More On: bitcoin

How much 6 popular cryptocurrencies lost in 2022 ?

How people who watch the market were wrong about bitcoin in 2022

Twitter Is Too Musk to Fail

Why Jim Cramer suggests purchasing bitcoin or ethereum, with one exception

El Salvador's bitcoin experiment has cost $375 million so far and lost $60 million

Altcoins like Cardano, Avalanche, and Solana, which have outperformed Bitcoin recently, have been thrust into the limelight because of Bitcoin's current woes.

Since the start of the year, Bitcoin has been mostly stuck in a range of about $35,000 to $45,000.

After China said it was going to loosen its monetary policy, bitcoin rose above $41,000. On Thursday, the biggest cryptocurrency rose as much as 0.6 percent to $41,500. This was the second day in a row that it had gone up. It's possible that Bitcoin could rise to as high as $51,000 if it can break through its 200-day moving average, which stands at just above $48,000.

"We expect an oversold bounce and a new low." Stockton said.

Since the start of the year, Bitcoin has been mostly stuck in a range of about $35,000 to $45,000. In late March, the price of gold broke out briefly to touch the 200-day moving average. This was followed by a drop of as much as 19 percent because of fears about monetary tightening. During that time, the token's relationship with big tech stocks reached a new high.

It helped crypto on Thursday, when coins matched the gains in Asian stocks. Wednesday, China's State Council said it would give more money to the real economy, especially small businesses that have been hit hard by the pandemic.

The managing director and head of technical strategy at Fundstrat, Mark Newton, says that after bitcoin fell to test a nearly three-month trend that has been connecting previous lows since early January, it looks like a good time to buy when it comes down again. Tokens should "rise" over the next week with "upside targets at $43,750 and then up to $44,200, which looks like the first real upside target," he said.

Altcoins like Cardano, Avalanche, and Solana have been getting more attention because of Bitcoin's problems. These so-called "altcoins" have recently done better than Bitcoin. Second-biggest cryptocurrency Ether has risen by 24% in the last month, while Bitcoin has only risen 7% in the same time frame.

Both Stockton and Newton warned about the long-term viability of Bitcoin's rise. Newton said that the bounce will most likely be short-lived, and that "movement back above $48,248 would be necessary to expect the start of a new multi-week or multi-month rally had begun," which is what Newton meant.

A "secondary support" level of about $27,200 could be reached if Bitcoin falls below $40,000 again. Since December 2020, Bitcoin hasn't been this low in price.

There are more withdrawals of money from the exchange.

Other reasons to keep going for Blockware lead insights analyst William Clemente was that there were other things that made sense.

On Wednesday, he said that cryptocurrency exchanges were losing BTC reserves at a rate that had never been seen before. This meant that any rise in demand would have to compete with a rapidly shrinking supply, which would push the price even higher.

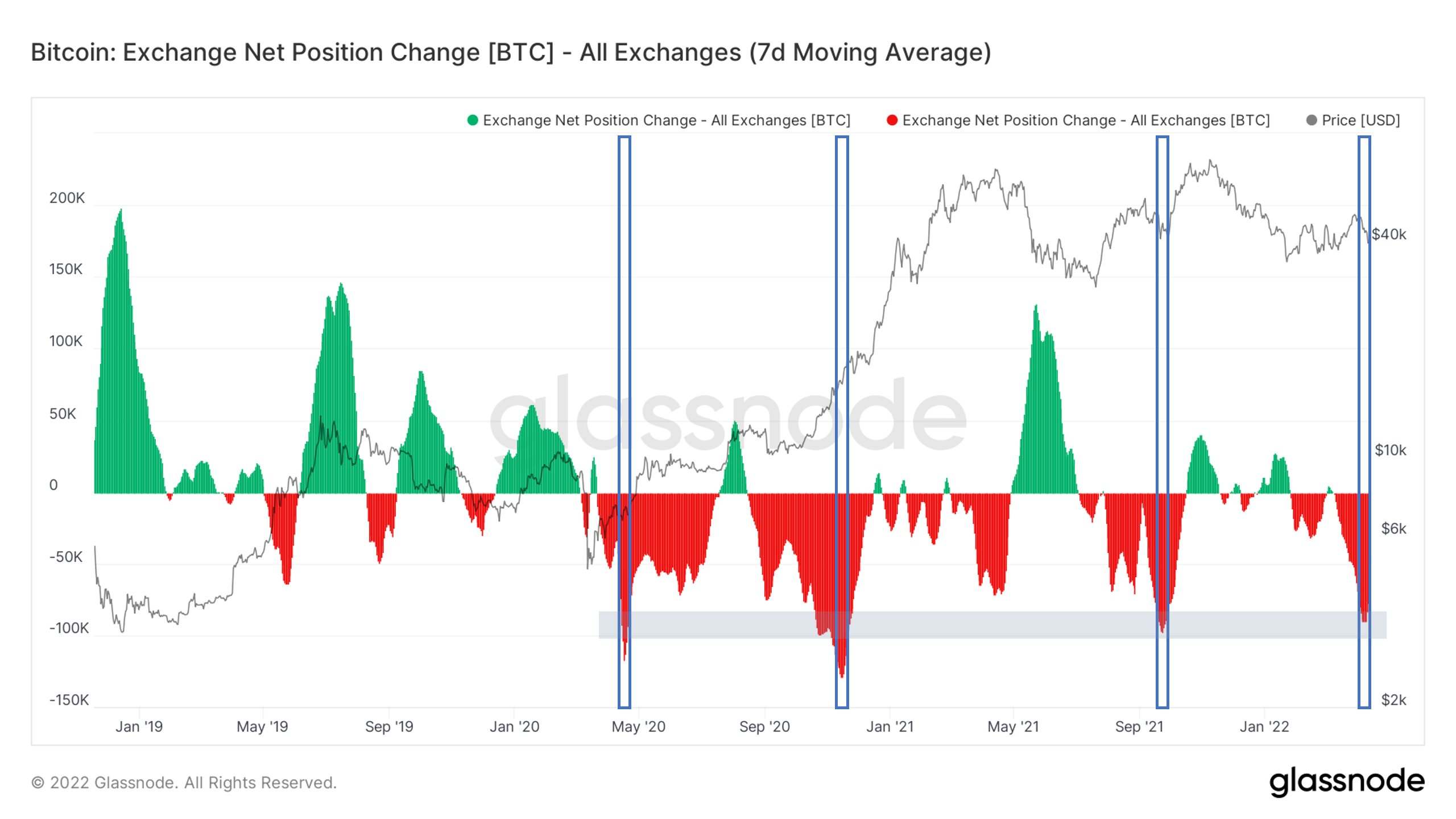

He wrote with data from on-chain analytics firm Glassnode: "On only three other occasions have we seen Bitcoin withdrawn from exchanges at this rate."

Glassnode's net position change indicator tracks changes in balances on 18 exchanges. It tracks both rises and falls in balances.

There are more withdrawals of money from the exchange.

Other reasons to keep going for Blockware lead insights analyst William Clemente was that there were other things that made sense.

On Wednesday, he said that cryptocurrency exchanges were losing BTC reserves at a rate that had never been seen before. This meant that any rise in demand would have to compete with a rapidly shrinking supply, which would push the price even higher.

He wrote with data from on-chain analytics firm Glassnode: "On only three other occasions have we seen Bitcoin withdrawn from exchanges at this rate."

Glassnode's net position change indicator tracks changes in balances on 18 exchanges. It tracks both rises and falls in balances.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.