More On: Kim Kardashian

Kim Kardashian settles with the SEC over her promotion of cryptocurrency and will pay a fine of $1.26 million

Kim Kardashian could be just the beginning of a crackdown on celebrities who use crypto

Kim Kardashian's plans to become a lawyer could be in danger because of the SEC 'pump and dump' scandal

Inside Kim Kardashian's new $70M Malibu home

Kim Kardashian loses 21 pounds, and people criticize her for doing so in a 'unhealthy' way

Kim Kardashian has agreed to pay the Securities and Exchange Commission $1.26 million to settle charges that she promoted a cryptocurrency on Instagram without saying that she was paid $250,000.

Monday, the SEC said that the reality TV star and business owner has agreed to help with its investigation.

The SEC said that Kardashian didn't say that she was paid to put a post about EMAX tokens, a crypto asset security being sold by EthereumMax, on her Instagram account.

Kardashian's Instagram post had a link to the EthereumMax website, which told people who wanted to buy EMAX tokens how to do so.

Gurbir Grewal, director of the SEC's division of enforcement, said in a prepared statement, "The federal securities laws are clear that any celebrity or other person who promotes a crypto asset security must disclose the nature, source, and amount of compensation they received in exchange for the promotion."

Kardashian has agreed that for the next three years, she will not promote any crypto asset securities.

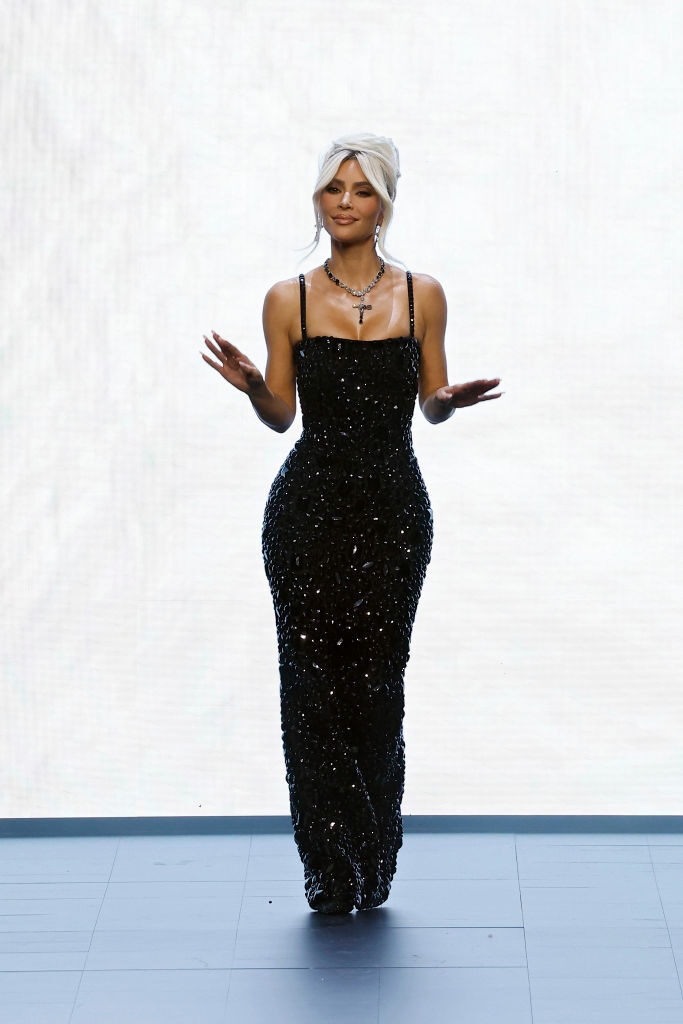

Kim Kardashian walks the runway of the Dolce & Gabbana Fashion Show during the Milan Fashion Week Womenswear Spring/Summer 2023 on September 24, 2022 in Milan, Italy. (Estrop/Getty Images)

“Ms. Kardashian is pleased to have resolved this matter with the SEC. Kardashian fully cooperated with the SEC from the very beginning and she remains willing to do whatever she can to assist the SEC in this matter. She wanted to get this matter behind her to avoid a protracted dispute. The agreement she reached with the SEC allows her to do that so that she can move forward with her many different business pursuits,” a lawyer for Kardashian said in an email.

Kardashian is well-known for her reality TV show, "The Kardashians," which is currently streaming on Hulu. She is also a successful businesswoman. Her brands include SKIMS, which sells shapewear, loungewear, and other items, and SKKN, which is a line of skin care products.

With 330 million Instagram followers, Kardashian is a huge megaphone for anyone who wants to promote a product.

Congress is paying more and more attention to cryptocurrencies. The Commodities Futures Trading Commission would be in charge of regulating Bitcoin and Ether, two popular cryptocurrencies. This comes after wild swings in the value of cryptocurrencies, dozens of scams, and hundreds of billions of dollars gained and lost.

Kardashian is not the first famous person to get in trouble with the law because of their involvement in cryptocurrency. In 2018, the agency settled charges against Floyd Mayweather Jr., a professional boxer, and DJ Khaled, a music producer, for failing to report money they got for promoting investments in digital currency.

“This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto asset securities, it doesn’t mean that those investment products are right for all investors,” said SEC Chair Gary Gensler. “We encourage investors to consider an investment’s potential risks and opportunities in light of their own financial goals.”

“Ms. Kardashian’s case also serves as a reminder to celebrities and others that the law requires them to disclose to the public when and how much they are paid to promote investing in securities,” Gensler added.

After prices went up during the pandemic, cryptocurrencies have had a rough year. Prices have gone up and down a lot, but mostly down, and federal regulators have accused companies in the sector of running illegal securities exchanges.

Bitcoin has lost more than half of its value since 2022. On Monday, it was worth almost $46,000, but it was only worth about $19,000.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.