More On: NFTs

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

Shares of Coinbase fall 11% because of a hot report on inflation

Millionaire Martin Mobarak was investigated for setting fire to a $10 million Frida Kahlo painting as an NFT stunt

Limit Break's DigiDaigaku NFT collection increases by nearly 100 percent when the company raises $200 million

Binance now has more Bitcoin than Coinbase

Here are three portfolio trackers that can help you keep organized, whether you're a DeFi degen with 100 accounts in MetaMask or an NFT investor with an uncountable amount of JPEGs.

The cryptocurrency ecosystem has grown dramatically in recent years, thanks to the emergence of decentralized finance (DeFi) and the adoption of nonfungible tokens (NFT), which has resulted in an explosion of projects across more than a dozen blockchain networks.

Portfolio trackers are a popular choice for traders who need to maintain a broad multichain portfolio due to the quickly increasing ecosystem, which requires investors to keep track of several wallet addresses.

Crypto traders can utilize three portfolio-tracking decentralized applications, or DApps, to assist them keep track of their investments.

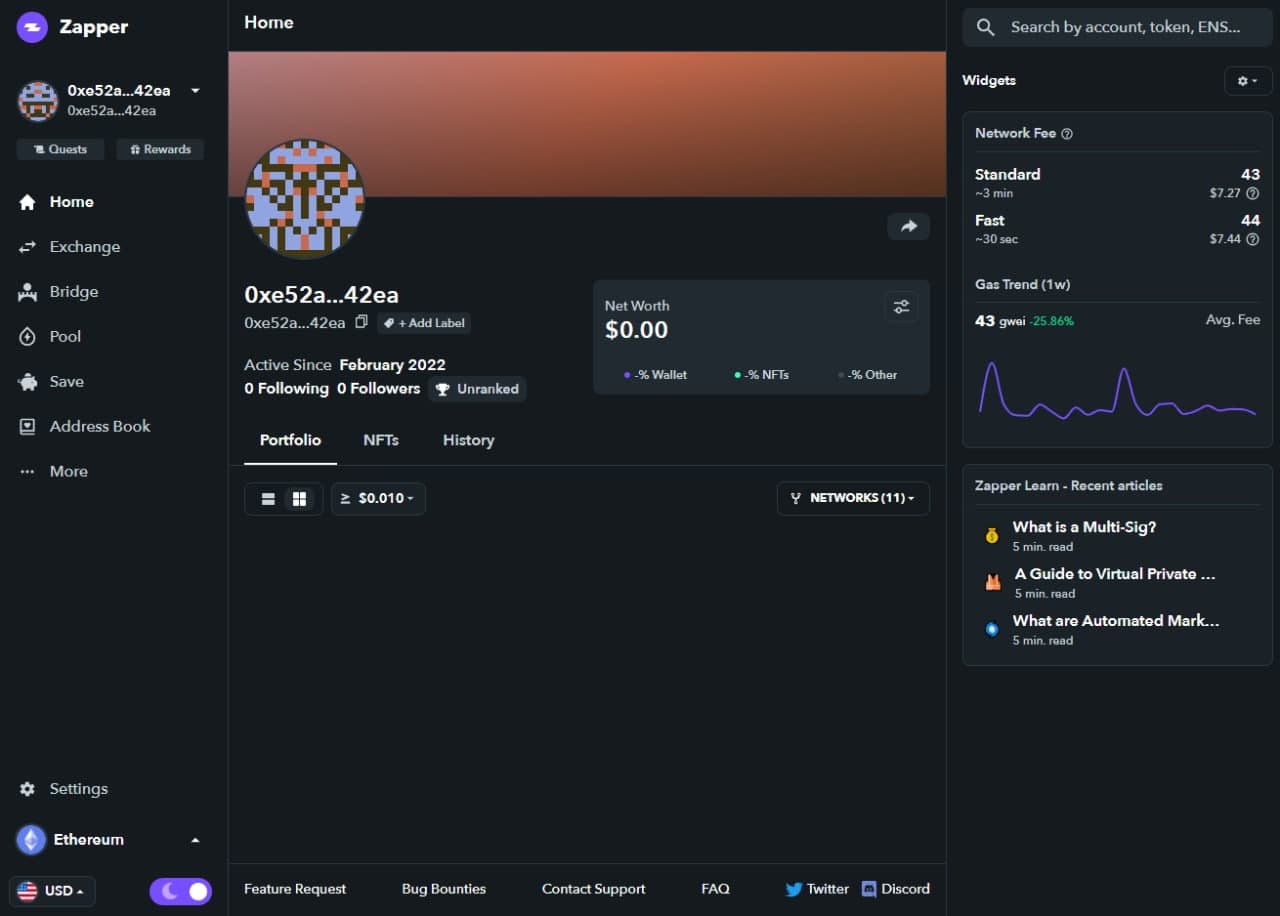

Zapper

Ethereum, Polygon, BNB Chain, Fantom, Avalanche, and Optimism are among the 11 networks that Zapper supports for basic cryptocurrency administration.

