More On: ApeCoin

Despite a record $200 million gas burn, ApeCoin falls and Ether trades flat

This is why ApeCoin (APE) has increased by 40% in the previous 24 hours

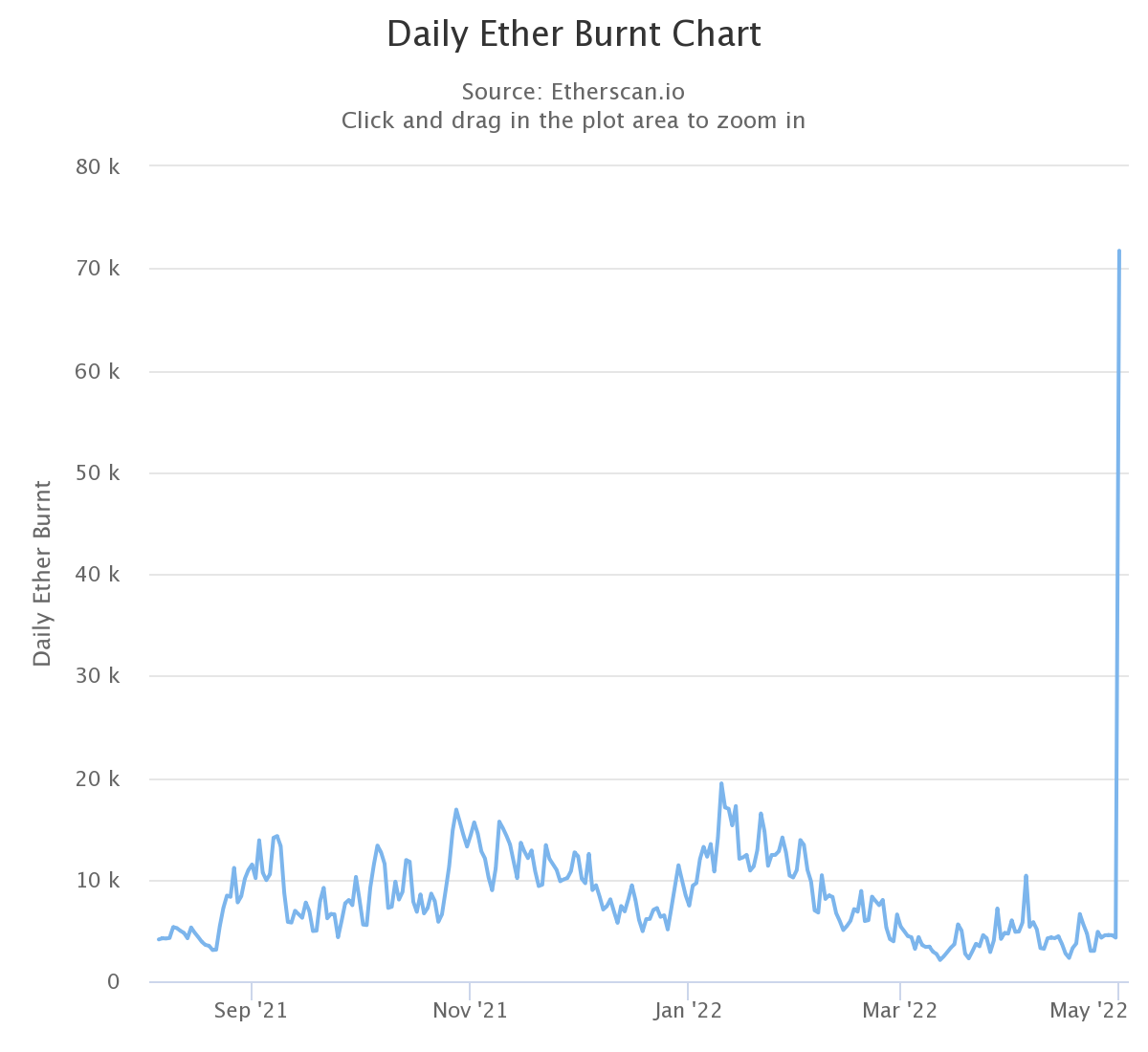

On Sunday, almost 71,000 ether were burnt to meet demand for a new NFT project. However, while the larger market remained flat, this had no impact on ether pricing.

