More On: crypto

It looks like Tom Brady lost a huge amount of money in the FTX Crash

How much 6 popular cryptocurrencies lost in 2022 ?

Why the FTX bubble burst and how it hurt people

Why Sam Bankman-Fried's world fell apart

The cryptocurrency exchange Bitfront closes

It's possible that donations to Ukraine's government in bitcoin and ether will alter the way organizations raise money in the future.

On February 24, Vitaliy Raskalov was 6,700 kilometers from home when Russia started an attack into Ukraine. During our Sunday evening Telegram conversation, I learned that the Kyiv-born photojournalist was in Mexico City, where he was busy organizing the delivery of protective vests to his native Ukraine. All of the costs will be covered by cryptocurrencies.

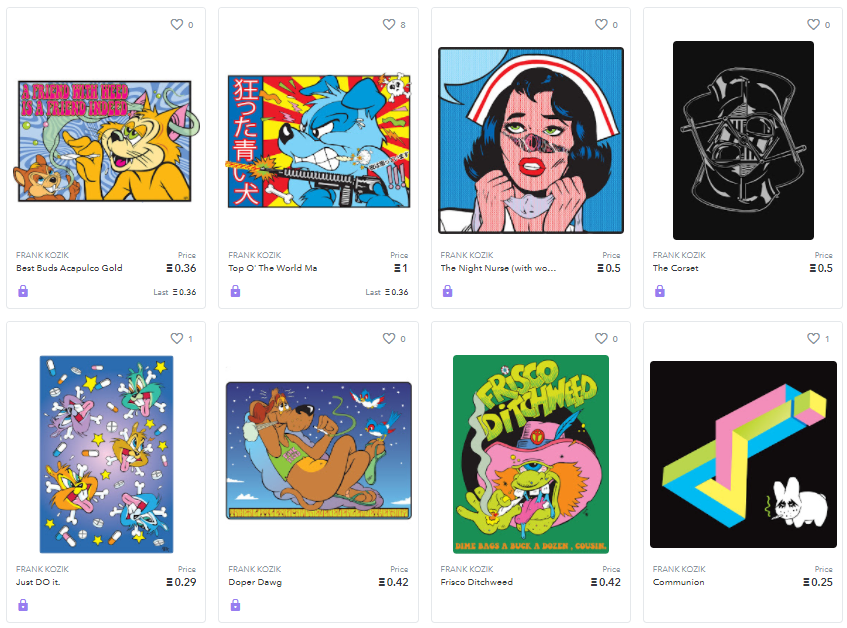

Since June, Raskalov has been selling a collection of his images on OpenSea, the most popular exchange for nonfungible tokens (NFTs). Proceeds from this series, which includes images taken from atop skyscrapers and other harrowingly tall structures, have been contributed to the Ukraine's resistance since the conflict began last week.

To support his nation, Raskalov explained that while he was unable to grab weapons and fight his country, he was still able to gather money and generate funds. It's estimated that he's already raised over $10,000 for protective gear such as helmets, torches, and bulletproof jackets, according to what he stated.

According to Chainalysis, Ukraine is the fourth-largest cryptocurrency adopter in the world, just after Vietnam, India, and Pakistan. More than $550,000 in cryptocurrencies were raised in 2021, compared to $6,000 in the previous year, according to Elliptic, another cryptocurrency tracking company.

According to Elliptic statistics, $55.7 million has been raised since Russia launched military activities in Ukraine last week.

Much of that is due to donations given to the government of Ukraine directly. Minister of digital transformation Mykhailo Fedorov of Ukraine tweeted out wallet addresses three days after Russia's invasion asking people to give Bitcoin, Ether and the stablecoin tether, which is tethered to the US dollar. The same URLs were also shared by Ukraine's official Twitter feed. The wallets have already received more than $47 million in donations, according to Elliptic. That might have an impact on future fundraising efforts, not only in Ukraine but throughout the world.

The previous four days have left Raskalov in disbelief. "That makes me so pleased. My emotions are all over the place right now. Twitter and a small NFT group raised almost $10 million. In the European Union, the majority of nations did nothing."

Approximately $550 million in help is being promised by the European Union.

Non-governmental organizations and efforts like Raskalov's have also raised millions of dollars for the Ukrainian government. With the help of Russian punk band PussyRiot, UkraineDAO (a decentralized autonomous organization is a group whose token owners vote on how money are spent) earned over $3 million in ether and then another $6.75 million via the auctioning of a Ukrainian flag sold as an NFT.

