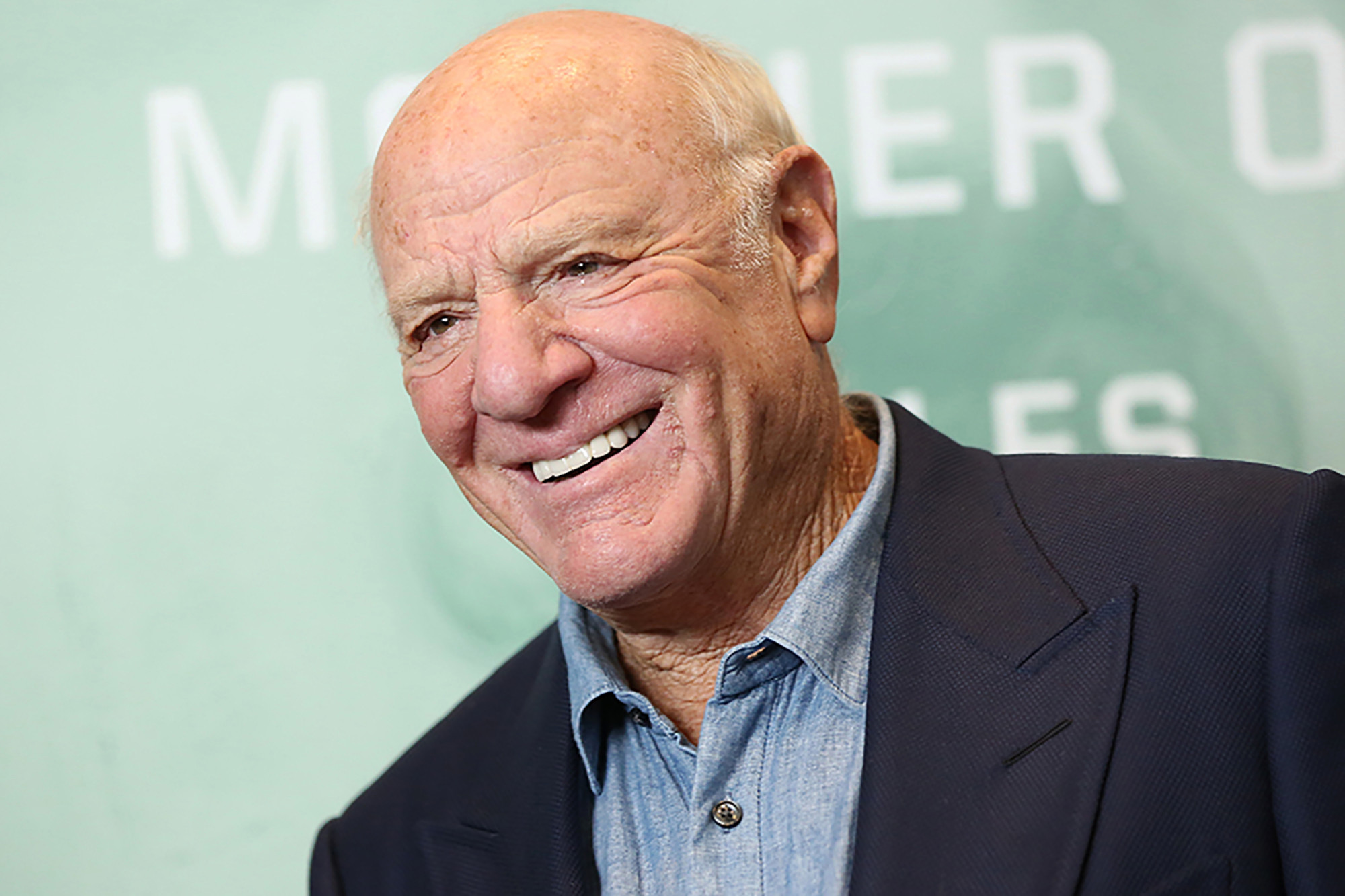

More On: barry diller

Barry Diller’s IAC bets $1 billion on gambling giant MGM Resorts

Barry Diller says his firms are ditching ‘absurd’ earnings guidance

IAC, the media conglomerate which operates Dotdash and Vimeo, has taken a 12 percent stake in Las Vegas hotel and casino giant, MGM Resorts, worth approximately $1 billion. IAC chairman and senior executive Barry Diller said his company was attracted to MGM, which owns resorts like The Mirage, The Excalibur and Luxor, for its online …

IAC, the media conglomerate which operates Dotdash and Vimeo, has taken a 12 percent stake in Las Vegas hotel and casino giant, MGM Resorts, worth approximately $1 billion.

IAC chairman and senior executive Barry Diller said his company was attracted to MGM, which owns resorts like The Mirage, The Excalibur and Luxor, for its online gaming business, among other things.

“What initially attracted us to MGM, besides its leadership in leisure, hospitality and gaming, was an area that currently comprises a tiny portion of its revenue – online gaming,” Diller said Monday. “IAC’s foundational concept of seeking opportunities to build interactive businesses is our base rationale – there is a digital first opportunity within MGM Resorts’ already impressive offline businesses, and with our experience we hope we can strongly contribute to the growth of online gaming.”

Diller said his company has been on the hunt for deals after spining off Tinder owner Match Group last month — leading it with $3.9 billion of cash and no debt.

IAC CEO Joey Levin touted the “immense potential” to move MGM Resorts’ business “online,” and said IAC will be a “minority investor and long-term strategic partner” for years to come.

In a letter to shareholders Monday, IAC said it purchased $1 billion in MG< common stock in order to chart a “new direction” for their company at a time when MGM’s business has been sidelined by the pandemic.

Revenue, not expenses, have been temporarily halted, IAC said, adding that MGM has enough cash and access to capital to make it through the pandemic stronger. In January, MGM sold MGM Grand and Mandalay Bay for $4.6 billion in a deal involving Blackstone Group. last year, a private equity firm bought Bellagio from MGM for $4.25 billion.

IAC said MGM currently operates over 35 percent of the rooms on the Las Vegas Strip and owns regional hotels and casinos across the US, as well as a handful of international properties, including two in Macau, China. The media firm explained that the key to getting into the $450 billion global industry of online betting is having a physical presence in each state, which has proven to be a deterrent to potential rivals. With the investment in MGM, IAC believes it will have a foothold in the space, giving it a leg up on the competition.

“Although we would never ‘bet the company,’ we know that this is a large bet for IAC,” said Diller and Levin. “We have long been driven to look opportunistically for chances to build great interactive businesses and compound capital for our shareholders, and MGM has a rare but clear opportunity to deliver on that promise.”