More On: Crypto

It looks like Tom Brady lost a huge amount of money in the FTX Crash

How much 6 popular cryptocurrencies lost in 2022 ?

Why the FTX bubble burst and how it hurt people

Why Sam Bankman-Fried's world fell apart

The cryptocurrency exchange Bitfront closes

To help those of you who are preparing your crypto tax returns, we've put up a list of helpful resources. With Crypto.com Tax, the one-stop shop for crypto, Crypto.com has provided their customers with precisely that.

What is the Crypto.com tax?

Crypto.com Tax is an online tax service provided by the company. To help people with their crypto taxes, this platform is absolutely free to use.

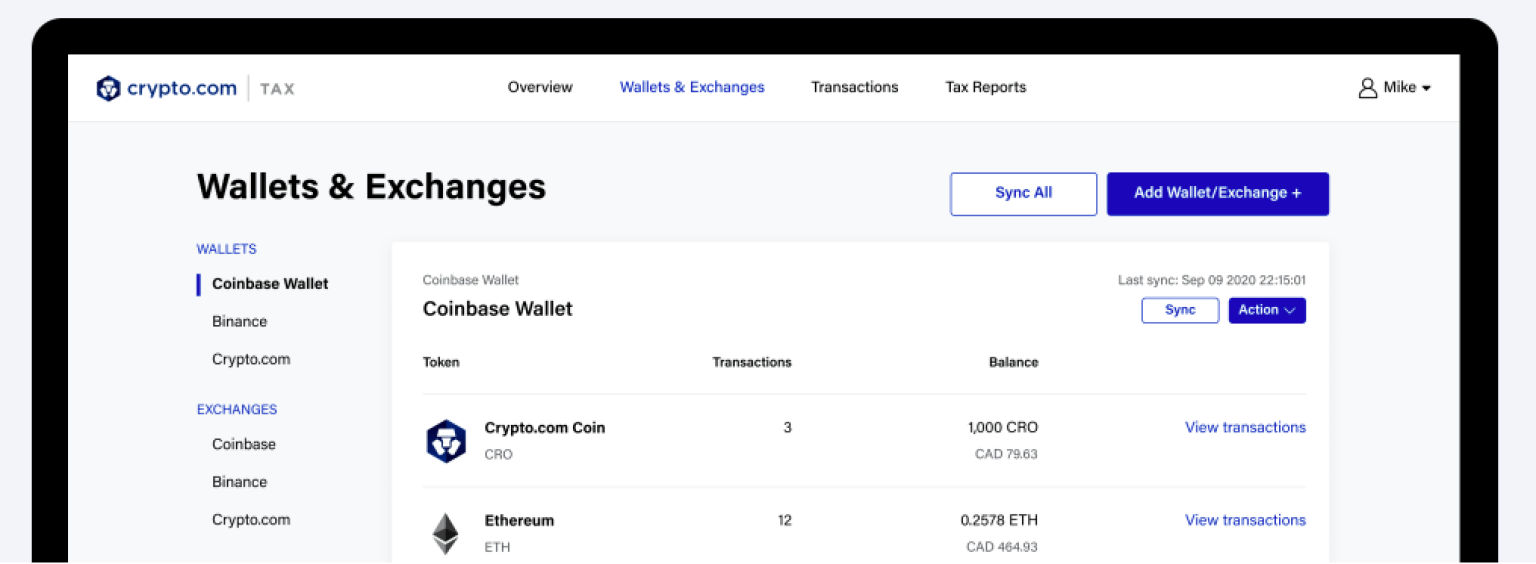

APIs and CSV files allow users to connect to widely used exchanges and wallets. The reports can then be generated with a simple interface and at no cost, regardless of the number of transactions.

Crypto.com Tax Is Available To Whom?

Anyone (in a supported region) can utilize the Crypto.com Tax service, regardless of whether or not they presently use Crypto.com.

Currently, Australia, Canada, Germany, the United Kingdom, and the United States are served by Crypto.com Tax. In addition, they say that there will be more jurisdictions on board in the future.

Creating an account is as simple as providing an email address and a strong password.

