More On: polkadot

Price Prediction: XRP, Dogecoin, and Polkadot prices 10 April

Price Prediction for Cryptocurrencies: SOL, DOT, ADA — Asian Wrap 08 April

Predictions for Cryptocurrencies Prices: Ethereum Will Break Through to $4000, Polkadot Will Continue to Rise

Polka Dot, Cosmos, and Gala Analysis on the 10th of March prices

Polkadot unable to hold above critical support, bulls concerned as DOT could fall 10%

There has been no discernible trend in the crypto market in the last several days.

Until Bitcoin burst over the $39.4k level, it looked as though the near-term perspective had changed from negative to positive. Around the time of writing, BTC was trading at $39.2k, while altcoins like Polkadot and Gala had been in a range for the previous several days. How strong are the bulls and can they put some purchasing pressure on prices?

PolkaDot (DOT)

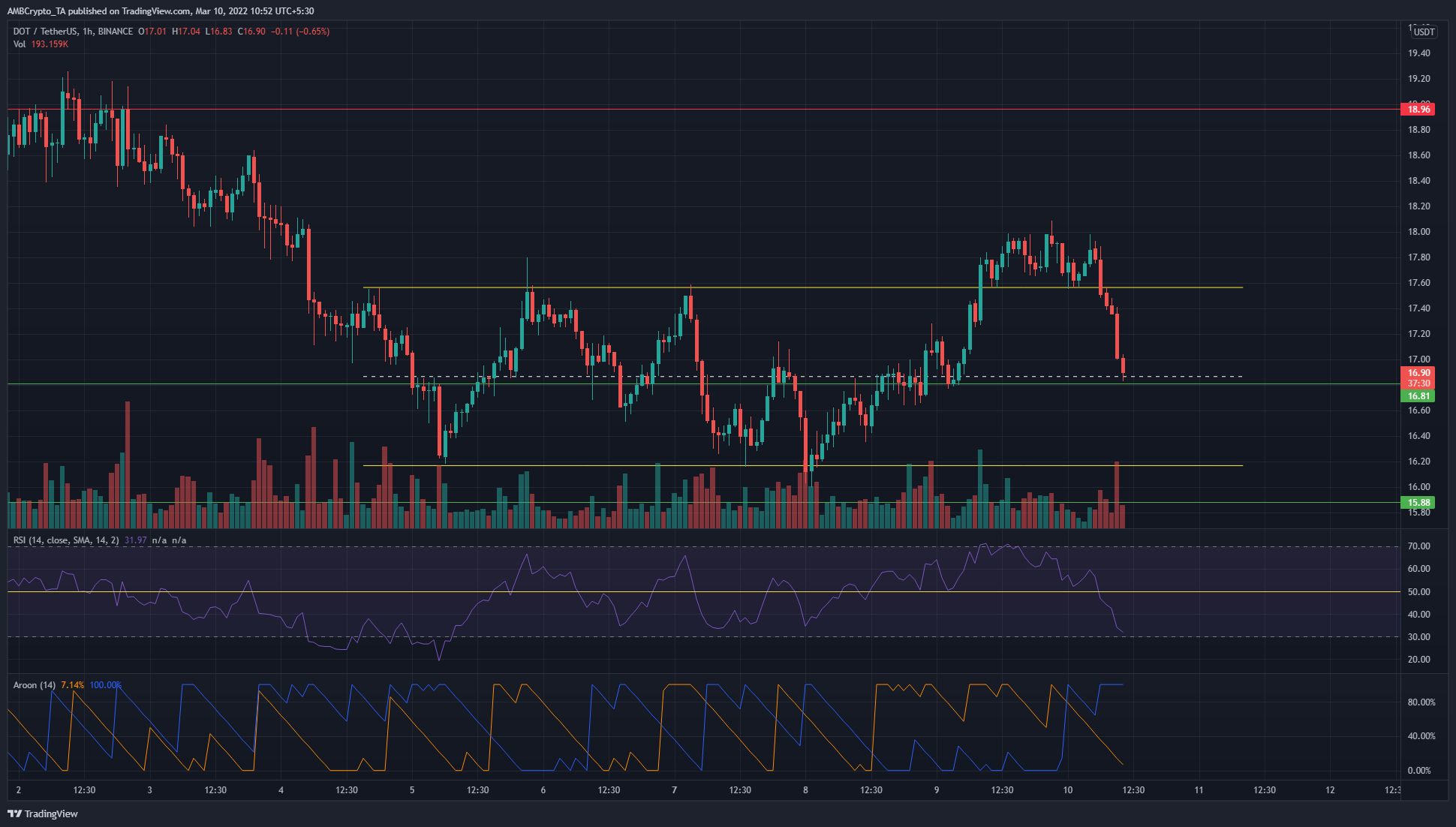

In the last three days, DOT has created a yellow range between $16.17 and $17.57. Within 24 hours, it seemed to shift the $17.6 highs to support, but has subsequently seen strong selling. Just above the $16.81 support level, it traded at $16.9 a share.

The RSI fell below 50 and the Aroon Indicator indicated that the recent bullishness had come to an end. Support for DOT might come from the mid-point and range lows within a few hours.

The Universe (ATOM)

There have been three degrees of importance for Cosmos in the previous week.. The $27.7 level of support and the $29.8 and $31.5 levels of resistance were all within this range. ATOM gained support at $27.7 over the last several days and then surged to $31.5 in an impulsive bullish move. Support for $29.8 had been anticipated to switch.

However, the latest selling has pushed the price back near the $27.7 demand zone. Bearish momentum was shown by the Awesome Oscillator crossing below zero and the CMF standing at -0.24, indicating considerable capital outflow from the market.

The gala (GALA)

Charts show that GALA has a short-term range (yellow). It had decreased to a price of $0.223, as at the time of this writing. In the last week, the OBV revealed that sellers dominated. As GALA rallied from the range lows of $0.21 to $0.235, the MACD began to move above the zero line, indicating some resistance from buyers.

It's possible that the price might once again test the lows of the range. The MACD had fallen below the zero line for the second time in a row as the negative momentum gathered strength.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.