More On: bitcoin holder

Bitcoin Entrepreneurs in Ukraine Raise Funds to Aid the Opposition

Today, a Bitcoin HODLer must understand why the percentage of 54.5 percent is so significant.

Due to concerns of a Russian invasion of Ukraine, Bitcoin, the most popular cryptocurrency, fell to its lowest level in more than two weeks

Some speculated that the price of the most popular cryptocurrency could fall to the $30,000 mark in the near future. The selling pressure on the Bitcoin network has been the subject of some on-chain study.

Mainstream has a lot of flaws

on-chain metrics firm Glassnode published an Analytics report on February 21 showing that Bitcoin bulls face a variety of challenges. As a result, the network data became increasingly gloomy. More than 4 million Bitcoins were stored at an unrealized loss due to diminishing demand on the blockchain.

In both Bitcoin and traditional markets, there was a lack of confidence due to a lack of predictability and danger. Increases in the Federal Reserve's benchmark interest rate, concerns about a confrontation in Ukraine, and escalating civil unrest in the United States and internationally are all possible factors. There was a statement in the report:

“As the prevailing downtrend deepens, the probability of a more sustained bear market can also be expected to increase, as recency bias and the magnitude of investor losses weighs on sentiment.”

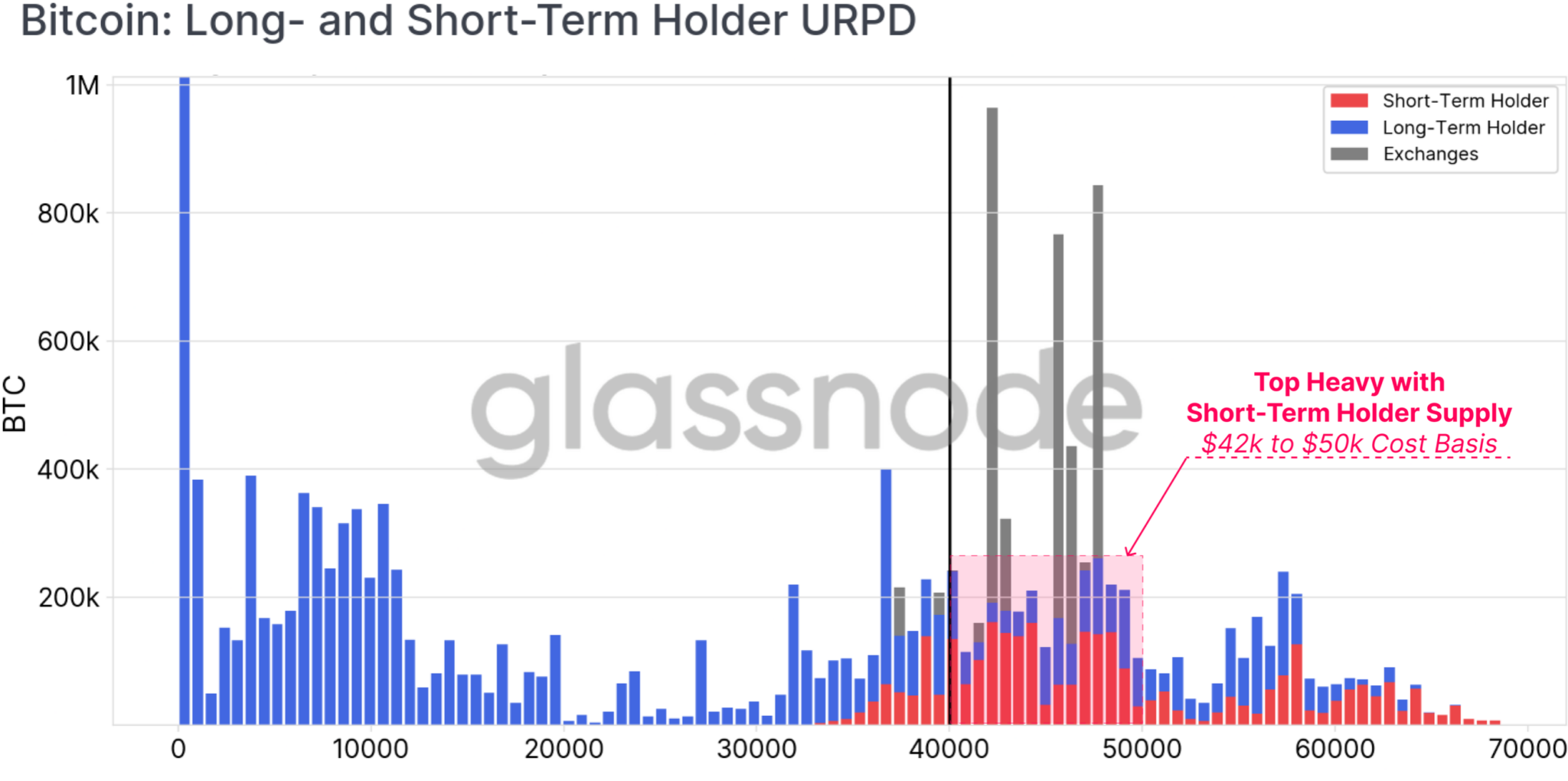

Take a look at some of these numbers. Bitcoin's Unspent Transaction Output (UTO) Realized Price Distribution (URPD) data suggested a bearish narrative.