The homepage's basic layout includes information about the many protocols that the linked wallet is currently using, as well as a breakdown of the value of assets held on each of the available networks.

Users can trade tokens using a basic swap interface that interfaces with liquidity on decentralized exchanges like Uniswap, Pangolin, and QuickSwap, as well as use the bridging tool to transfer assets between supported chains.

Traders can also fund pools using Zapper-integrated protocols like SushiSwap, PancakeSwap, Curve, Aave, and Compound.

Yearn.finance's yield farming choices and the ability to deposit funds into vaults are among the other integrations.

Zerion, Instadapp, and DeFi Saver are portfolio managers that are comparable to Zapper.

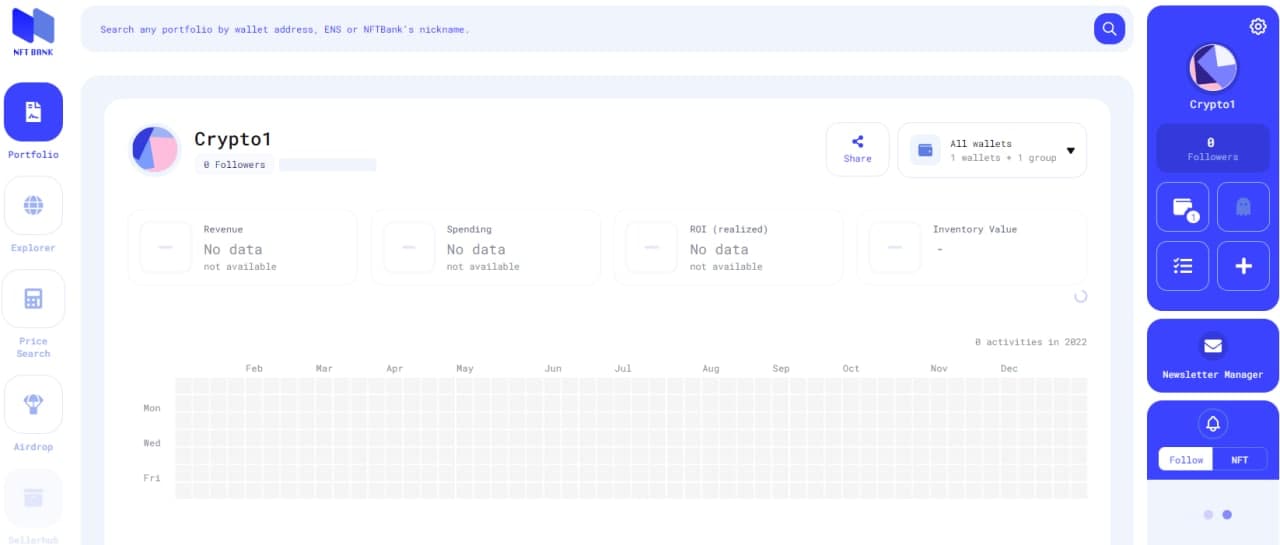

NFTBank

NFTBank is a free portfolio tracker that is aimed to assist users in managing their NFT assets by providing a number of tracking and research options.

The main portfolio interface shows the total revenue, total spending, return on investment, and current inventory value of the assets kept, as well as a basic breakdown of the profits and losses of the NFTs in the associated wallet.

There's also the opportunity to publish a screenshot of the portfolio's development via social media, as well as a simplified yearly calendar that shows which days had the most activity for the wallet or set of wallets in question.

Users can examine a more complete breakdown of their assets, track the performance of each asset, view an activity record for all contacts with various collections, and download tax filing forms to submit earnings to the proper government agencies.

NFTBank also has an NFT explorer that can browse through Ethereum, Klaytn, Ronin, and Polygon collections to get information on current and past floor prices, percentage change, 30-day volume, and the daily amount of newly listed NFTs in each collection.

Users can search 1,222 distinct collections for the "bargain of the day" using a pricing search option that breaks them down by anticipated price, floor price, listing price, rarity rank, and an overpriced/underpriced rating.

The DappRadar portfolio tracker, ArtCentral.io, and Value.app are all NFT trackers that are comparable to NFTBank.

