More On: Blockchain

DeFi Must Be Defended

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

Shares of Coinbase fall 11% because of a hot report on inflation

Blockchain is not required for Web 3.0, according to the Internet's father.

Bitfarms sells $62M BTC to boost market liquidity

Although the Ethereum blockchain is not the first thing that comes to mind when considering climate solutions, Nori has created it as an engine to incentivize farmers to embrace carbon-negative agricultural methods that remove carbon from the air and reintroduce it into the ground

The startup just raised $7 million in venture money to alleviate some of the bitter irony inherent in operating carbon removal activities on one of the world's most inefficient blockchains by relocating to Polygon. Additionally, the business is investigating new carbon capture sources, expanding its carbon removal marketplace, and launching a token to accomplish all of this.

Nori is more concerned with carbon removal than with emissions reductions or avoidance. Its marketplace compensates farmers who employ regenerative farming strategies such as soil carbon sequestration. Nori's first carbon removal solution is soil sequestration, with other approaches coming to market in the future.

To date, the company has enrolled approximately ten farms in its scheme, distributed $1 million to participating farmers, and witnessed approximately 2,200 transactions involving buyers of carbon credits.

Now, as a climate supporter and in the exercise of my journalistic duty, I went ahead and purchased a ton of carbon to see what would happen. I received a gleaming certificate, which Nori dutifully recorded on the Ethereum blockchain. I'm tempted to do the math; 2,200 transactions on the Ethereum blockchain equals a lot of energy consumed. At current prices (as calculated by Digiconomist), that equates to around 583 kilowatt hours burnt only to keep track of the carbon credits. According to the EIA, the average household in the United States consumes approximately 10.7 MWh of electricity each year, which equates to approximately 54 dwellings' worth of energy consumption — or approximately 27.5 tons of carbon emissions. When confronted with these figures, I face-palm so hard that my brain produces CO2, increasing my personal carbon emissions in the form of steam coming out of my ears.

To be fair to Nori, the cost of Ethereum transactions has skyrocketed, and depending on when each transaction occurred on the chain, they will have used significantly less energy to reach 2,200 transactions — and after I vented my frustration at Nori's founder, he explained that when they founded the company in 2017, there were few viable alternatives to using the Ethereum blockchain. They are aware of the issue, though, and are actively migrating to Polygon.

"Where else would we have gone in 2017?" By far the largest blockchain with the most developer tools is Ethereum. There were no other options available at the time, and it's great to see all these other layer two solutions becoming accessible late last year," said Paul Gambill, Nori's CEO. "One thing to keep in mind is that this has been a very inexperienced operation up to this point."

With a proof-of-concept in place and the need for a carbon-removal market demonstrated sufficiently to close a $7 million Series A round led by M13, Toyota Ventures making its first investment from its climate fund, and participation from seed investor Placeholder, Nori is ready to strap on its walking boots and begin walking the walk. The first task on the list is to migrate the application to Polygon.

"At this scale, [Ether] is not a viable option for us. Although we are not a high-throughput, high-transaction application on the chain, we are transitioning to Polygon and will possibly merge in June or July. That resolves the issue, and thus [energy usage] becomes a non-issue for us," Gambill explains, referring to the difference between the company's current and future solutions. "Polygon is a chain that validates proof-of-stake transactions. It consumes almost no energy when compared to a proof-of-work chain."

While it has to be seen whether Polygon is as efficient as its authors say, even if it consumes 1,000 times the power currently expected, it would still consume several orders of magnitude less power than running Nori's solution on Ethereum. Which brings me to my next point: why bother with the blockchain at all when a database will suffice?

"That is my preferred question. In 2017, a paper examined the overall magnitude of voluntary carbon offset trading. They segmented the data by primary and secondary sales. That is strange, I thought. What is a secondary sale in the first place?" Gambill explains, noting that secondary sales were twice as large as main sales. "What happens is that these carbon credits are manufactured and then sold to brokers, who resale them to other brokers, and so on. And, in fact, they are very rarely retired by an end buyer."