ApeCoin (APE) prices fell as much as 11% on Monday in an otherwise flat crypto market, following the sale of a long-anticipated non-fungible token (NFT) project for APE over the weekend.

Bitcoin (BTC) and ether (ETH) both gained 1.8 percent in the last 24 hours, according to statistics. The two assets are still trading below critical levels of $40,000 and $3,000, respectively. A drop in broader markets in recent months has contributed to a drop in cryptocurrencies.

Movement in the other majors was erratic. XRP and Terra's LUNA climbed up to 4%, while Solana's SOL fell 1.2 percent. A drop in SOL was caused by a seven-hour network outage on the Solana over the weekend, when bots associated with an NFT project bombarded the network, creating temporary technical challenges.

Even as markets in Asia and Europe rose, investors in broader markets remained anxious about more rate rises in the United States. The Hang Seng in Hong Kong concluded 4% higher, while the FTSE in the United Kingdom is up 0.47 percent so far. Futures on the S&P 500 and Nasdaq plummeted as much as 0.38 percent, while crude oil prices fell 3.77 percent.

Ethereum has set a new record for gas consumption

Over the weekend, a single NFT project contributed to a rise in gas costs on the Ethereum network.

Late on Saturday, virtual land on the "Otherside" metaverse, a portion of the Bored Ape Yacht Club ecosystem established by Yuga Labs on Ethereum, went on sale for a set price of 305 apecoin, or more than $7,000 at the moment, due to high demand.

While the virtual land was sold at a predetermined price, the high demand drove up gas costs to several ether, with some reaching thousands of dollars at one time. Some consumers claimed to have paid costs ranging from $9,000 to $14,000. Data suggest that gas prices were reverted to normal at the time of publishing of this article on Monday.

Users spent over 71,000 ether in gas fees – approximately $200 million at the time of writing, according to CoinGecko – in order to acquire territory on Otherside. This is by far a network record high, topping a January peak of almost 19,200 ether. The fees were burnt or permanently erased, essentially removing $200 million in liquidity from the market.

A record amount of ether was burned on Sunday. (Etherscan)

Over the weekend, demand for ether to pay for petrol did nothing to alter overall prices. According to price data, ether touched a low of $2,743 on Saturday night before rising $100 on Sunday and then dipping to $2,800 at the time of writing.

APE prices, on the other hand, have dropped 11% in the last 24 hours to little over $15. The tokens and their futures were among the most actively traded in the previous week, with higher-than-usual volumes and liquidations.

APE has fallen in the past 24 hours. (TradingView)

As a result of the weekend's price movement, several users lost money on both decreasing prices and unsuccessful mints.

"APE fell down, and those who wanted to buy Otherdeed couldn't because of failed Ethereum transactions, causing them to lose money on both fronts," explained Jolyon Horsfall, Co-CEO of NFT launchpad project SparkWorld, in an email to CoinDesk.

"[This] demonstrates how inefficient it may be, which does not assist consumers who want access to NFTs and may limit demand from NFT projects to use Ethereum as their preferred network," he noted.

Others agreed with the sentiment. "High fees are a double-edged sword for public blockchains," says Nikos Kostopoulos, blockchain advisor at Netcompany-Intrasoft. "On the one hand, they legitimize the success of a project and signal a growing user base prepared to pay high costs to access the network, but on the other hand, they become an incentive for consumers to seek alternatives."

An ApeCoin-branded blockchain is also not out of the question. Yuga Labs advised community members to explore creating a new blockchain to adequately grow the ApeCoin ecosystem in a tweet on Sunday.

=====

Related Video:

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.