More On: xrp

As sentiment improves, XRP whales continue to accumulate

An attacker publishes a bogus XRP giveaway on the PwC Venezuela Twitter account

Ripple's cross-border growth confronts the SEC

Ripple lawsuit update: Judge rejects SEC's request to suppress Ripple docs

Jed McCaleb, co-founder of Ripple, will complete selling XRP holdings by July 16th

- The price of bitcoin has seen some of its gains eroded by new regulatory crackdown proposals from the United States on cryptocurrencies.

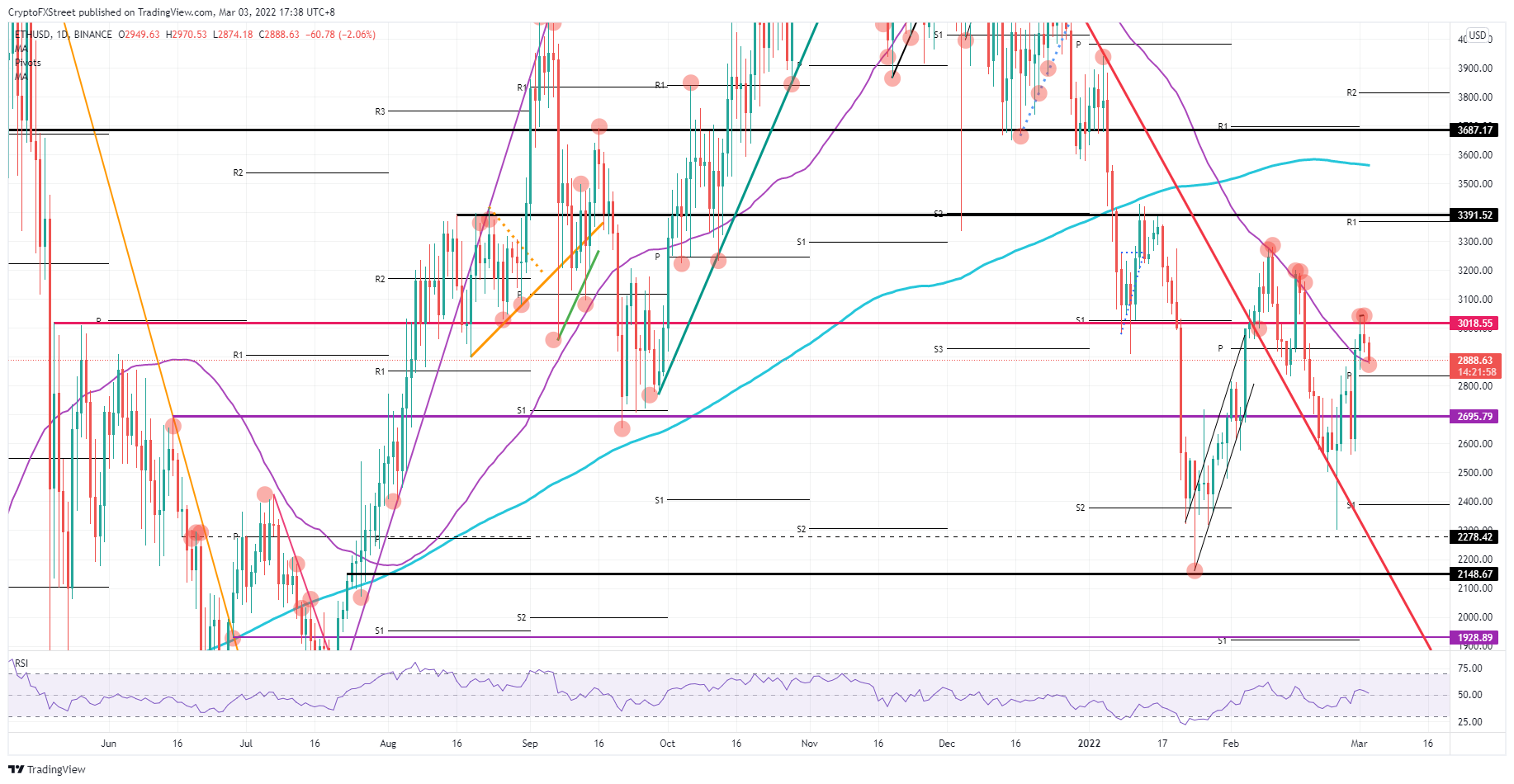

- After Powell's address before Congress, the price of Ethereum fell farther away from $3,018.

