More On: Blockchain

DeFi Must Be Defended

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

Shares of Coinbase fall 11% because of a hot report on inflation

Blockchain is not required for Web 3.0, according to the Internet's father.

Bitfarms sells $62M BTC to boost market liquidity

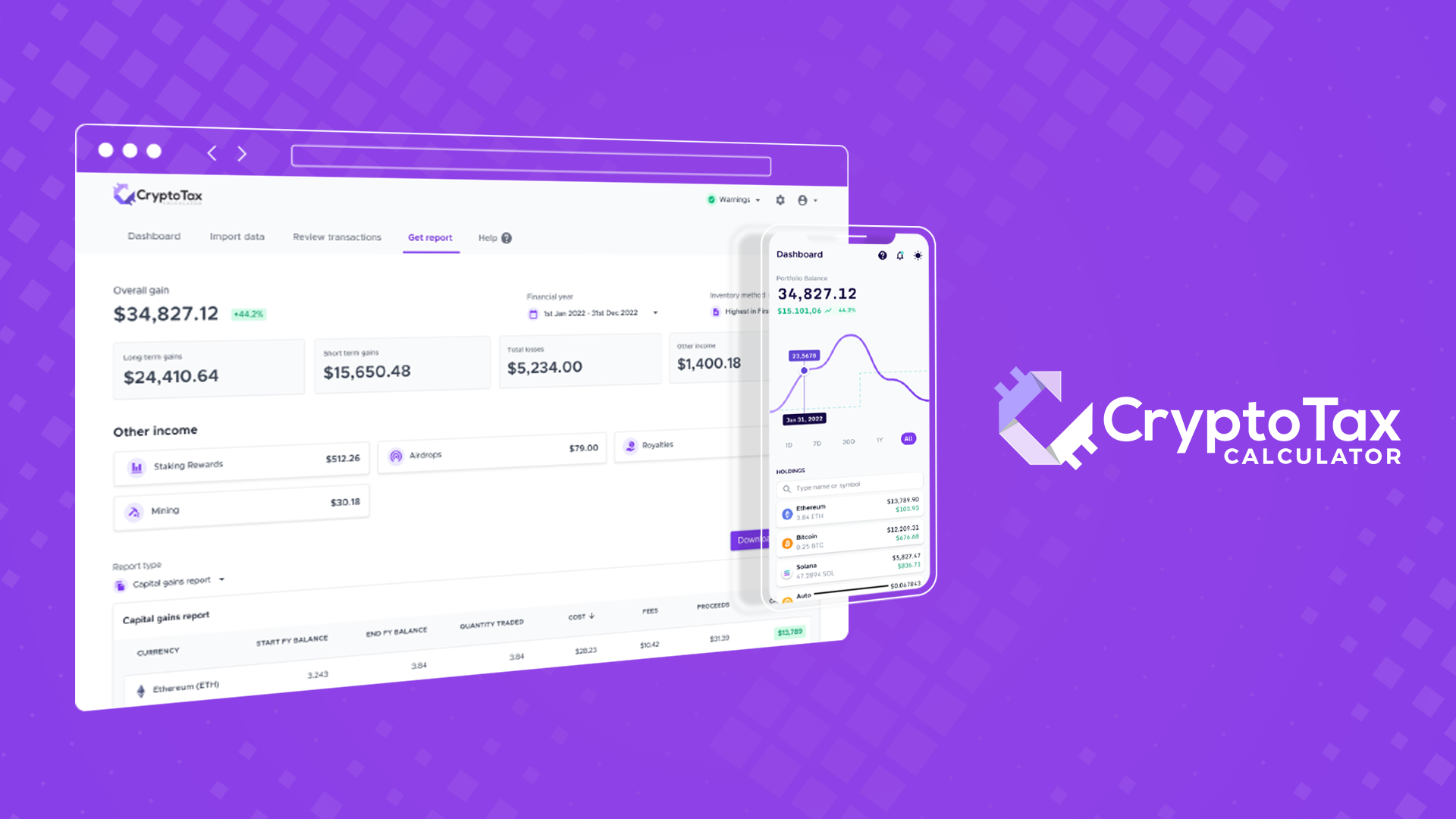

Just in time for the start of the US tax season, Australian startup CryptoTaxCalculator (CTC) announced it has acquired seed money to further expand its automated crypto tax reporting tool into the US market.

