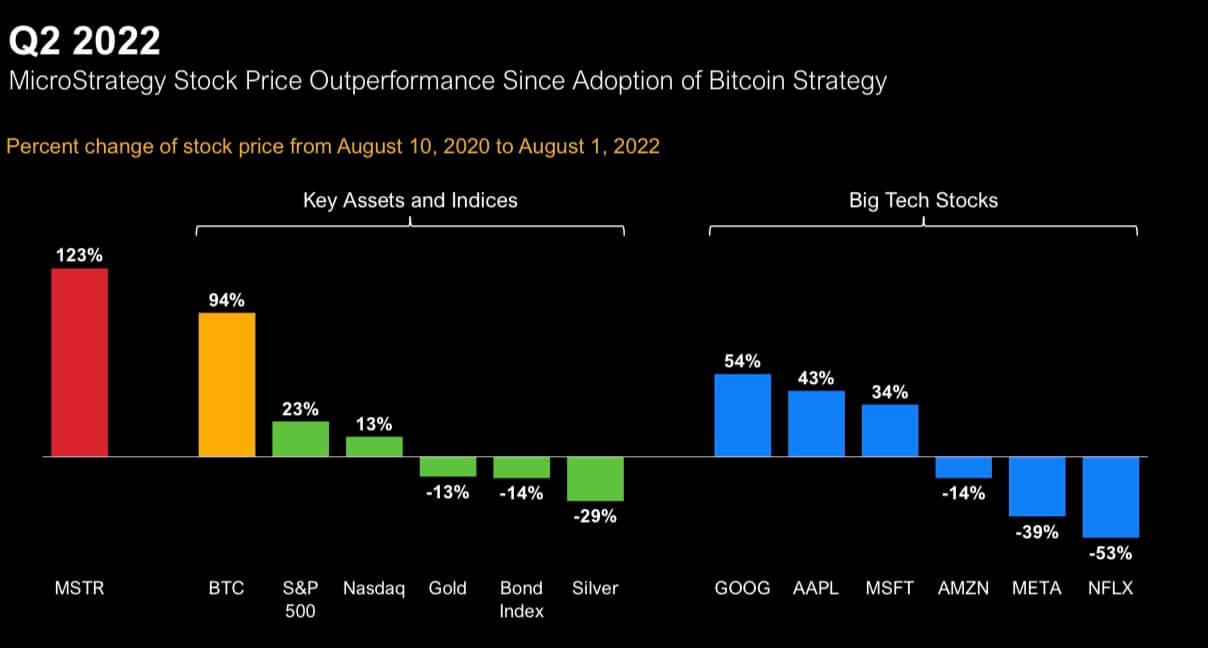

Despite the losses, MicroStrategy stock has outperformed the Nasdaq, Gold, Silver, and even some of the world's largest technology businesses since its Bitcoin adoption.

According to its earnings report filed on August 2, MicroStrategy incurred a $918 million impairment charge on its Bitcoin (BTC) assets in the second quarter.

According to the article, the corporation will create a new position of executive chairman, which Michael Saylor will assume.

Meanwhile, Phong Le, the company's president and chief financial officer, will succeed Saylor as CEO, and Andrew Kang, the company's remaining president, will become the new CFO.

Bitcoin holdings at MicroStrategy

As of June 30, the business intelligence firm had 129,699 Bitcoins and was worth $1.988 billion.

According to the company, this represents a cumulative impairment loss of $1.989 billion since it began purchasing Bitcoin in 2020. The company indicated that their average cost per bitcoin is around $30,664.

Meanwhile, despite the losses, the corporation has stated that it would continue to hoard its Bitcoins.

Since adopting Bitcoin, MicroStrategy's stock has outpaced the Nasdaq, Gold, Silver, and even the stock performance of some of the largest technology firms, like Google, Meta, Netflix, Microsoft, and others.

Michael Saylor will be appointed as the next executive chairman.

During the results call, Michael Saylor announced his resignation as CEO of MicroStrategy.

Saylor said that in his new capacity, he will be able to focus on acquiring more cryptocurrencies for the organization. Saylor stated:

"As Executive Chairman, I will be able to devote more time to our bitcoin acquisition strategy and associated bitcoin advocacy projects, while Phong will be given the authority to handle broad business operations."

MicroStrategy shares are being shorted.

According to Bloomberg News, short holdings in Microstrategy shares have lately increased.

According to the research, 51% of MicroStrategy's available shares are sold short, valued at $1.4 billion.

According to the research, short positions increased by 680,000 shares in the past seven days and by 1.2 million shares in the last 30 days.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.