- The price of XRP has been moving sideways in anticipation of a trigger that might send it in either direction.

There are indicators that the loophole in the sanctions against Russia and Ukraine is about to be closed, and this might have a negative impact on the growth of cryptocurrencies. At the State of the Union address, Vice President Biden called for an end to the affluent Russians' escape route through cryptocurrency. When FED chairman Powell said he was open to more legislation to better monitor and manage cryptocurrency, it poured gasoline to the flames of the debate. As a result, all major cryptocurrency pairs have experienced some trepidation following these remarks.

There is a danger that the Bitcoin bulls will be denied at $44,088 and fall back to $42,000.

Coins such as Bitcoin (BTC) and Litecoin (LTC) showed a full recovery in value following the Russian invasion, as both countries' central banks imposed cash withdrawal limits. Biden and Powell's call for more regulation as it emerges that cryptocurrencies are undermining sanctions against Russia created some headwinds for Bitcoin. Investors are rushing to lock in profits as a result of the heightened unfavorable attention being paid to cryptocurrencies, sending the price of BTC down.

At $45,261, a level that aligns with the December 17 low, considerable profit-taking was seen in the Bitcoin price. In light of the current profit-taking, bulls face yet another rejection at $44,088, a level that dates back to August of 2006. Below $41,756 or the psychological $42,000 level around the baseline of a bearish triangle we had drawn up earlier, there is no support to be found.

There is still a chance that a breakthrough might occur at any time. Bears would fail in their attempt to squeeze out bulls if the price broke through $44,088 to the upside. They would then be stopped out themselves. After soaring beyond $45,261, the advance would further accelerate, with a rapid rise to $48,760 and, from there, setting Bitcoin for a return to $50,000 next week.

The 55-day simple moving average (SMA) is being defended by Ethereum bulls, although support is eroding.

In the wake of Powell's testimony before Congress, the price of Ethereum (ETH) has taken another step down. Following his pledge to raise interest rates again, Powell delved into the topic of cryptocurrency and labeled it a danger worth prioritizing with regulations. Increased regulation of cryptocurrency therefore rises back up the list of legislative priorities after being pushed down by the events in Ukraine and domestic inflation.

There are currently bulls protecting the 55-day SMA around $2,880 for Ethereum (ETH). The 55-day SMA, despite the fact that it appears to be a smart investment right now, has not had a great reputation in the past. Hence, once the US session starts and Powell makes more negative comments on cryptocurrencies in his second day of congressional hearings, expect a possible breach, which is likely to push the ETH price below the 55-day SMA at $2,880, through the monthly pivot at $2,835, and down to a possible end point at around $2,695.

Residents of Russia will be compelled to flee into cryptocurrencies as further sanctions are put in place to protect them from the financial penalties that have been imposed. ETH price action might rise over $3,018 and break the double top of rejection from Tuesday and Wednesday, indicating a large influx of flux over the following days. That might lead to a test of $3,391 on the upside, as the inflow will outnumber any short-selling attempts.

XRP is trying a monthly pivot to the negative as the strength of the dollar weighs on the market..

There is a lot of pressure on Ripple's (XRP) price since bears are trying to breach the new monthly pivot at $0.76. For the second day in a row, the dollar's gain is aiding bears on the other side of the asset pair. XRP's worth has fallen as safe havens, like the US dollar, have been widely sought in the wake of the Ukraine crisis and Russia's probable retribution against the West.

Once the monthly pivot at $0.76 gives way, the price of XRP is likely to accelerate its journey upwards.. Given the lack of obstacles, it's feasible that Bitcoin might decline to $0.62, with probable stopping points of profit-taking by bulls at $0.70 and $0.68. It's impossible to resist the combined impact of the harsh comments from Biden and Powell, as well as the safe-haven bid, which makes $0.62 a virtually certain outcome in the next few hours or days.

The only way this could change is if the safe-haven bid was removed. One way or another, Russia's army may give up its military presence in Ukraine in exchange for this. As a result, the safe-haven buy would vanish, and a strong risk-on flow would drive XRP up to $0.88, erasing the previous high of $0.84.

Video: Bitcoin bulls breakout and continue rally, BTC target is $50,000

** Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of USA GAG nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.