54.5 percent of all BTC held at an unrealized loss (2.56 million $BTC) were owned by BTC Short-Term Holders. As a result, the price of a stock is likely to be affected by the depicted sell-side headwinds.

“With prices currently trading underneath the lower end of this range, and alongside dwindling on-chain activity, the coins held by this price sensitive cohort market represent a likely source of sell-side pressure, unless balanced by an equivalent influx of demand.”

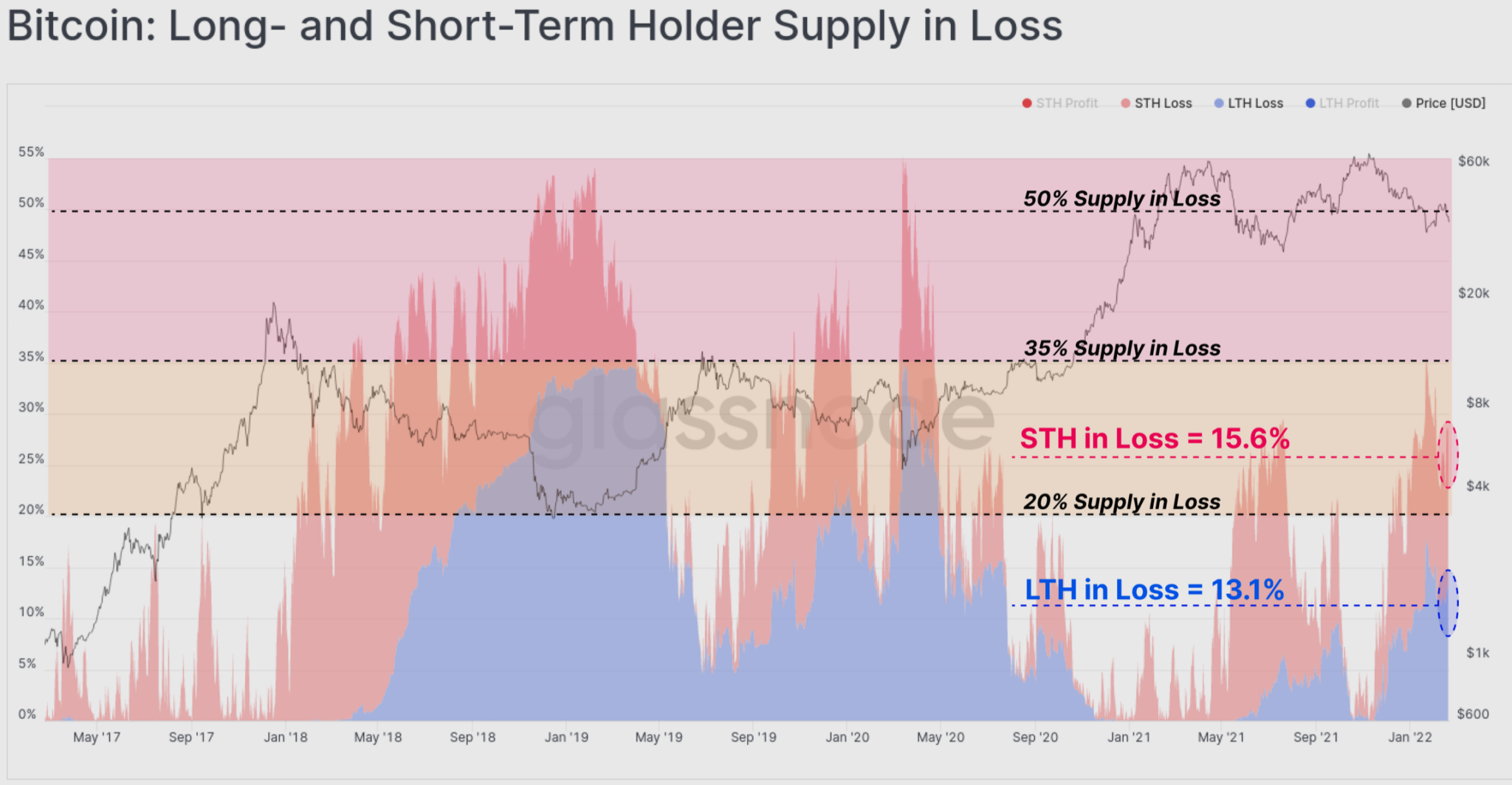

This group was the most likely to use their coins when the market was volatile. There is a distinct lack of confidence among them, as they appear to be the most pessimistic investors in the current market. In the STH-NUPL metric, 17.9 percent of Bitcoin's Market Cap was attributed to unrealized losses held by STHs. The fear has been bolstered by this.