CTC, based in Sydney, is one of several platforms that have gained prominence this year for assisting crypto traders with the complexity of tax reporting, however it is unique in that it is primarily focused on resolving issues experienced by users of decentralized exchanges.

If you're paying taxes on crypto you purchased or sold through a centralized crypto exchange such as Coinbase, Binance, or Gemini, determining how much you owe may be straightforward, as many of these exchanges provide a form outlining your trades, gains, and losses. However, for users of decentralized exchanges such as Uniswap or Curve, the procedure can be far more onerous — and this is where CTC comes in handy, according to co-founder and CEO Shane Brunette in an interview with TechCrunch.

CTC's workforce has increased from three full-time employees last autumn to over thirty today. According to the company, its platform now serves over 80,000 users, an increase of 1,700 percent over the last year. Brunette credits some of this increase to the increasing popularity of decentralized finance (DeFi), which CTC was built to serve due to its experience in decentralized transactions.

Unlike centralized exchange transactions, decentralized, on-chain transactions are not recorded by a trusted third-party mediator who can give a user with their transaction history for tax filing purposes, Brunette explained.

Brunette, who is a keen cryptocurrency trader himself, encountered these difficulties firsthand when he was required to submit taxes on his trading. He and his brother co-founded CTC, and they chose to launch the product on Reddit in 2018, he explained. According to Brunette, CTC first focused on integrating with decentralized apps built on the Ethereum Virtual Machine (EVM), but has subsequently expanded to integrate with more than 400 exchanges, as indicated on its website.

The company serves consumers in 21 different tax jurisdictions, with around 40% of users based in the United States and another 40% in Australia, Brunette said. He stated that a sizable chunk of CTC's US customers joined the platform more recently, particularly during the "DeFi summer" in mid-2020.

"You can think of something like the Ethereum network as a big accounting book that has all transactions dating all the way back to the dawn of time, as well as information on all participants and their activities on that particular chain. The issue is that it has been written in a very confusing manner from an accounting standpoint," Brunette explained.

CTC is fully integrated with the blockchains that support decentralized exchanges. Users need just to supply CTC with their public wallet address, and the platform aggregates all transactions and smart contracts associated with that wallet, basically reverse engineering the wallet's transaction history, Brunette explained.

While centralized exchanges have consolidated as the cryptocurrency sector matures, decentralized finance is expanding, and consolidation in that field cannot take place in the same way, Brunette explained.

"The issue that tax authorities face, for example, is how to ensure that individuals are tax compliant when there is no one present to subpoena or provide a transaction history for that individual. How are you going to keep track of all of this? And hence, I believe the US government's current strategy is to try to pass laws that supports the use of a financial middleman to give transaction history, which directly contradicts the crypto ethos," Brunette said.

Brunette created CTC with a sense of the widespread distrust many cryptocurrency users have regarding centralization and middlemen.

According to Brunette, the blockchain technology is "wonderful." While anyone can potentially inspect the transaction data kept on a blockchain, he added, having the appropriate tools to understand it is necessary.

"That is our primary focus — developing tools that enable an overview of all the different blockchains as well as the ability to pull in data from a centralized exchange, so you can get a clear path of an individual's transaction history and reconsolidate to arrive at a tax outcome," Brunette explained.

While CTC collects all of the data necessary to create a transaction history and performs tax calculations on behalf of its users, Brunette advises advanced crypto users to consult a tax professional to assist them in interpreting regulatory grey areas and determining what taxes they actually owe and which rules apply to their activity.

Brunette explained that the CTC does not provide "final" tax statistics, but rather aggregates information on what income is taxable.

"We provide lump sums to enable you to calculate your tax rate, et cetera, so it's really categorizing it. Thus, you've gained this amount by staking rewards – what do you intend to do with it? It is worthwhile to consult with a tax specialist and seek assistance," he stated.

The seed round raised a total of A$4 million (about $2.9 million in US dollars) for the previously self-funded startup. AirTree Ventures spearheaded the funding alongside Coinbase Ventures in the United States and 20VC, a fund run by podcaster Harry Stebbings in the United Kingdom.

Source: TechCrunch

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.