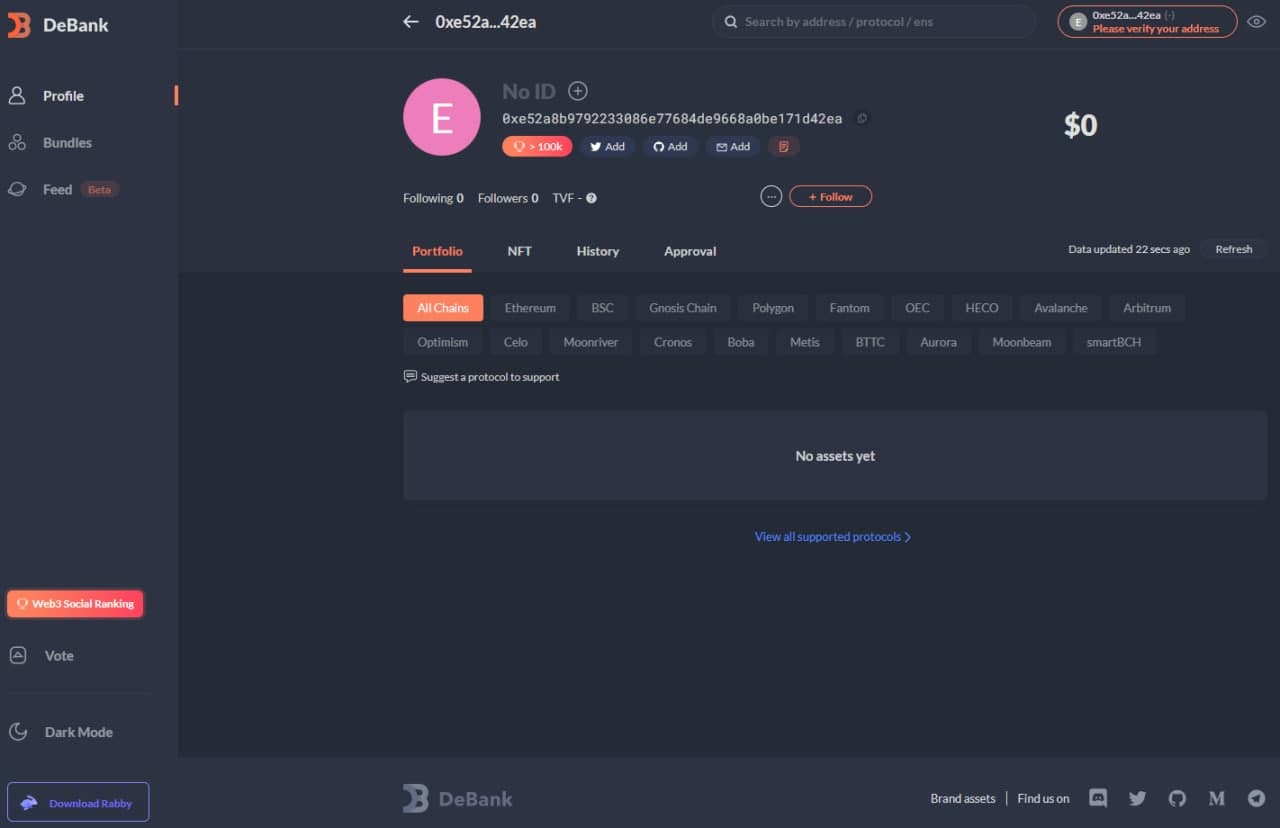

DeBank

DeBank is a more advanced interface for DeFi investors that allows them to manage their assets across 19 different blockchain networks, including Ethereum, BNB Chain, Polygon, Chronos, and HECO.

DeBank's main interface displays a breakdown of the value held on each network, as well as a more detailed analysis of the amount held and staked in each wallet as well as across DeFi and NFT platforms.

On the Ethereum network, DeBank's NFT section presently supports 414 collections and gives basic information such as the name of the specific NFT and its floor price.

The Token Approval portion of DeBank is a useful feature for active DeFi users, as it provides all of the active contract approvals for the connected wallet, as well as the amount approved and a breakdown of the risk exposure.

- Keep in mind that u can manage your token approval permissions @DeBankDeFi with straightforward UI:

— DeBank (@DeBankDeFi) February 28, 2021

1. Decline untrusted ones

2. Search to verifyhttps://t.co/XpcpO0VdCi https://t.co/7O6xLAwrIn pic.twitter.com/RXlMPWy28l

Users can decline any currently approved contracts directly through DeBank using the Token Approval Management tool.

The platform contains a "Feeds" area, which is a social feature that allows users to track the latest trades, NFT purchases, and social commentary of other users with high Web3 Social Rankings.

DeBank also provides a "DeFi List," which includes data on over 1,165 different protocols spread across all supported networks and is broken down by tags like yield aggregator, decentralized exchange, options, or NFT, as well as total user deposits and the number of active users in the previous 24 hours.

Ape Board, Zerion, and Tin.network are all portfolio trackers comparable to DeBank.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.