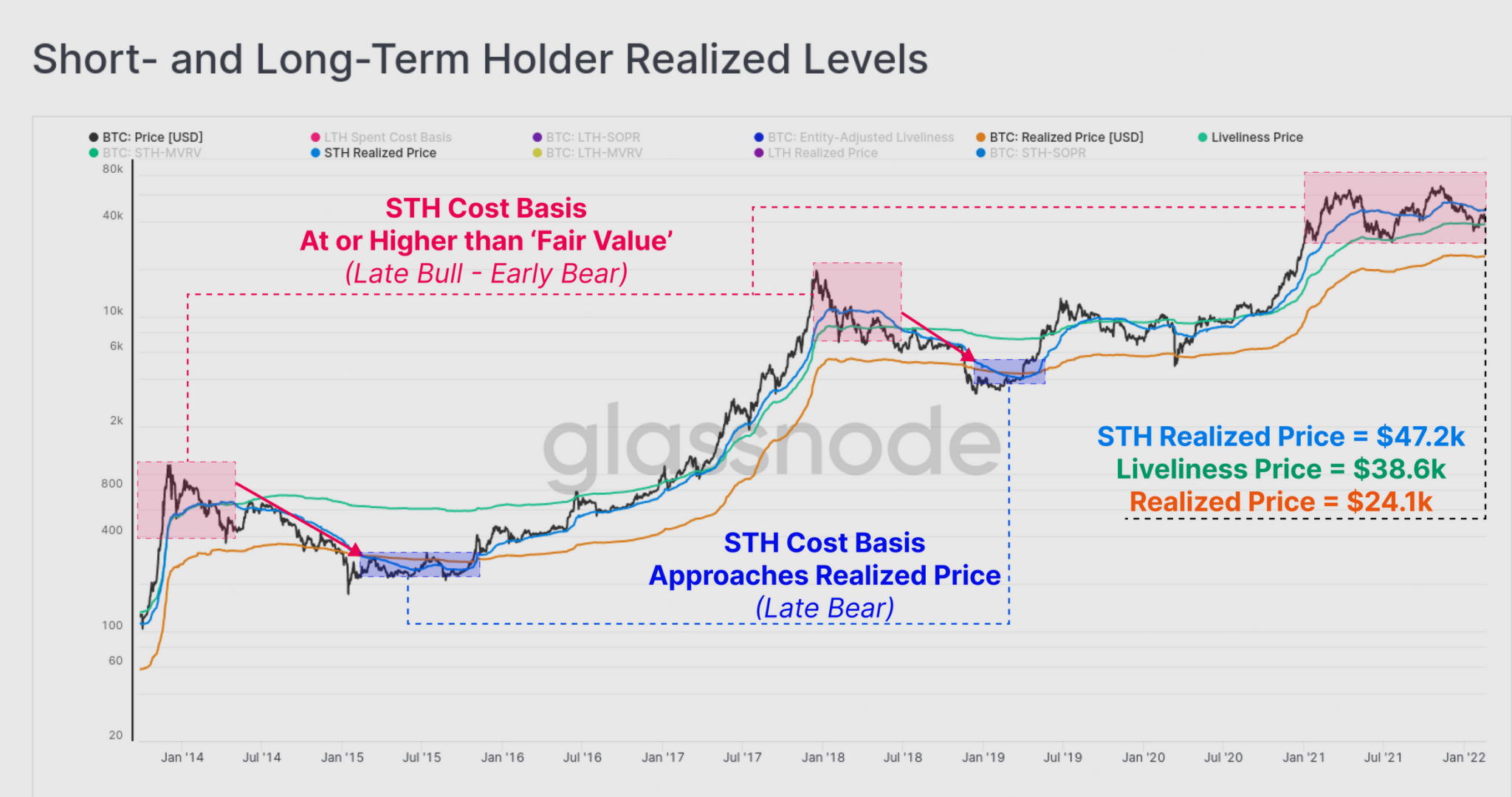

An average on-chain cost of $47.2k can be seen in the graph below. This represents an average unrealized loss of -19.3 percent as of the date of this article's creation.

HODLers have suffered a blow.

Long-term coin holders have been distributing more coins over the past year, according to the graph. The opposite was true in this instance. The report cited previous cycles as an example:

“In both the 2013-14, and 2018 bear markets, when STHs hold coins well above this fair value estimate, it has signalled that the bearish trend has some time left in it to reestablish a price floor.”

The graph below shows that both HODLers and non-HODLers suffered losses in terms of the amount of coins they own.

Different metrics are putting pressure on the bulls of the Bitcoin market. A strong market recovery will likely require Bitcoin investors to HODL, rather than sell the currency to reduce risk..

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.