More On: cardano

Despite 'crypto winter,' Cardano is rising

Decentralized Twitter might be built by Cardano's Charles Hoskinson

Cardano Price Prediction in 2022 and Beyond

Price Prediction for Cryptocurrencies: SOL, DOT, ADA — Asian Wrap 08 April

Cardano NEWS: ADA Crypto Network Expands ADA adds over 450,000 wallets in Q1 2022 with New Fund and Research Initiative

Despite a 15% drop in the overall value of decentralized finance in 2022, the Cardano Protocol has experienced a tremendous increase in the liquidity of its crypto project.

Conclusion

- Cardano's overall value will continue to rise in 2022, despite the unfavorable market attitude.

- Since the beginning of 2022, the total value locked in Cardano has climbed considerably.

- There is around $208 million worth of assets locked up on the blockchain.

Smart contract-based blockchain technologies have relied heavily on Cardano since its introduction in 2017.

Since the Alonzo Hard Fork in September 2021, when smart contract capability was fully activated, Cardano has played a critical role in the decentralized finance industry.

As a result, the whole project's fortunes are expected to change in 2022.

Cardano's total value locked (TVL) has increased by 25,259.3 percent since the beginning of 2022, according to BeInCrypto Research. During the first week of January, Cardano's TVL was $822,261, and by March 16, 2022, it had risen to nearly $208,520,000.

Since it was created on peer-reviewed research, Cardano is the first blockchain platform to be developed using evidence. Decentralized applications, communities, and systems all benefit from a unique blend of technologies that ensure long-term viability and security for everybody (DAPPS). Cardano, one of the most popular technologies on TVL, offers a variety of applications in education, retail agriculture, government, healthcare, and finance.

What factors have contributed to the rise in the total locked value of Cardano?

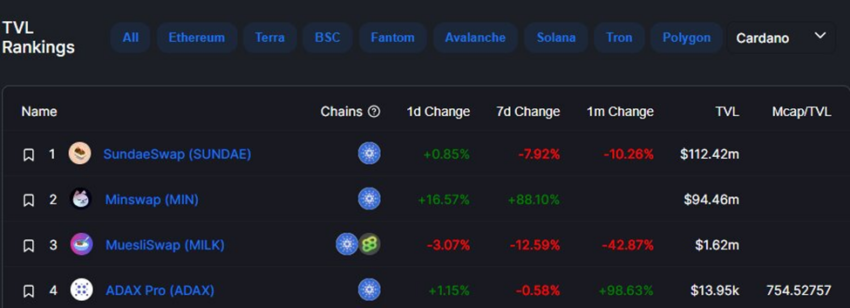

DefiLlama, a reputable source, lists only six decentralized protocols, despite the fact that several sources claim Cardano has several DAPPS in the areas of lending, payment/wallets, trading, interest accounts, derivatives/options, asset management, insurance, financial analytics, and identity/Know Your Customer. Decentralized exchanges SundaeSwap (about $112.28 million), MiniSwap (approximately $95.36 million), MuesliSwap (approximately $1.6 million), and ADAX Pro (approximately $14,060) continue to contribute to the shifting fortunes of Cardano's TVL.

There are a number of other lending protocols, including but not limited to VyFinance (VYFI) and Meld, that might add value in the future (MELD)

Cardano has dropped into the top 30 chains with the most value locked after reaching more than $200 million in TVL in March, which can be ascribed to the large percentage gains in the aforementioned decentralized exchanges.

Up-to-date information about the Cardano project

According to Input Output Hong Kong (IOHK) Chief Executive Officer Charles Hoskinson (Cardano creator), additional DAPPS may be expected after the Vasil Hard Fork is deployed in June 2022, which is scheduled to happen on Saturday, March 12, 2022.

What most also don't understand is that many Cardano DApps are waiting for the Vasil hardfork in June to launch to benefit from pipelining. So it seems we ain't seen nothing yet on TVL https://t.co/mMHxwRrF96

— Charles Hoskinson (@IOHK_Charles) March 12, 2022

It has been determined that the Vasil Hard Fork will be primarily focused on scalability improvements, in accordance with the Cardano Roadmap. If this happens, the Cardano ecosystem would undergo a number of changes, including the creation of smart contracts. Cardano may handle at least 2 million transactions per second by June 2022 if the first Hydra Heads (a layer 2 scaling solution designed at boosting the blockchain's scalability and security) open in March.

As of this writing, Cardano's development activity is on the rise. It lags Solana (SOL), however it has exceeded Polkadot, Kusama, Ethereum, and Flow (FLOW) in the current ranks of development activity.

Cardano's novel token, ADA, has not benefited from the surge in total value locked. It debuted on January 1, 2022, with a trade price of $1.31, and on January 18, 2022, it surged 24% to an annual high of $1.63.

At the time of this writing, ADA is trading at between $0.7819 and $0.8614.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.