More On: xrp

As sentiment improves, XRP whales continue to accumulate

An attacker publishes a bogus XRP giveaway on the PwC Venezuela Twitter account

Ripple's cross-border growth confronts the SEC

Ripple lawsuit update: Judge rejects SEC's request to suppress Ripple docs

Jed McCaleb, co-founder of Ripple, will complete selling XRP holdings by July 16th

Conclusion

- The weekend's XRP price activity was a bull trap for bulls.

- An initial rise in ripple prices was quickly reversed by a strong drop to the negative.

- As bulls try to get out of their losing positions, the market is likely to continue lower at a faster pace.

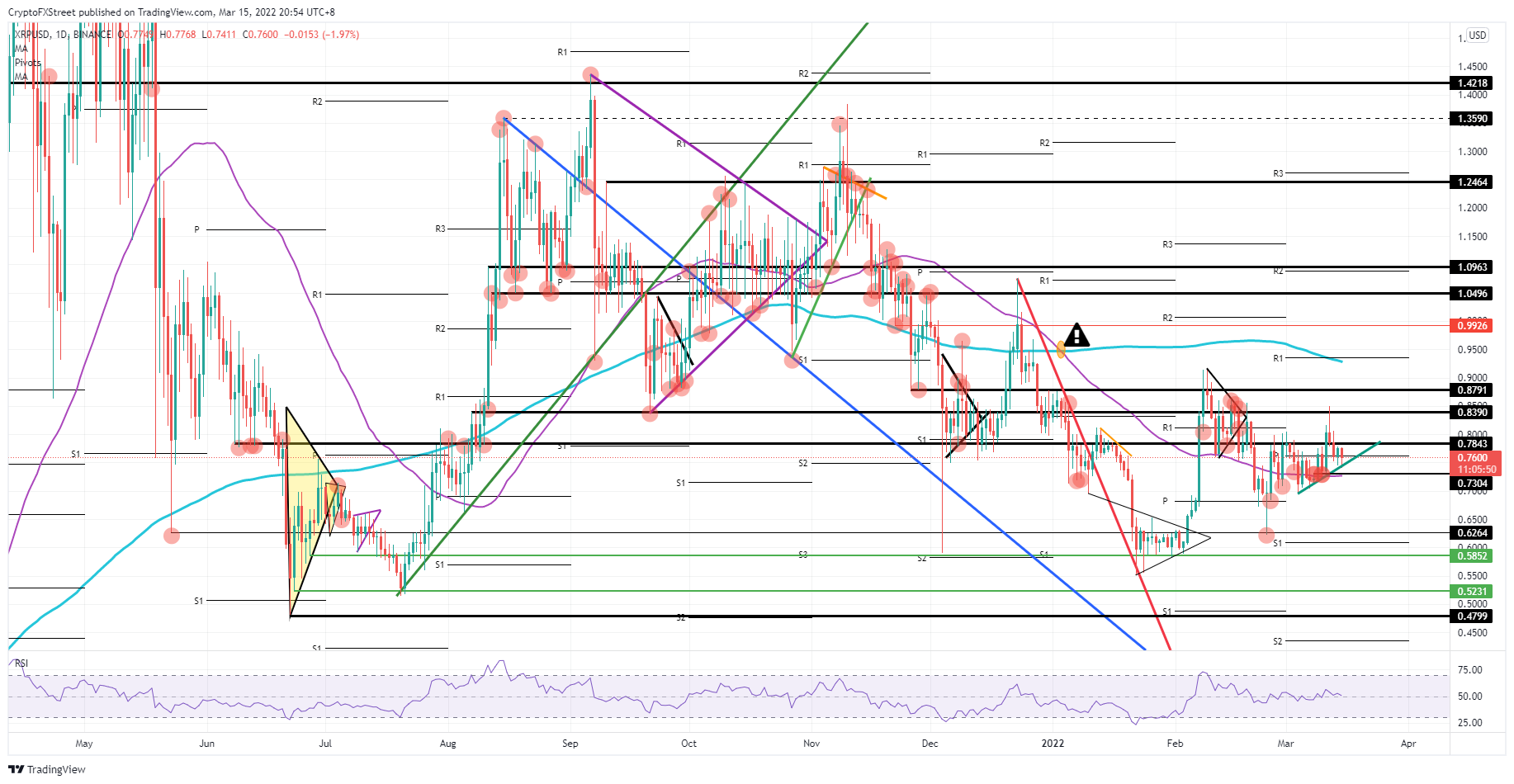

As of this writing, Ripple (XRP) is on the verge of breaching its short-term uptrend after bulls were unable to break over $0.8390 over the weekend. Since then, the price has decreased by almost 11%, leaving bullish traders holding a big loss in their hands. Many yield curves are anticipating a recession, but some traders have no idea what to do next. Global markets are becoming increasingly concerned. If bulls decide to give up their gains, anticipate the price to fall to the February low of $0.6264, supported by the 55-day Simple Moving Average and a short-term floor.

The price of XRP is expected to retest its February lows.

In the end, the XRP price movement on Saturday was an exception to the rule as a bullish breakout or burst was short-lived and the price was pushed back down to the pivot level at $0.7590. This weekend's early breakout of a bullish triangle has trapped many bulls in the process, allowing them to immediately swing to the sell-side. There is a risk that purchasers will be pushed out of the market because there is just too much supply of XRP.

XPR's price movement might first drop to $0.7304, the short-term bottom from the beginning of March and the 55-day Simple Moving Average (SMA) below. There is still a lot of potential for the Relative Strength Index (RSI) to fall before it becomes oversold. In such case, XPR might fall to the historic level of $0.6264 or the monthly S1 support level of $0.6000, before being turned around for a bullish influx.

It's possible that today's Nasdaq rebound off the short-term green ascending trend line will take place since the Nasdaq is just outside the door this morning. As of $0.7843, an assault is likely.

For Wednesday and Thursday, a break above this level would re-establish $0.8390 as a key resistance level and allow bulls to cautiously build up more of a position in the market action in order to avoid becoming stuck once more.

The 200-day SMA and the monthly resistance pivot at R1 might act as a magnet for long positions to be sold off, allowing the price to rise to $0.9300. Bears may also take some short positions at this level to protect space above the 200-day SMA and maintain the death cross.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.