Non-Fertilization Treaty (NFT)

When NFT trader Andrew Wang, 23, saw all of these bitcoin fundraisers, he had an idea for his 140,000 followers on Feb. 24: What if an NFT collection was launched to raise funds?

"All of these resources are at our disposal. Communities, art and smart contracts are only some of the things that are available to us in the world of cryptography "Wang spoke to me over Zoom on Sunday, groggy from lack of sleep. The term "smart contract" describes a contract that automatically executes when specific conditions are satisfied. One is commonly used in NFT transactions.) Why not raise ether by bringing together artists and writing a smart contract together??"

Reli3f, a group of Wang, five other organizers and developers, and 37 NFT artists, was formed as a result of this effort. 'Web3' refers to an internet in which blockchain technologies like cryptocurrency and NFTs are heavily incorporated. In addition to Raskalov, who provided a shot of Kyiv, the project's contributors include a number of Ukrainian artists. However, given how soon Reli3f proved to be a success, Wang's portrayal of the project as an experiment is misleading.

Group chats packed with interested organizers were rapidly created after Wang put out the tweet on February 24. During the following 24 hours, 37 artists had committed to produce one piece of work apiece. On the same night, the collection was launched, with 200 copies of 37 distinct NFTs selling for $130 apiece. After 30 seconds, it has raised $980,000 in 371 ether, or $980,000 in ethereum. Wang and his staff distributed the monies on Sunday night, just before he talked to me. As part of the Reli3f initiative, the Kyiv Independent newspaper and the medical assistance charity Hospitallers each received 61 ether ($160,000) from Reli3f.

We have just deployed 185 ETH to support the people of Ukraine. Here is the breakdown of where the funds are going, and our thought process behind the decision. 🧵

— RELI3F (@reli3fxyz) February 28, 2022

As Wang put it, "We're looking into ways to do this again and do it better." It was an experiment and the more you do it, the better you get.

In order to verify the transactions, Reli3f constructed a Twitter thread that included a link to the transactions. The team's smart contract was also put to the test. A blockchain-enabled charity model is one that Wang believes will become more common in the future.

"Web3 is, in my opinion, unbiased. A decent instrument may be used for both good and ill; this is a matter of choice "that Reli3f can serve as an example of the latter, he stated. "In our opinion, this is an integral aspect of Web3. This thread has all of the transaction hashes, and we've discussed how we arrived at specific values. Money is clearly visible."

Wang cited the additional benefit of circumventing bank transfer limitations as another reason to use cryptocurrencies. There are limits on how much money residents may withdraw or move around in certain banks in Ukraine, notably in the east. Restrictions on currency exchange and a withdrawal limit of 100,000 Ukrainian hryvnia ($3,350) are among the measures implemented by the National Bank of Ukraine.

Organizations that don't have wallets set up are at the root of the problem Ukraine's government's unprecedented success in generating donations via bitcoin wallets might soon change.

The good and the bad of cryptography

Cryptocurrency's adoption in Ukraine is a clear demonstration of its advantages: As a result of a spontaneous, international fundraising effort, huge quantities of money have been given to local groups rapidly without the burden of bureaucracy. However, there are also some drawbacks.

Both sides can benefit from the potential of Bitcoin and ether to sidestep institutional constraints.. Both the United States and the European Union have imposed severe sanctions on Russian financial institutions, exports, and prominent business and political individuals. The aim is that President Vladimir Putin will be driven to the negotiating table if the economy is squeezed. Some others are concerned that cryptocurrencies, which can easily sidestep such regulations, would lessen the impact of this.

To deal with foreign partners and avoid sanctions, Russia is turning to cryptocurrency, according to an essay by Dalhousie University's associate professor of international development studies, Robert Huish. Huish points out that Siberia is a major centre for cryptocurrency mining, which provides Russia with a steady supply.

As predicted, frauds have also been on the rise due to the inherent anonymity of cryptocurrency. There have been reports of bogus wallet addresses purporting to be from charity. Twitter was forced to issue a warning when a number of OpenSea collections resembling Reli3f appeared.

Even yet, Raskalov is upbeat, and not only about bitcoin. Our main source of revenue after we win the battle, when we begin to rebuild our nation, will be cryptocurrencies."

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.