As is the case with many other commodities that become commoditized, carbon credits are rebundled and resold on a closed market by middlemen who charge transaction fees for moving a piece of paper around.

"That is not going to speed up the rate at which we remove carbon from the air," Gambill observes sarcastically. "Our underlying principle is that if we are serious about climate change, we should build systems in which every new dollar invested results in fresh carbon being removed from the atmosphere."

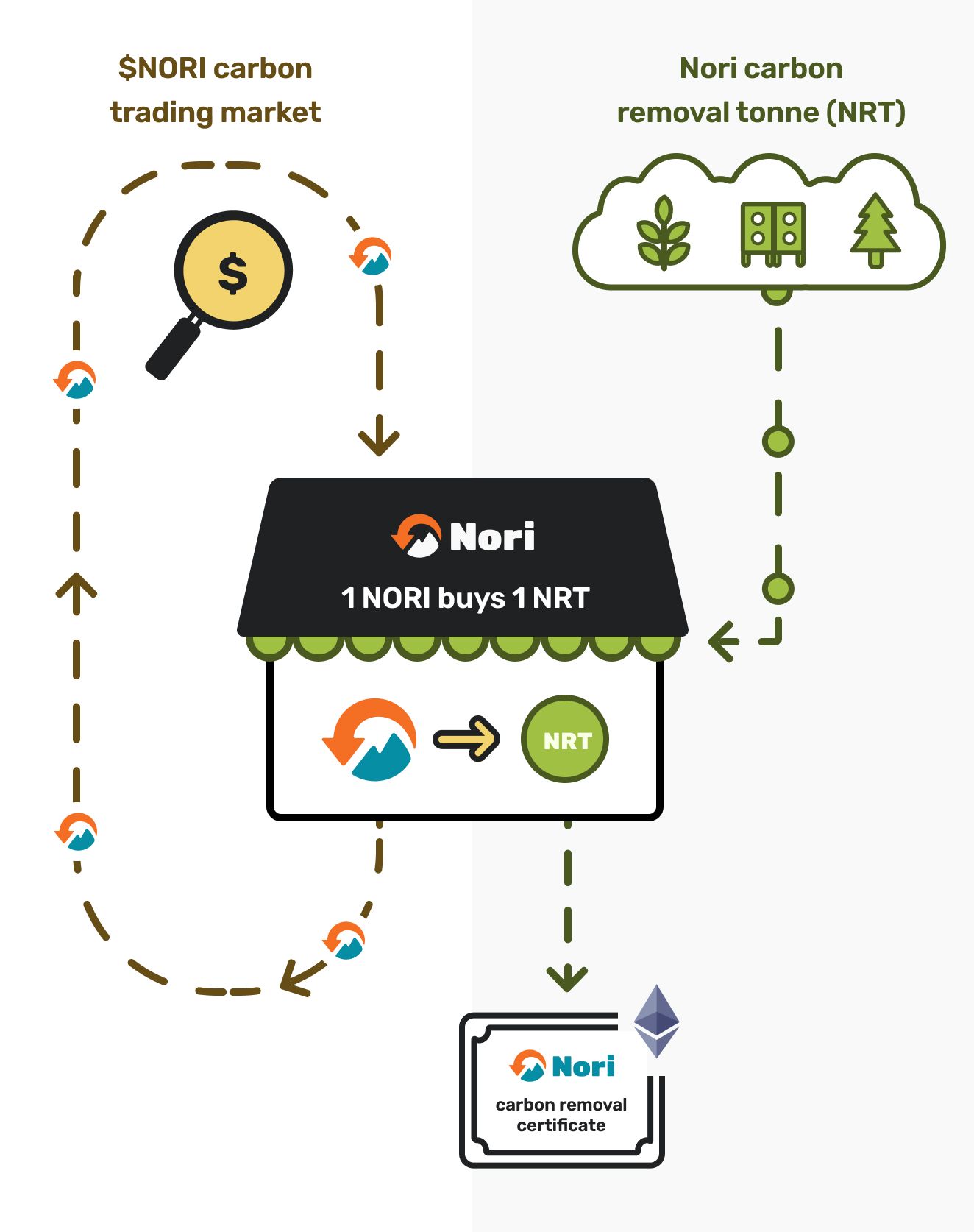

Nori is now operating two distinct assets: the NRT and the Nori Token. The NRT is an abbreviation for Nori Carbon Removal Tonne, and it signifies one tonne of CO2 eliminated from the atmosphere for a period of at least ten years. A supplier of NRTs can register them in the Nori marketplace after completing the Nori enrollment process. NRTs are then marketed directly to individuals and businesses looking to reduce their carbon footprint. This manner, anybody can contribute to climate change reversal. If you've made it this far in this article, you clearly have a patient soul — if you also have the cost of a tray of lattes lying around and a desire to expend an exorbitant amount of energy doing so, you, too, can experience Nori's power firsthand by spending $15 to pull a ton of carbon out of the air right now.

"Where else would we have gone in 2017?" By far the largest blockchain with the most developer tools is Ethereum. There were no other options available at the time, and it's great to see all these other layer two solutions becoming accessible late last year," said Paul Gambill, Nori's CEO. "One thing to keep in mind is that this has been a very inexperienced operation up to this point."

With a proof-of-concept in place and the need for a carbon-removal market demonstrated sufficiently to close a $7 million Series A round led by M13, Toyota Ventures making its first investment from its climate fund, and participation from seed investor Placeholder, Nori is ready to strap on its walking boots and begin walking the walk. The first task on the list is to migrate the application to Polygon.

"At this scale, [Ether] is not a viable option for us. Although we are not a high-throughput, high-transaction application on the chain, we are transitioning to Polygon and will possibly merge in June or July. That resolves the issue, and thus [energy usage] becomes a non-issue for us," Gambill explains, referring to the difference between the company's current and future solutions. "Polygon is a chain that validates proof-of-stake transactions. It consumes almost no energy when compared to a proof-of-work chain."

