More On: eth

Who is worse for your wealth, politicians or billionaires?

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

Official death certificate revealed Queen Elizabeth II’s cause of death

After losing, the women's basketball team from Mali gets into a fight

Meghan Markle didn't know how to act around the Crown Jewels

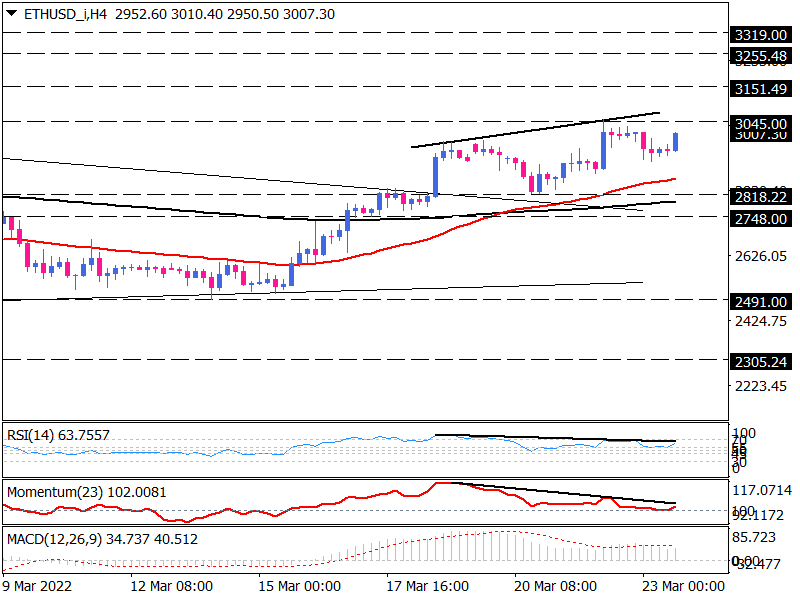

Last Friday, the bulls finally broke above the consolidation pattern on the 4-hour chart for the first time in a long time.

After the 50-EMA crossed over the 200-EMA, the rising moving averages help keep the bullish momentum going. This isn't the only thing that looks like the price goes up and down. Between 3045 and 2818, the price of this cryptocurrency is swinging between these two points. As long as the price stays above the EMAs, the bullish outlook for the price would stay in place. There must be a clear break above 3045 to keep this uptrend going. That's been a strong level of resistance for more than a month. This level is also important for the Ethereum coin because it is the 127.2 percent Fibonacci extension of the previous downward swing, which makes it a very important point.

If prices fall more, buyers will have a better chance of getting strong enough to try to break through 3045 again. As soon as bulls get through this area, they may have to face the 161.8 percent level at 3088. By holding above this barricade, the price will rise to 3151 and 3255, depending on how strong the move is.

However, short-term momentum oscillators don't seem to agree with the current bullish trend at this point in time. By making lower tops, both the RSI and the momentum have shown signs of being different. There is a lot of momentum behind the 100-threshold, and it's going down. There is less optimism in the market if the MACD bar is going down, because it gets smaller and smaller.

In this case, if sellers follow divergent oscillators when they enter the market, the price can fall to meet the 50-EMA. This is because the fast EMA didn't work. The 200-EMA, which is 2818, could be a support. The broken triangle line might make things look bad if the hurdle is crossed.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.