More On: link

The Starlink Terminal Hacking Has Started

Joe Biden accidentally helped Hunter pay a bill for escorts linked to Russia

Chinese military 'planning to destroy' Elon Musk's Starlink satellites

BTC, ADA, AXS, LINK, and FTT are the top five cryptocurrencies to keep an eye on this week

End of Bullish Trading Pattern Approaches for Chainlink (LINK).

Indications point to a positive reversal for Chainlink (LINK).

Conclusion

- As of this writing, Link is trading in a bearish wedge pattern.

- MACD and RSI divergences point to a positive outlook for the stock market.

- At $28, there is some resistance.

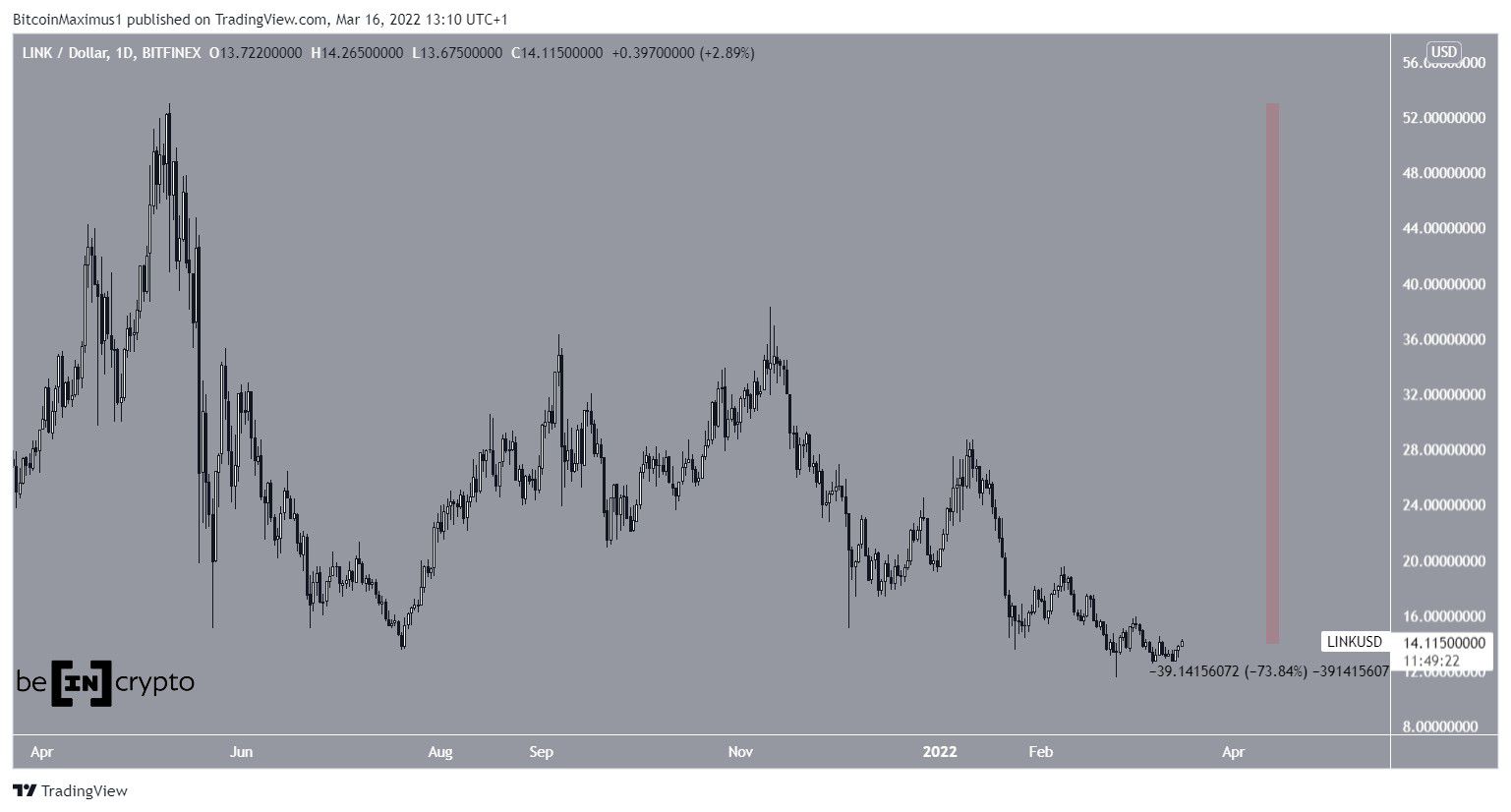

After hitting an all-time high of $53 on May 10, 2021, LINK's price has been steadily declining thereafter. For about six months, the price fluctuated and remained above $25.