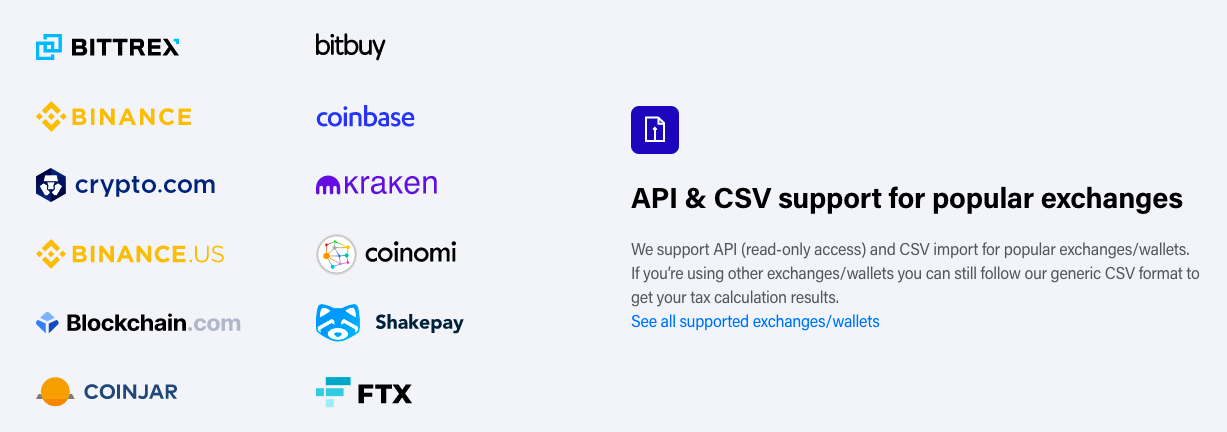

Wallets and Exchanges on Crypto.com that are tax-supported

There are a broad variety of wallets, exchanges, and blockchain platforms supported by Crypto.com Tax. Currently, this list includes:

Exchanges

- Crypto.com Exchange

- Binance & Binance US

- Bitfinex

- Bittrex

- Bitrue

- Blockchain.com Exchange

- Changelly Pro

- Coinbase & Coinbase Pro

- CoinJar

- CoinSpot

- FTX

- Gate.io

- Gemini

- HitBTC

- Huobi Global

- Kraken

- KuCoin

- OKX

Wallets

- Crypto.com App

- Blockchain.com Wallet

- Coinomi

- Exodus

Cryptocurrencies that are supported

CoinGecko lists more over 10,000 cryptocurrencies supported by Crypto.com Tax. A wide selection of FIAT (or traditional currencies) is supported by Crypto.com Tax, which includes USD, GBP, CAD, AUD, CAD, AUD, and EUR.

What Sorts of Reports Am I Able to Produce?

Currently, anyone can use Crypto.com Tax to generate free crypto tax reports for the following purposes:

- A capital gain or loss is the difference between the sale price, the cost basis, and the selling expenses.

- Detailed transaction records for your reference.

- A breakdown of all the cryptocurrency you've received and whether or not it's taxable may be found in your Income Report.

- a record of all the crypto you've transferred as gifts, donations, or payments

Forms for the United States Internal Revenue Service

- The 8949-T Boxes C and F have already been picked for Parts I and II, respectively. Users who receive the 1099-B forms should check the boxes A-B for Part I and E-F for Part II if they have received them

- D is the second-to-last slot on the

Importing a tax return into a tax-filing program

- Using TurboTax Online

- Download and CD-ROM versions of TurboTax

- TaxAct

To what exchange or wallet can I connect Crypto.com Tax?

How you link your API keys or upload your CSV file will be determined by the wallet or exchange to whom you are connected.

Your transaction history will be exported and imported into the Crypto.com App as a CSV file, for example, when you are connected to the app to import transactions.

You may effortlessly link your API keys to Coinbase through a series of prompts, and your transactions will be automatically synced with your Coinbase account.

Step-by-step instructions may be found on Crypto.com Tax for any way of linking to a wallet or exchange.

After Import, Why Do I Keep Getting Errors?

Due to the complexity of bitcoin transactions, there may be problems when you import your data.

Verify that the transactions match your records by going through them one by one. If there is a discrepancy, click on the three dots and manually change the information.

FIAT deposits and withdrawals, or staking transactions, are the most common kind of missed transactions. A complete list of faults and solutions is available in their support center.

Whether or not transactions can be excluded is a question.

It is possible to exclude or "ignore" transactions that appear on the report. Refuse or cancel an order.

- At the very top of your screen, click on Transactions.

- To the right of your transaction, click on the three dots to reveal more options.

- Ignore this message by clicking the Ignore button.

Restoring a transaction is as simple as selecting "restore" from the previous menu.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.