While it has to be seen whether Polygon is as efficient as its authors say, even if it consumes 1,000 times the power currently expected, it would still consume several orders of magnitude less power than running Nori's solution on Ethereum. Which brings me to my next point: why bother with the blockchain at all when a database will suffice?

"That is my preferred question. In 2017, a paper examined the overall magnitude of voluntary carbon offset trading. They segmented the data by primary and secondary sales. That is strange, I thought. What is a secondary sale in the first place?" Gambill explains, noting that secondary sales were twice as large as main sales. "What happens is that these carbon credits are manufactured and then sold to brokers, who resale them to other brokers, and so on. And, in fact, they are very rarely retired by an end buyer."

As is the case with many other commodities that become commoditized, carbon credits are rebundled and resold on a closed market by middlemen who charge transaction fees for moving a piece of paper around.

"That is not going to speed up the rate at which we remove carbon from the air," Gambill observes sarcastically. "Our underlying principle is that if we are serious about climate change, we should build systems in which every new dollar invested results in fresh carbon being removed from the atmosphere."

Nori is now operating two distinct assets: the NRT and the Nori Token. The NRT is an abbreviation for Nori Carbon Removal Tonne, and it signifies one tonne of CO2 eliminated from the atmosphere for a period of at least ten years. A supplier of NRTs can register them in the Nori marketplace after completing the Nori enrollment process. NRTs are then marketed directly to individuals and businesses looking to reduce their carbon footprint. This manner, anybody can contribute to climate change reversal. If you've made it this far in this article, you clearly have a patient soul — if you also have the cost of a tray of lattes lying around and a desire to expend an exorbitant amount of energy doing so, you, too, can experience Nori's power firsthand by spending $15 to pull a ton of carbon out of the air right now.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.