It was only on Jan. 21 that the negative trend started again, resulting in a February 24 low of $11.43. Despite the price's recent uptick, no meaningful reversal has occurred.

LINK has fallen by 74% since its all-time high in the market.

Movements of the future

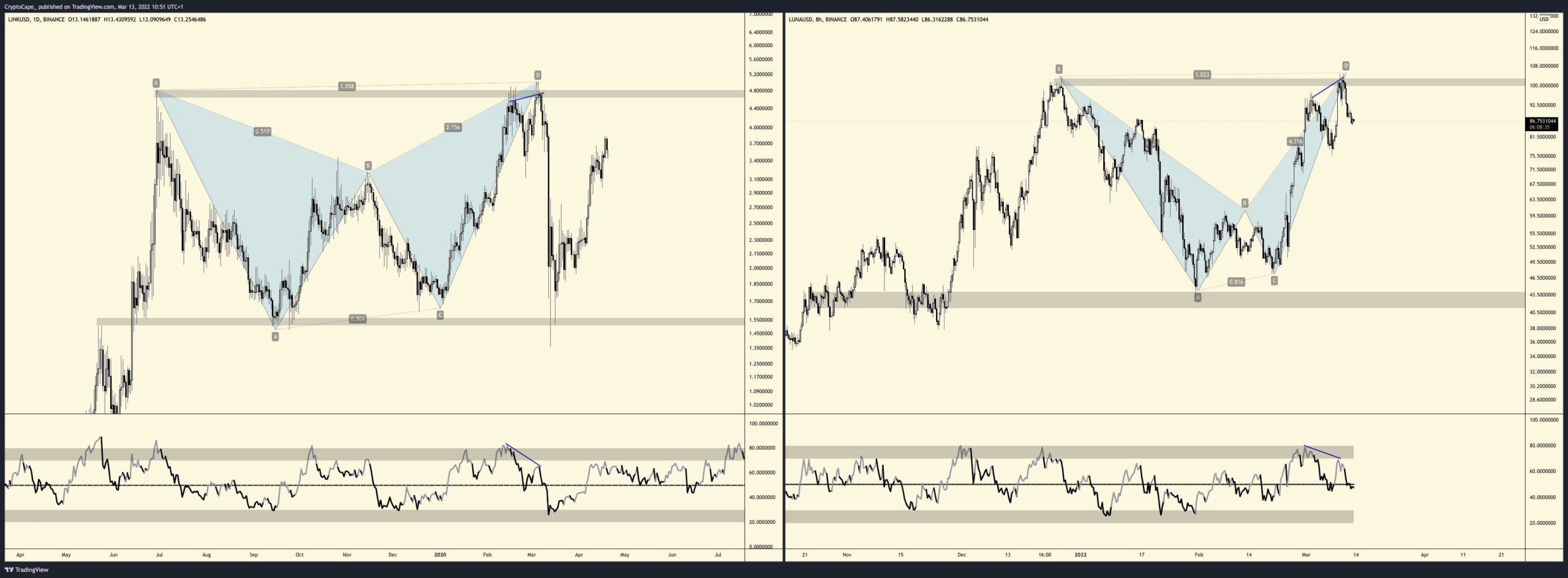

@CryptoCapo_, a cryptocurrency trader, posted a chart of LINK before to the recent dip that indicates the bearish trend.

An ascending wedge has been trading in the area since Nov. 10. Breakouts are more likely when we see an ascending wedge formed, which is considered bullish.

The RSI and MACD have also produced bullish divergences, which is even more significant (green lines). Bullish trend reversals frequently occur before such stark divergences. As a result, such a change in LINK's direction is feasible.

There is a $28 level of potential resistance if a breakout happens. Retracement level of 0.618 fib and horizontal resistance area.

Counting the waves

LINK's downward trend from its all-time high in May may be part of an A, B, C corrective structure (black). If this is the case, the price is now in the third wave of the C-shape.

To put it another way, waves A:C in this structure have an about 1:2 ratio, which is the second most frequent among such structures.

There is a quick reversal that typically occurs after an ending diagonal in Wave C.

It is possible that the long-term bottom is in if the descending wedge breaks out.

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.